Apa itu Withholding Tax (WHT) Berikut Pembahasannya!

It is a tax of 1.45% on your earnings, and employers typically have to withhold an extra 0.9% on money you earn over $200,000. FUTA tax: This stands for Federal Unemployment Tax Act. The tax funds.

Tax Advisor Instant Tax Solutions A Special note on Withholding Tax

Withholding tax atau WHT merupakan pemotongan pajak oleh pihak ketiga atau perusahaan dari gaji karyawannya dan kemudian dibayarkan langsung kepada pemerintah. Jumlah yang dipotong untuk WHT ini adalah besaran pajak penghasilan yang harus dibayar oleh karyawan tersebut selama satu tahun. Sebagai penjelas, WHT umumnya diambil dari pihak yang.

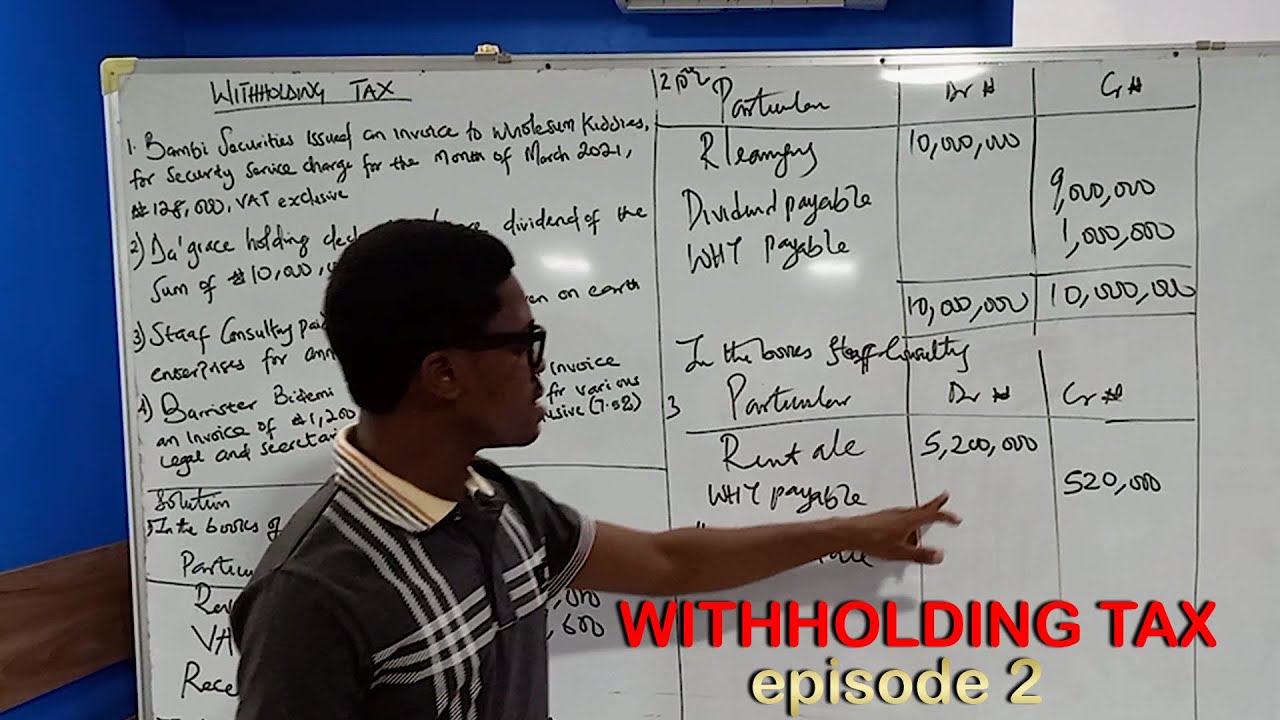

Withholding Tax Filing in Nigeria

Tax rate. Payment to non-resident director. 24% (22% from 01 Jan 2016 to 31 Dec 2022) Payment to non-resident professional/ firm (unincorporated business) 15% on gross income or prevailing non-resident individual rate on net income. Payment to non-resident public entertainer. 15% on gross income.

Everything You Need to Know About Double Tax Treaty Withholding Tax (WHT) WTax

Withholding tax is income tax withheld from employees' wages and paid directly to the government by the employer, and the amount withheld is a credit against the income taxes the employee must pay.

Wht withholding tax concept with big word or text Vector Image

Withholding tax merupakan salah satu sistem pemungutan pajak yang diterapkan di Indonesia. Dengan sistem ini, Direktur Jenderal Pajak dapat menunjuk wajib pajak sebagai pihak ketiga untuk melakukan administrasi pemotongan/ pemungutan pajak, mulai dari menghitung, menyetor, dan melaporkan pajak terutang. Sistem withholding tax atau juga dikenal.

[AccRevo Platform บัญชีดิจิทัล] 📈 EWithholding Tax มาติดตามดูว่า E Witholding Tax ทำงานกัน

Non-resident in tax haven: 20 / 20 / 20. Lebanon (Last reviewed 23 January 2024) Resident: 10 / 10 / NA; Non-resident: 10 / 10 / 7.5; Interest on bank deposits are subject to 7% starting 31 July 2022 and apply for residents and non-residents. The rate was increased from 7% to 10% for 3 years from 1 August 2019.

Withholding Tax (WHT) Calculation SAP Blogs

The Tax Withholding Estimator doesn't ask for personal information such as your name, social security number, address or bank account numbers. We don't save or record the information you enter in the estimator. For details on how to protect yourself from scams, see Tax Scams/Consumer Alerts. Check your W-4 tax withholding with the IRS Tax.

Withholding Tax (WHT) GRA

3. Withholding tax scope in KSA under the domestic tax law and Double Taxation Agreement 3.1. Key categories of income subject to WHT 3.1.1. WHT is an income tax imposed on non-residents who generates income from a source in the Kingdom. 3.1.2. WHT is essentially imposed on payments from a source in the Kingdom made

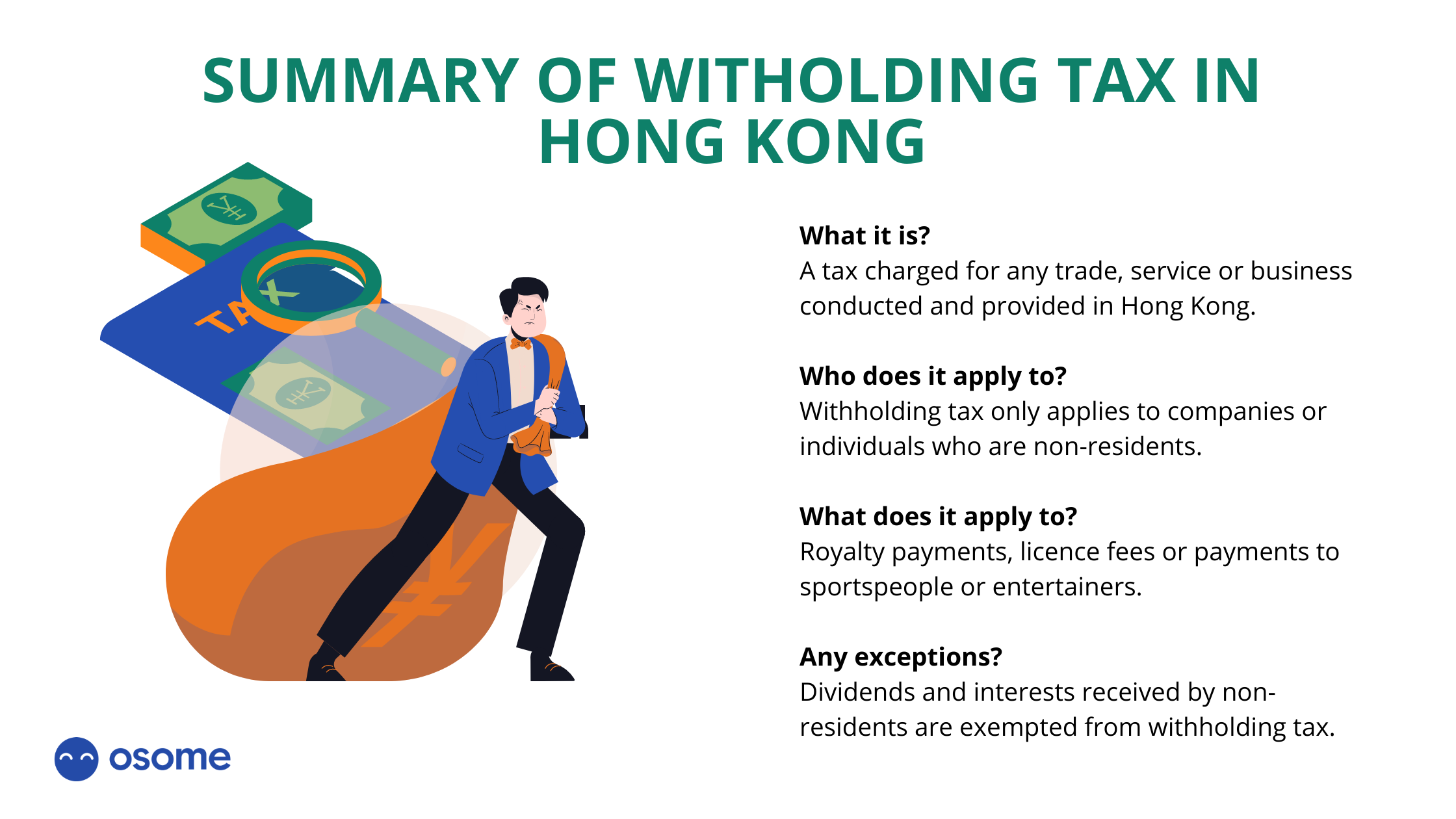

All You Need to Know About Withholding Tax in Hong Kong

They have also been revised to reflect certain income tax rate increases enacted under Chapter 59 of the Laws of 2021 (Part A). Accordingly, effective for payrolls made on or after January 1, 2022, employers must use the revised withholding tax tables and methods in this publication to compute the amount of New York State taxes to be withheld

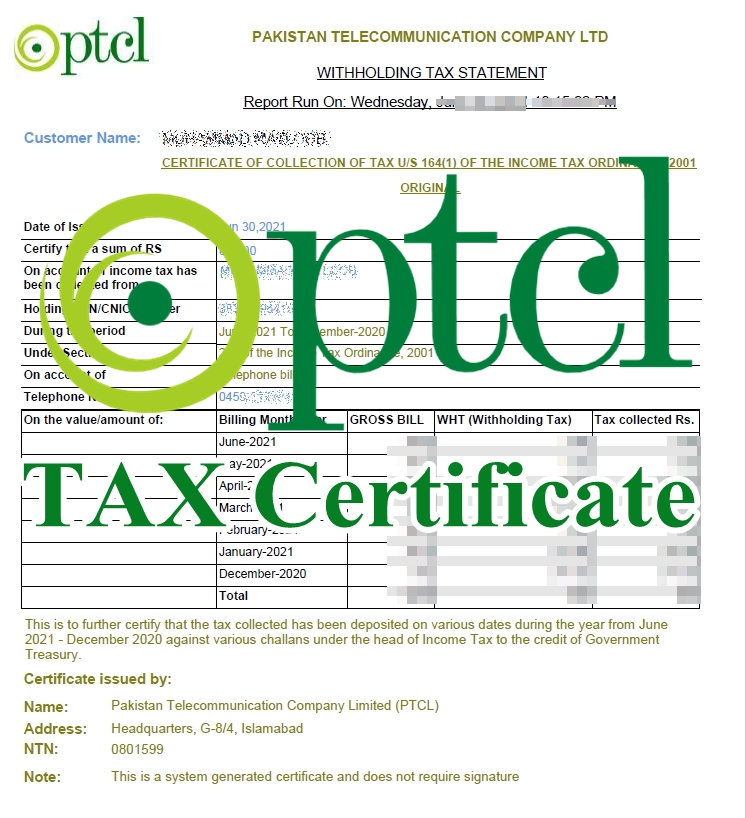

PTCL Tax Certificate Get your PTCL WHT Tax Deduction Certificate

Jenis-jenis yang Menggunakan Sistem Withholding Tax. Jenis-jenis pajak yang penyetorannya bisa menggunakan sistem withholding Tax, di antaranya: #1 Pemotongan PPh Pasal 21. PPh Pasal 21 adalah pajak yang dipotong dari penghasilan yang berhubungan dengan pekerjaan, jasa, dan kegiatan yang dilakukan oleh Wajib Pajak (WP) Orang Pribadi Dalam Negeri.

HOW TO FILE WITHHOLDING (WHT) TAX ON TAXPROMAX YouTube

Seperti yang sudah banyak orang tahu, withholding tax adalah salah satu jenis sistem pemungutan pajak yang sering dipilih oleh beberapa masyarakat Indonesia. Dalam hal ini, ada 6 jenis objek pajak yang meliputi di dalamnya, yaitu: 1. Pemotongan PPh Pasal 4 Ayat 2.

Tax changes 2019 withholding tax VGD

Withholding tax adalah salah satu sistem pemotongan atau pemungutan pajak, di mana pemerintah memberikan kepercayaan kepada wajib pajak untuk melaksanakan kewajiban memotong atau memungut pajak atas penghasilan yang dibayarkan kepada penerima penghasilan sekaligus menyetorkannya ke kas negara. Bisa diartikan pula bahwa sistem withholding tax.

Withholding Tax (WHT) Calculation SAP Blogs

Corporate - Withholding taxes. Last reviewed - 07 February 2024. Under US domestic tax laws, a foreign person generally is subject to 30% US tax on the gross amount of certain US-source income. All persons ('withholding agents') making US-source fixed, determinable, annual, or periodical (FDAP) payments to foreign persons generally must report.

WHT රඳවා ගැනීමේ බදු Withholding Tax YouTube

Ini dia, 6 macam withholding tax di Indonesia: 1. Pemotongan PPh Pasal 4 Ayat 2. Pajak Penghasilan Pasal 4 Ayat 2 (PPh Pasal 4 Ayat 2) adalah pajak penghasilan yang bersifat final, dimana pajak ini dipotong dari penghasilan dengan ketentuan yang diatur melalui peraturan pemerintah (PP). Penghasilan yang terkena potongan PPh Pasal 4 Ayat (2.

VAT & WHT (Withholding Tax) Episode 2 YouTube

New York State Tax Quick Facts. State income tax: 4% - 10.9%. NYC income tax: 3.078% - 3.876% (in addition to state tax) Sales tax: 4% (local tax 3% - 4.875%) Property tax: 1.73% average effective rate. Gas tax: 25.35 cents per gallon of regular gasoline, 23.7 to 25.3 cents per gallon of diesel. For taxpayers in the state of New York, there's.

Should advertisers pay Withholding Tax on Google & Facebook advertising in Malaysia? ecInsider

Domestic Article 23 WHT is payable at the rate of 2% for most types of services where the recipient of the payment is an Indonesian resident and 15% for a variety of payments to resident corporations and individuals. For non-residents, Art. 26 WHT of 20% is applicable.