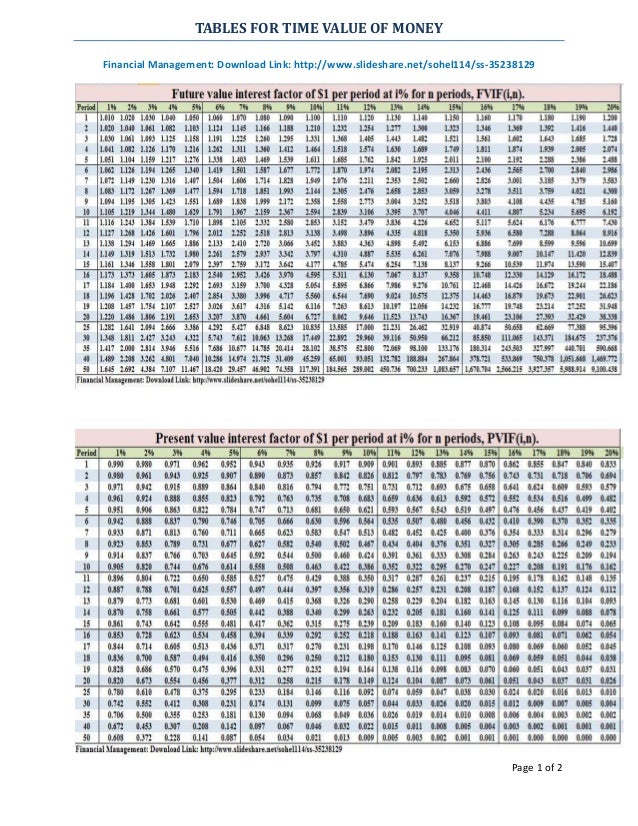

Tables for Time Value of Money

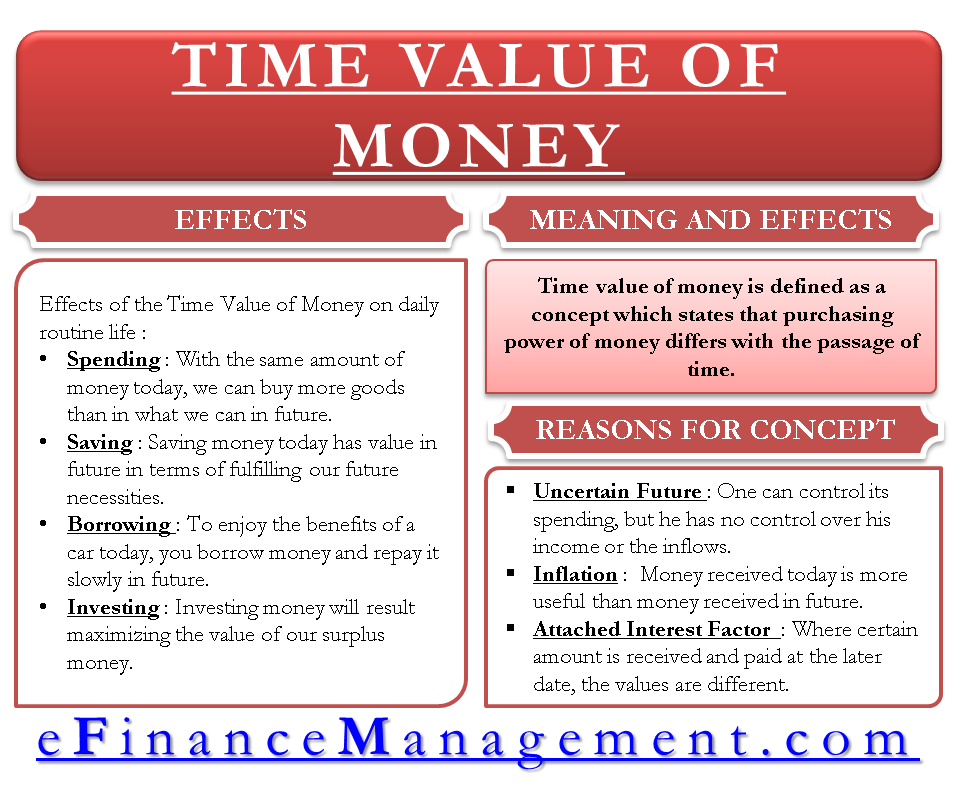

The time value of money is the relationship between a dollar at one point in time and the value of that same dollar at another point in time. For example, $50 today likely won't have the same value as $50 a year from now, just as $1 million now is not the same as $1 million 20 years ago (when a million dollars bought more than it does now)..

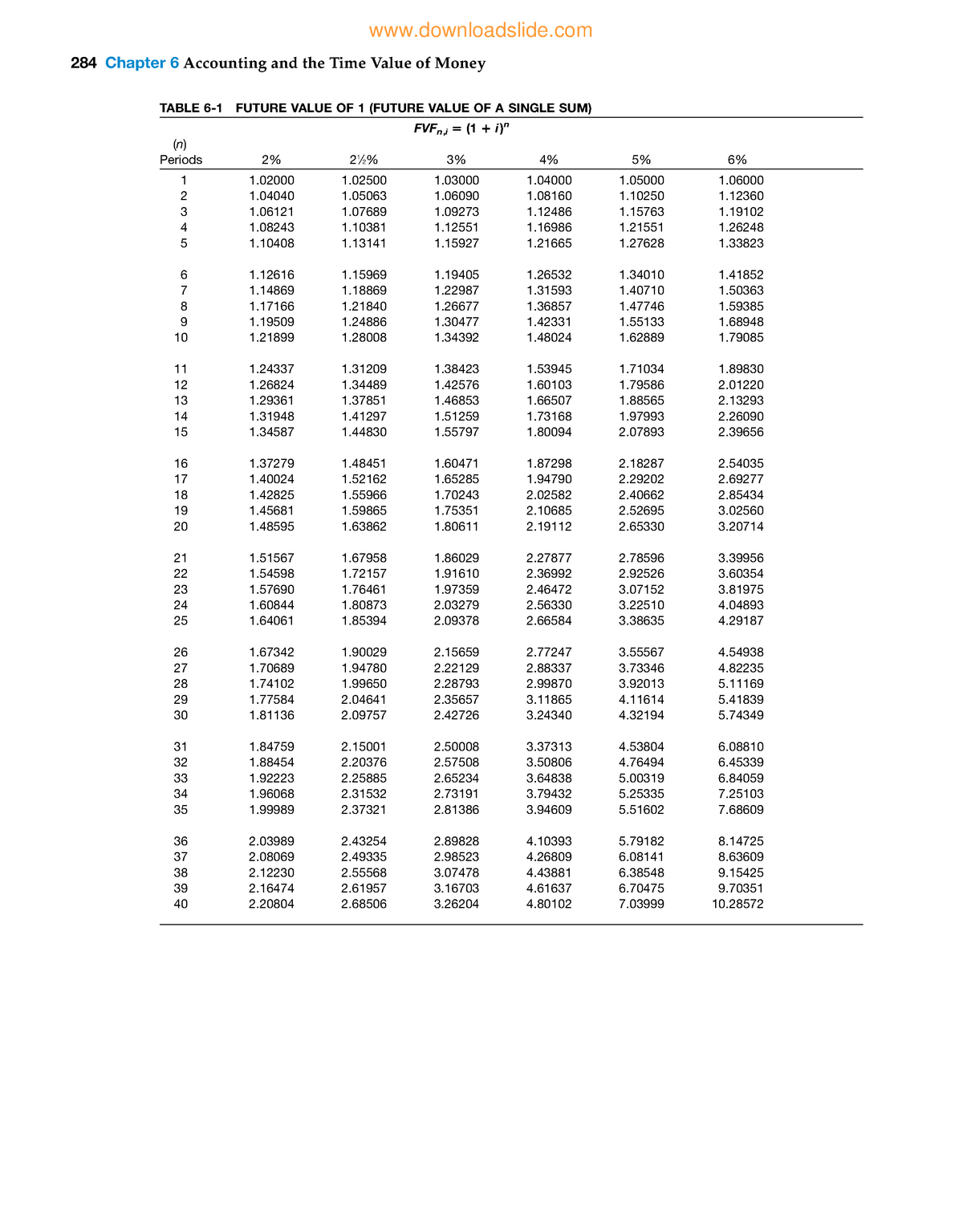

Table Time Value of Money 284 Chapter 6 Accounting and the Time Value of Money TABLE FUTURE

The time value of money is the idea that receiving a given amount of money today is more valuable than receiving the same amount in the future due to its potential earning capacity. If you invest.

Time value of money Meaning, Examples, Formula and Uses Finance Basics

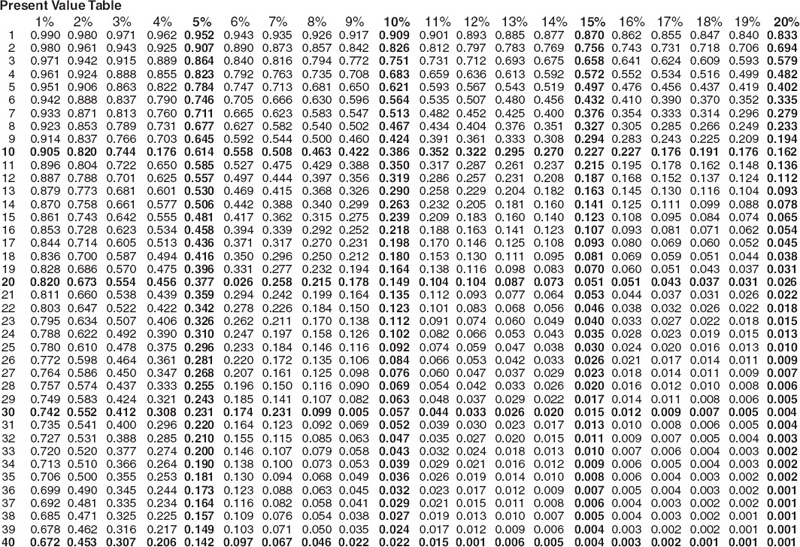

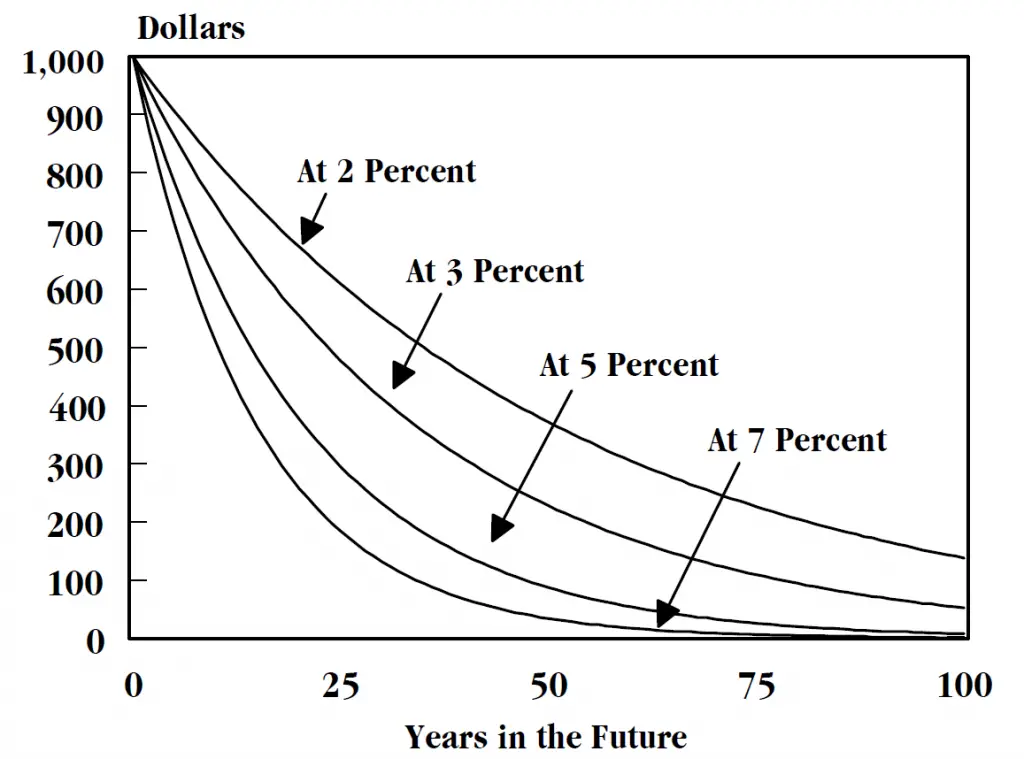

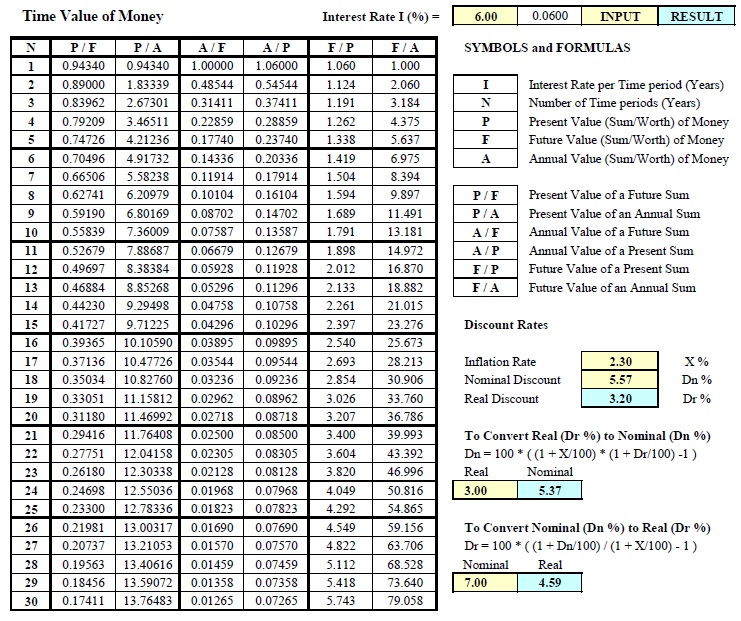

The calculation of time value of money (TVM) depends on the following inputs: present value (PV), future value (FV), the value of the individual payments in each compounding period (A), the number of periods (n), the interest rate (r). You can use the following two formulas to calculate present value and future value without periodical payments.

Bonds Payable Time Value of Money and issuing a bond at par (market = stated rate) YouTube

Excel Templates: https://calonheindel.etsy.com/Start a Print On Demand Etsy Store with Printful: https://www.printful.com/a/8269674:5b.Looking to make mone.

Appendix A Time Value of Money Tables Finance and Accounting for NonFinancial Managers, 3rd

The time value of money is a financial principle that states the value of a dollar today is worth more than the value of a dollar in the future. This philosophy holds true because money today can.

What is the time value of money and why is it important? QuickBooks

Present value and Future value tables Visit KnowledgEquity.com.au for practice questions, videos, case studies and support for your CPA studies

Image result for present value of an annuity table Annuity, Time value of money, Annuity table

What Is the Time Value of Money? The time value of money (TVM) is a core financial principle that states a sum of money is worth more now than in the future.. In the online course Financial Accounting, Harvard Business School Professor V.G. Narayanan presents three reasons why this is true:. Opportunity cost: Money you have today can be invested and accrue interest, increasing its value.

What Is The Time Value Of Money? WorldAtlas

Appendix A: Time Value of Money Tables Get Finance and Accounting for NonFinancial Managers, 3rd Edition now with the O'Reilly learning platform. O'Reilly members experience books, live events, courses curated by job role, and more from O'Reilly and nearly 200 top publishers.

Time Value Of Money Excel Template Card Template

Time Value of Money Explained. Time Value of Money comprises one of the most significant concepts in finance. The idea focuses on identifying the real value of cash flows Cash Flows Cash Flow is the amount of cash or cash equivalent generated & consumed by a Company over a given period. It proves to be a prerequisite for analyzing the business's strength, profitability, & scope for betterment.

The ultimate guide to the time value of money

12. Stockholders' Equity 1h 58m. 13. Statement of Cash Flows 1h 57m. 14. Financial Statement Analysis 3h 39m. 15. GAAP vs IFRS 56m. Learn Using Time Value of Money Tables with free step-by-step video explanations and practice problems by experienced tutors.

:max_bytes(150000):strip_icc()/Term-Definitions_Time-value-of-money-1bd784d74c3848d7b2d431569715d0d1.jpg)

Time Value of Money Explained with Formula and Examples

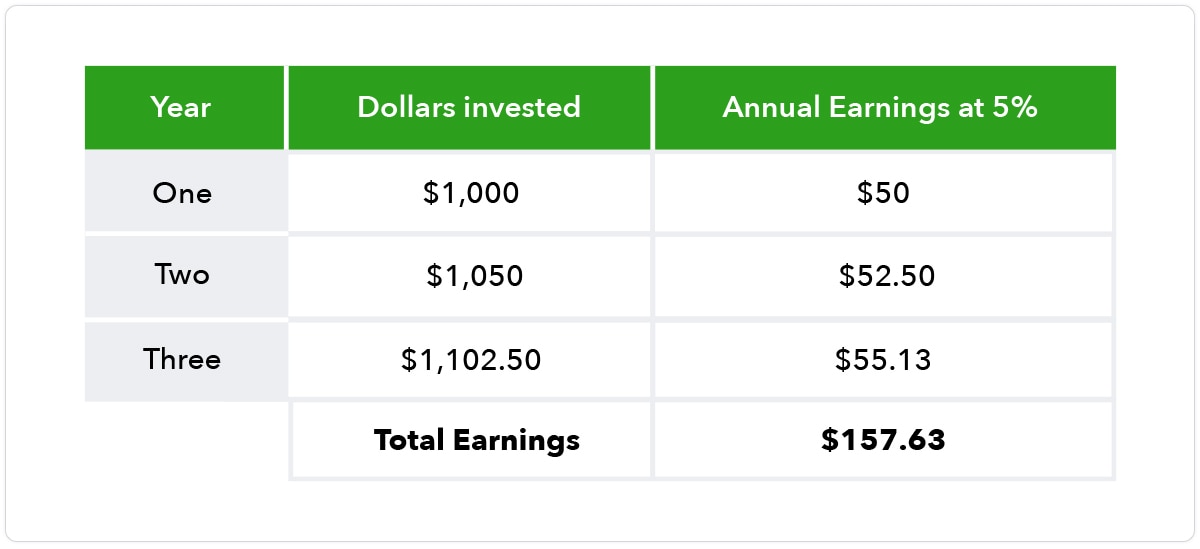

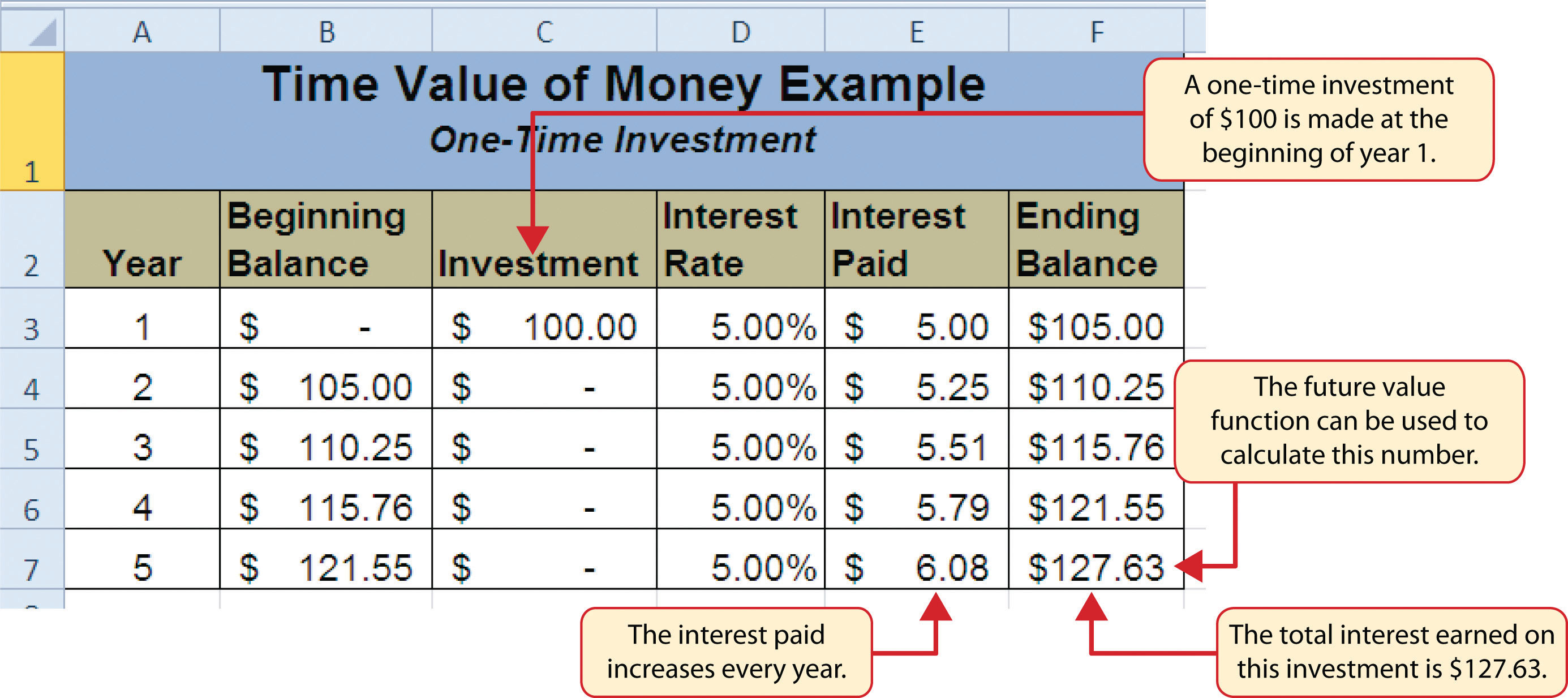

The formula for compound interest is: P n = value at end of n time periods. P 0 = beginning value. i = interest. n = number of periods. For example, if one were to receive 5% compounded interest on $100 for five years, to use the formula, simply plug in the appropriate values and calculate.

Time Value Of Money Table Present Value F Wall Decoration

This Refresher Reading reviews three key aspects of the time-value of money. The first area is a review of calculating present and future values of expected cash flows. In the second section, the focus shifts to solving for implied bond and stock returns given current prices. The final section introduces cash flow additivity, an important principle which ensures that financial asset prices do.

The Time Value Of Money Formula New Trader U

In this formula, FV is the future value of money, PV is the present value of money, and i is the interest rate. The number of compounding periods per year is given by n. The future value of money is based on a growth rate. That rate depends on the interest rate and the period of time involved (typically a number of years).

Explain Time Value of Money Concept

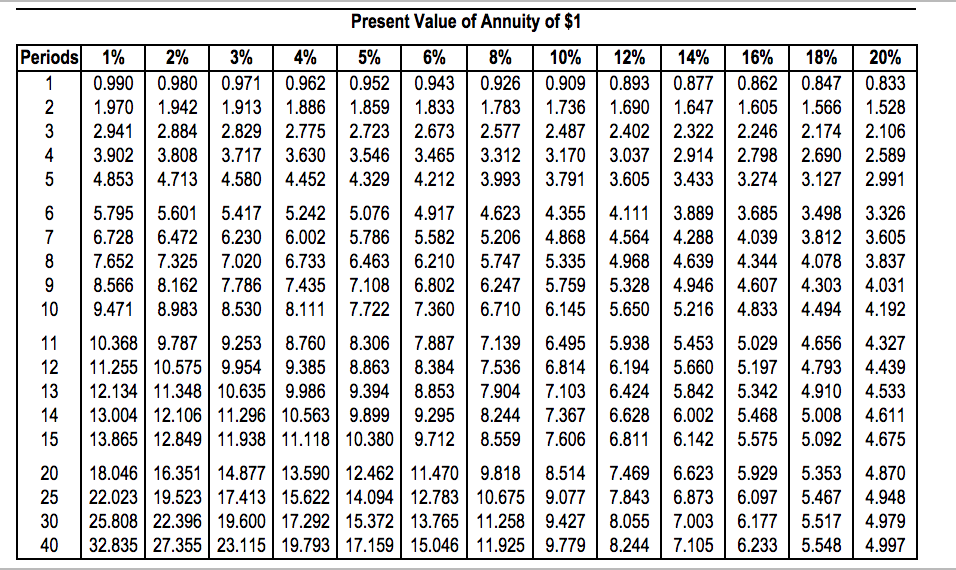

Table 3--Future Value of an Ordinary Annuity of $1 (157.0K) Table 4--Present Value of an Ordinary Annuity of $1 (153.0K) Table 5--Future Value of an Annuity Due of $1 (157.0K) Table 6--Present Value of an Annuity Due of $1 (153.0K) To learn more about the book this website supports, please visit its Information Center. 2007 McGraw-Hill Higher.

Time Value of Money

The formula for the time value of money, from the perspective of the current date, is as follows: Present Value (PV) = FV ÷ [1 +( i ÷ n) ^(n × t) Where: PV = Present Value. FV = Future Value. i = Annual Rate of Return (Interest Rate) n = Number of Compounding Periods Each Year. t = Number of Years. Alternatively, to calculate the future.

Time Value of Money

Using the future value formula. FV = PV × (1 + r)n FV = PV × ( 1 + r) n. 7.14. that we covered earlier, we would arrive at the following values: $105 at the end of year one, $110.25 at the end of year two, $115.76 at the end of year three, $121.55 at the end of year four, and $127.63 at the end of year five.