What is Payback Period? Formula + Calculator

The discounted payback period involves using discounted cash inflows rather than regular cash inflows. It involves the cash flows when they occurred and the rate of return in the market. From another perspective, the payback period is when an investment breaks even from an accounting standpoint. Discounted payback, in contrast, includes the.

:max_bytes(150000):strip_icc()/DiscountedPaybackPeriodFinal-8d84faa170034f0992e06a8cc42039c5.png)

Discounted Payback Period What It Is, and How To Calculate It

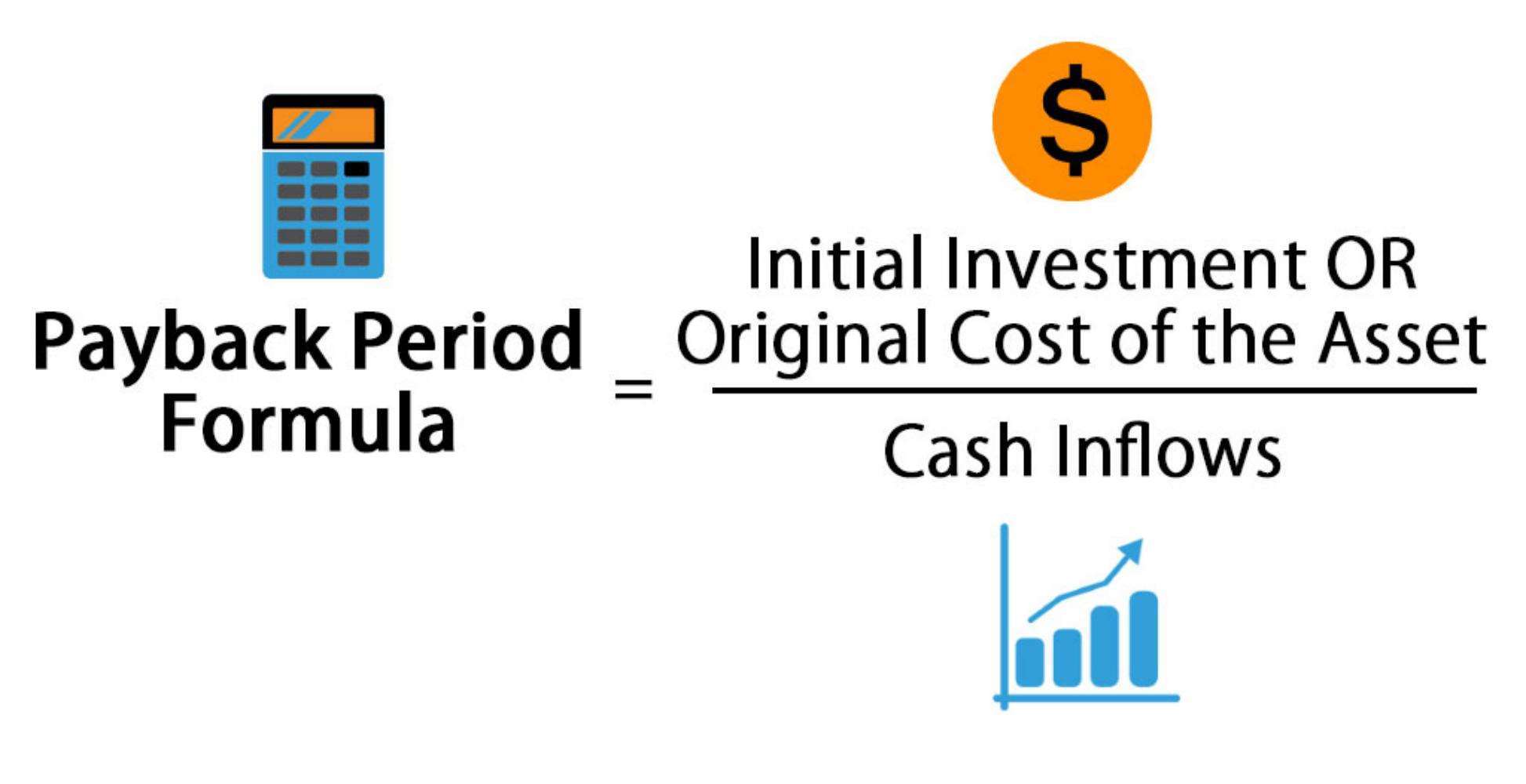

• The payback period is the estimated amount of time it will take to recoup an investment or to break even. • Generally, the longer the payback period, the higher the risk. • There are two formulas for calculating the payback period: the averaging method and the subtraction method.

Contoh Soal Discounted Payback Period Data Dikdasmen

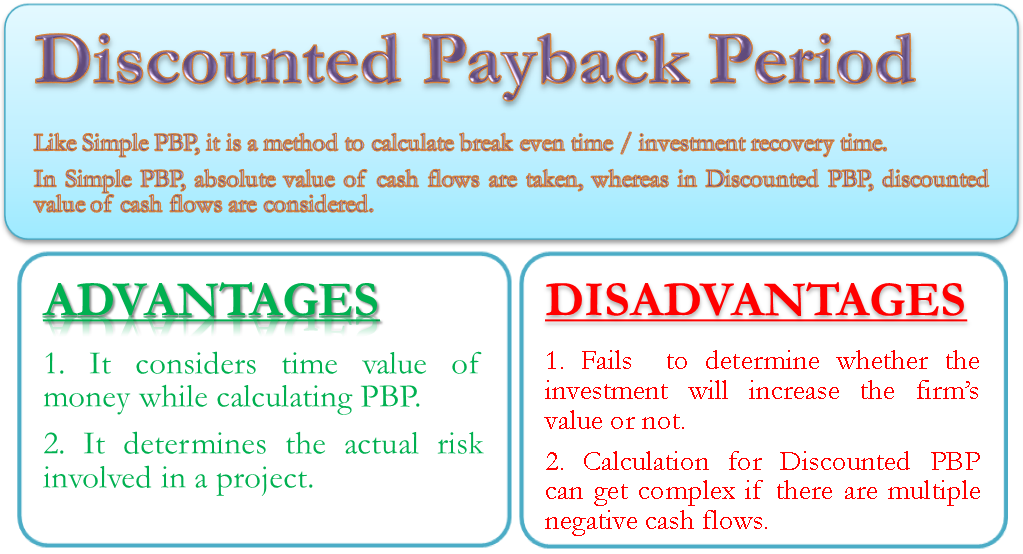

Discounted Payback Period: The discounted payback period is a capital budgeting procedure used to determine the profitability of a project. A discounted payback period gives the number of years it.

Discounted Payback Period Formula and Calculation

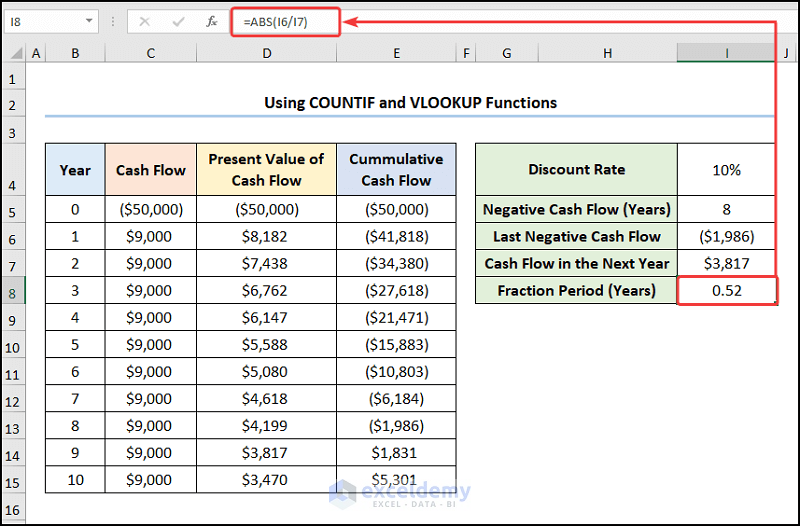

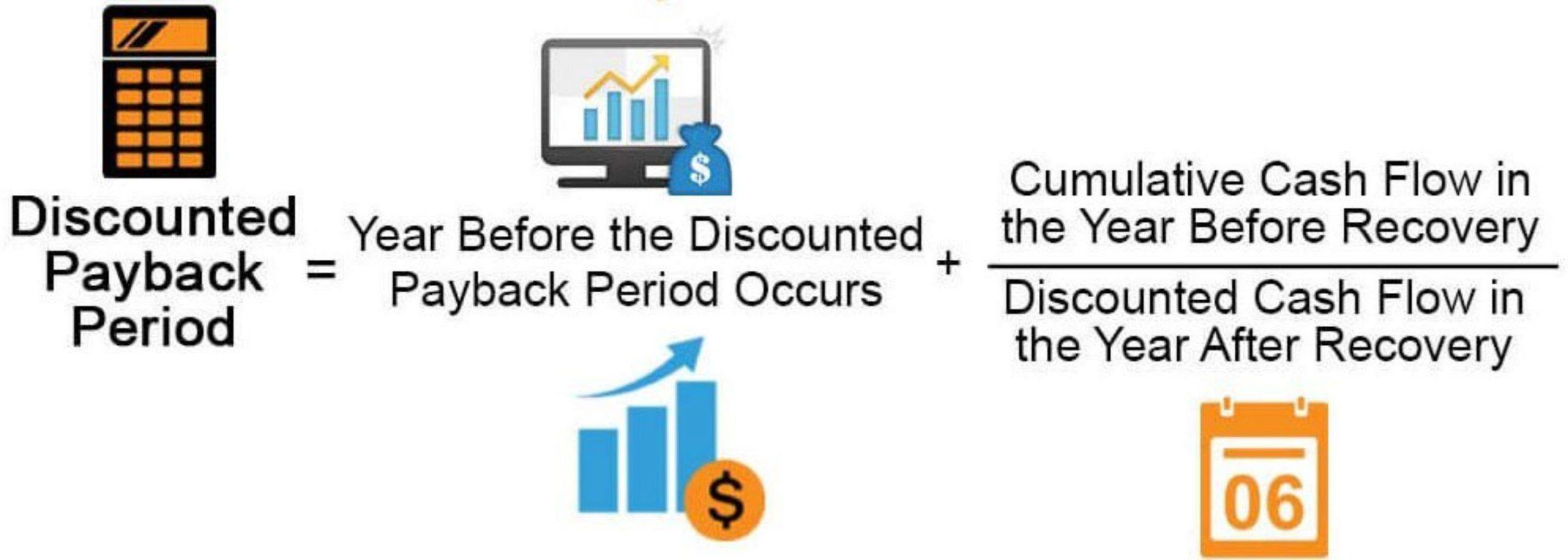

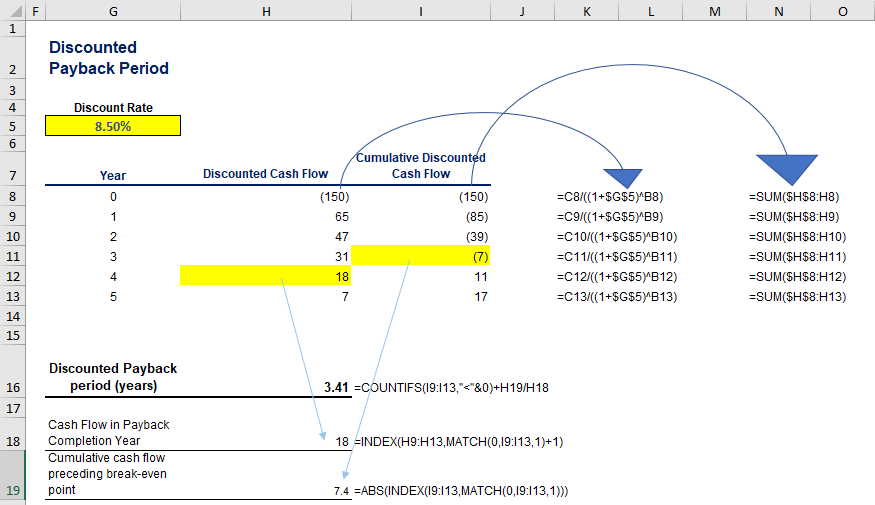

Calculating the payback period is a two-step process: Step 1: Calculate the number of years before the break-even point, i.e. the number of years that the project remains unprofitable to the company. Step 2: Divide the unrecovered amount by the cash flow amount in the recovery year, i.e. the cash produced in the period that the company begins.

Discounted Payback Period (Preview) Payback Period YouTube

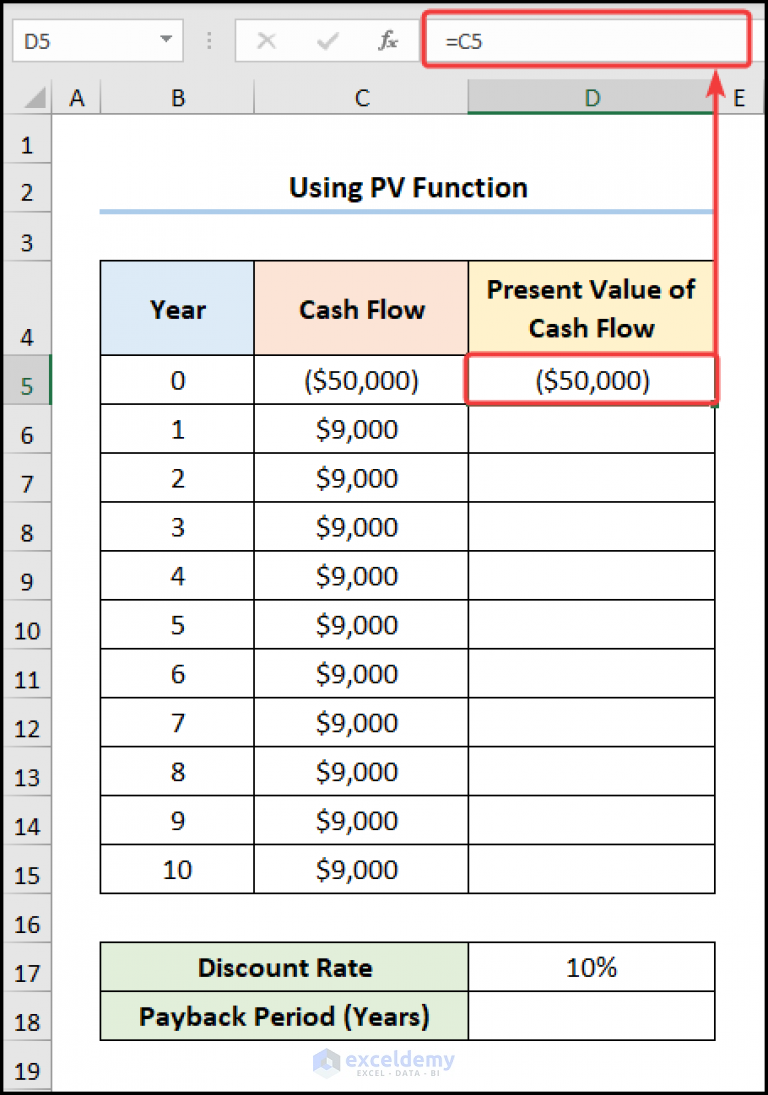

Maka, untuk menghitung discounted payback period adalah dengan membagi cell E5 dengan cell D6. Hasilnya ditambah dengan tahun terakhir arus kas kumulatif bernilai negatif atau tahun ke-2 ( cell B5). Berdasarkan perhitungan tersebut, discounted payback period adalah selama 2,99 tahun.

How to Calculate Discounted Payback Period in Excel

The discounted payback period is an upgraded capital budgeting method in comparison to the simple payback period method. It helps determine the time period required by a project to break even. Even though it suffers from some flaws, it is a good method to determine the viability of a project as it considers the time value of money.

Discounted Payback Period Formula and Calculation

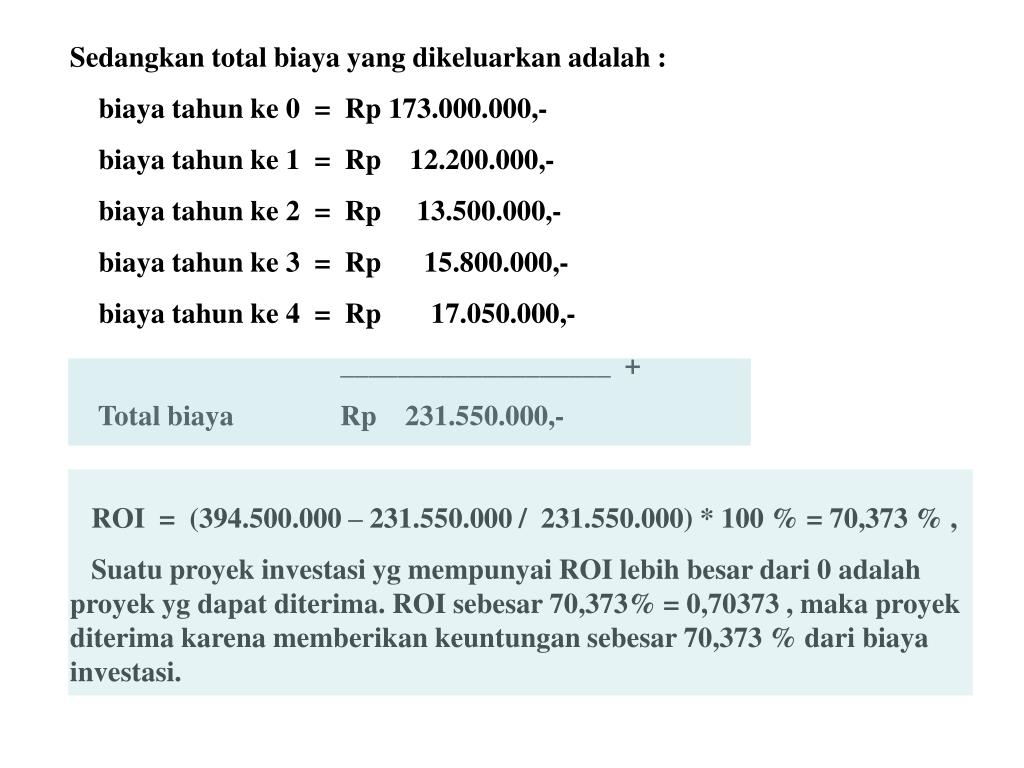

Payback Period Diskon. Discounted payback period adalah waktu yang dibutuhkan untuk memulihkan biaya awal investasi, tetapi dihitung dengan mendiskontokan semua arus kas masa depan. Metode penghitungan ini memang memasukkan nilai waktu uang ke dalam akun. Baca juga: Strategi Pengembangan Bisnis: Pengertian Lengkap dan Tahapannya. Rumus Payback.

How to Calculate Discounted Payback Period in Excel

Discounted Payback period is the tool that uses present value of cash inflow to measure the time require to recover the initial investment. The concept is the same as the payback period except for the cash flow used in the calculation is the present value. It is the method that eliminates the weakness of the traditional payback period.

Discounted Payback Period Definition, Formula, Example & Calculator ProjectManagement.info

Metode Discounted Payback Period . Metode Discounted Payback Period (DPP) adalah metode penghitungan waktu yang diperlukan untuk mengembalikan investasi awal atau modal yang ditanamkan, dengan mempertimbangkan nilai waktu uang atau time value of money.. Dalam metode ini, arus kas masuk dan keluar dari proyek akan dihitung estimasi nilainya kemudian menghitung perkiraan jumlah tahun yang.

Discounted Payback Period Definition, Formula, Benefits eFM

The discounted payback period is used to evaluate the profitability and timing of cash inflows of a project or investment. In this metric, future cash flows are estimated and adjusted for the time value of money. It is the period of time that a project takes to generate cash flows when the cumulative present value of the cash flows equals the.

Payback Period How to Use and Calculate It BooksTime

Payback Period = Rp100 juta / Rp20 juta/tahun = 5 tahun. Dengan kata lain, perusahaan tersebut akan membutuhkan waktu 5 tahun untuk mendapatkan kembali investasi awalnya. Cara menghitung payback period cukup sederhana. Kamu hanya perlu membagi total investasi awal dengan arus kas bersih yang diharapkan setiap tahunnya.

Menghitung Payback Period dan Discounted Payback Period dengan Excel YouTube

Langkah ketiga, Anda dapat menggunakan rumus Discounted Payback Period: Discounted Payback Period = Investasi Awal / DNPV Discounted Payback Period = Rp 1.000.000 / Rp 137.528,53 ≈ 7,27 tahun. Jadi, dalam kasus ini, Discounted Payback Period adalah sekitar 7,27 tahun. Ini berarti Anda akan mendapatkan kembali investasi Anda dalam waktu.

Mengenal Rumus Payback Period dan Cara Hitungnya di Excel

Payback Period. Untuk mengkalkulasikan payback period caranya cukup mudah, yaitu dengan menelusuri arus kas kumulatif dari periode ke periode, hingga arus kas kumulatif tersebut mencapai angka nol.. Asumsikan suatu investasi, pada tahun ke-0, memerlukan investasi awal sebesar 100 juta. Pada tahun ke-1, investasi tersebut sudah bisa menghasilkan arus kas masuk sebesar 30 juta, pada tahun ke-2.

Discounted Payback Period AwesomeFinTech Blog

Payback Period: The payback period is the length of time required to recover the cost of an investment. The payback period of a given investment or project is an important determinant of whether.

Payback Period How to Use and Calculate It BooksTime

Years to Break-Even Formula. But since the payback period metric rarely comes out to be a precise, whole number, the more practical formula is as follows. Payback Period = Years Before Break-Even + (Unrecovered Amount ÷ Cash Flow in Recovery Year) Where: Years Before Break-Even → The number of full years until the break-even point is met.

What is the Discounted Payback Period? 365 Financial Analyst

First, input the initial investment into a cell (e.g., A3). Then, enter the annual cash flow into another (e.g., A4). To calculate the payback period, enter the following formula in an empty cell.