RTGS Limit Maximum and Minimum RTGS Limit

RTGS is a funds transfer system based on a gross settlement concept where money is moved from one bank to another in real-time. RTGS is primarily designed for high transaction amounts. As such, while there is no maximum limit on the transfer amount, you need to transfer a minimum of INR 2 lakhs at a time.

Fund transfer limit for rtgs neft imps फंड ट्रांसफर लिमिट RTGS NEFT IMPS (max you can transfer

Maximum RTGS limit online per day via Citibank Online. Citigold Private Client and Citigold customers: Up to Rs.75 lakh. Others: Up to Rs.25 lakh. 8 a.m. to 7 p.m. Monday to Friday and working Saturdays. RTGS transfer limit per day via Citi mobile banking. Citigold Private Client and Citigold customers: Up to Rs.25 lakh.

SBI RTGS Limit Limit for New Beneficiary & Limit Per Day

RTGS Transaction limits. RTGS transactions are meant for high-value transactions, and the RBI has set the minimum RTGS limit to initiate a transaction at Rs 2 lakh. RBI has not set any maximum limit for financial transactions that individuals can make through RTGS. However, banks may set their own upper limit for the maximum funds that can be.

RTGS Meaning, Timing and Charges, all about Real Time Gross Settlement.

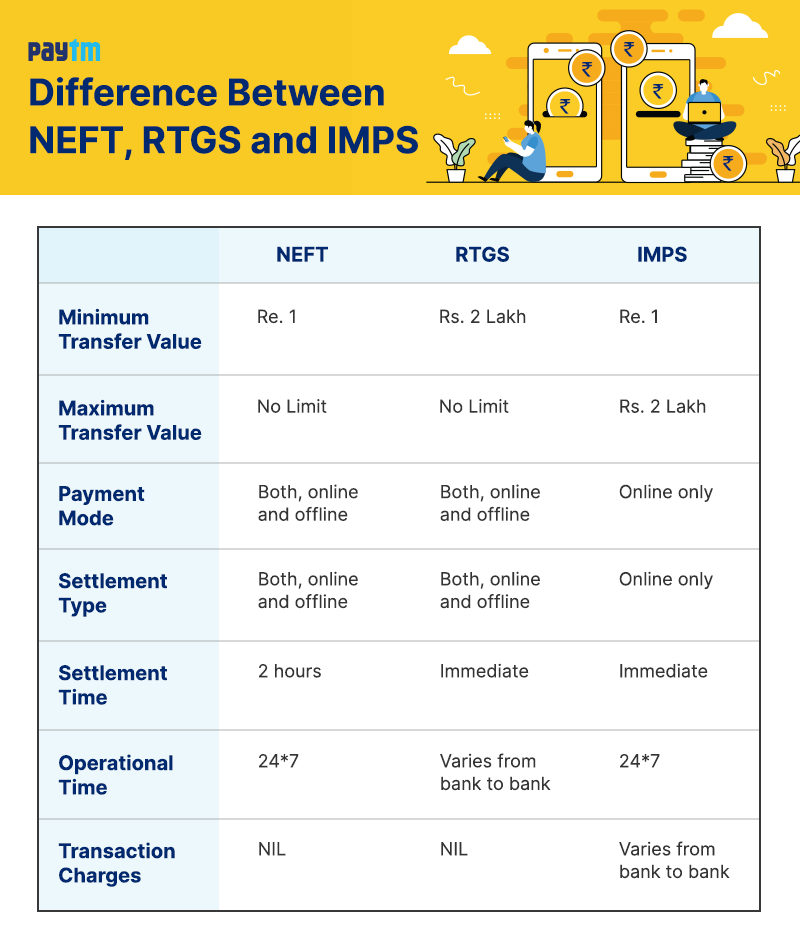

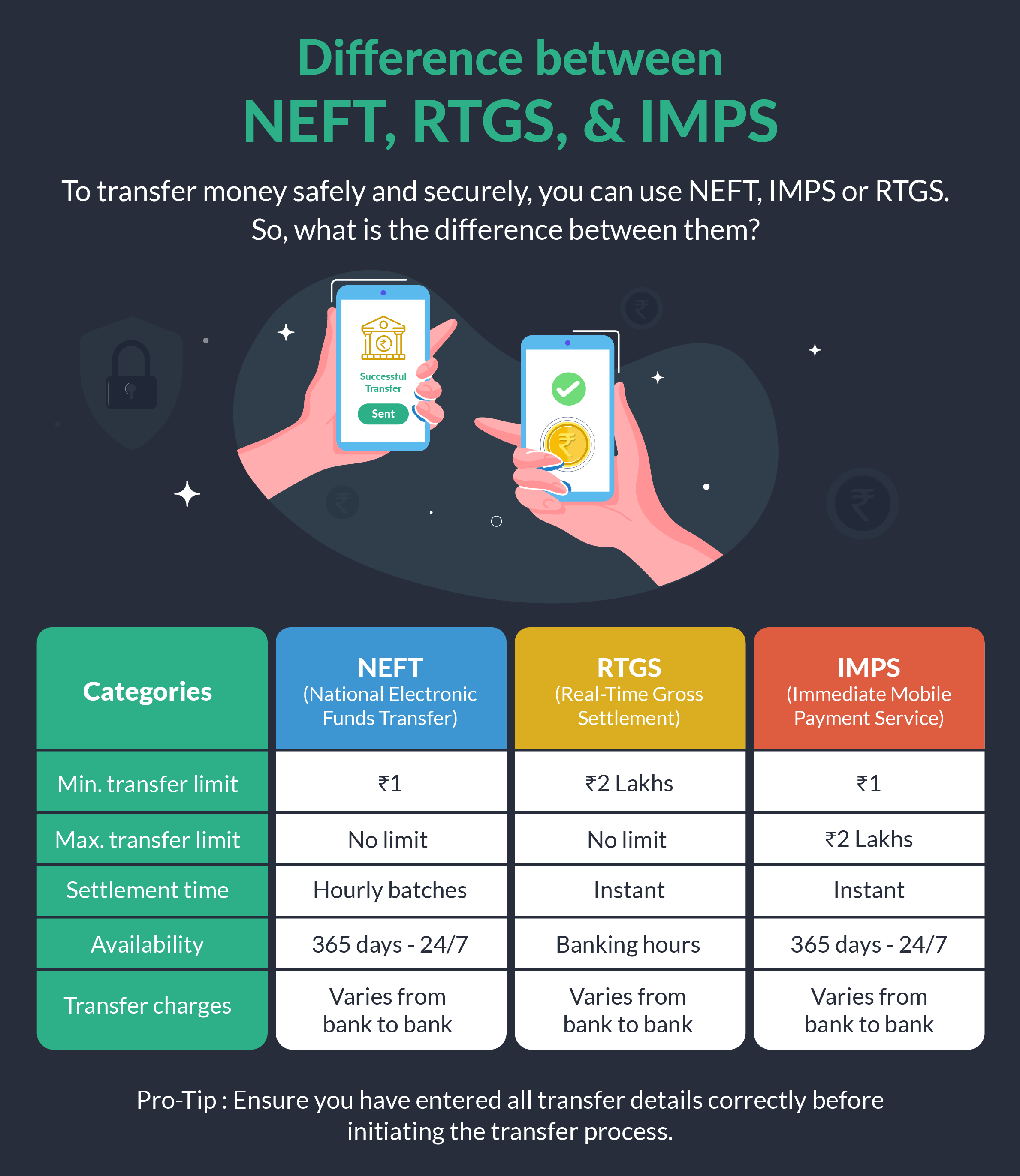

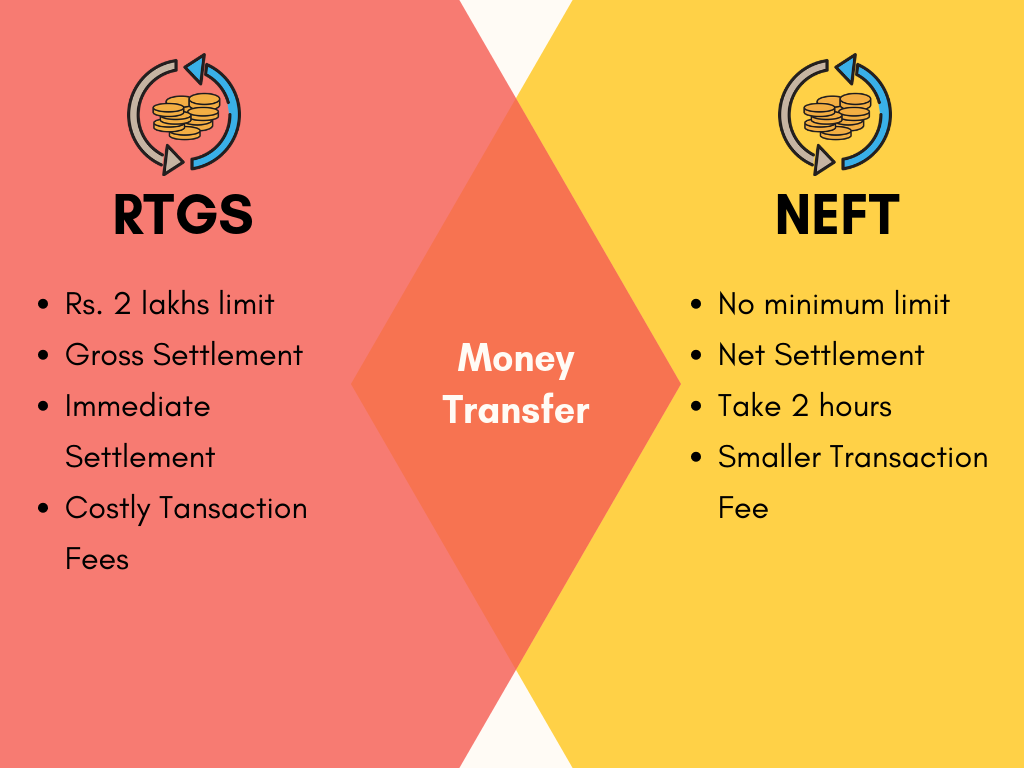

Looking at the above-mentioned differences, it is evident that NEFT and RTGS are two majorly different modes of fund transfer. While NEFT has no minimum or maximum limit on the amount to be transferred, RTGS transactions can only be performed if the amount to be transferred is equal to or more than Rs. 2 lakh.

Detailed Comparative Difference Between NEFT, RTGS and IMPS

Sender to receiver information, if any. IFSC code of the receiving branch. (IFSC Code is printed on cheque leaves.) These facilities are available at all our Core Banking branches .For further details, please contact our nearest branch or contact New Businesses Department at Corporate Centre, Mumbai on 022-22855822 or e mail : [email protected].

What is the limit for RTGS Transfer?

Transaction Limit of RTGS. RTGS service is mainly meant to carry out high-value transactions. The minimum amount that you can remit via RTGS is Rs. 2,00,000 with no upper or maximum ceiling. Get Free Credit Report with Complete Analysis of Credit Score Check Now

RTGS, NEFT, IMPS Transaction Limits, Charges And Other Details YouTube

What are the transaction limits for RTGS? The minimum amount you can transfer via RGS is Rs.2 lakh. When it comes to the upper limit, there is no associated cap when you transfer through the bank branch. Instead, if you choose to do the transfer via internet banking, there may be a limit. It is generally Rs 25 lakh, it may vary across banks.

Learnically — What is RTGS, RTGS Transfer, Daily Limits and...

Q5. Is there any minimum / maximum amount stipulation for RTGS and NEFT transactions? Ans: The RTGS system is primarily meant for large value transactions. The minimum amount to be remitted through RTGS is Rs. 2 lakh. There is no upper ceiling for RTGS transactions. For NEFT transaction there is no lower and upper value limit. Q6.

NEFT Vs RTGS Meaning, Amount Transferable & Timings Comparison

Real Time Gross Settlement (RTGS) is a system which allows you to transfer money from one bank to another on real time basis. Click here to know more about RTGS with Axis Bank. No Limit ( on working days) through CMS online channel 9.30 PM: Post-banking hours up to INR 1 crore per transaction (on working days) through -CIB/ RIB.

SBI RTGS Limit Limit for New Beneficiary & Limit Per Day

Service Availability: Depending on the type of transfer, the timings will vary. IMPS and NEFT are available 24x7, while RTGS operates only during banking hours. Fund Transfer Limit: The amount of money that can be transferred is the fund transfer limit. The limit will be different for different payment methods. IFSC Code for Top Banks.

NEFT, RTGS और IMPS में अंतर और उपयोग डिजिटल पेमेंट से फण्ड ट्रान्सफर करें

Transaction Limits. Transaction Limits. Minimum - Rs. 2 Lakh. Maximum - RTGS transaction through Branch - No upper ceiling. RTGS transaction through NetBanking - the maximum amount of funds that can be transferred per day is as per customer's TPT limit ( Maximum upto Rs. 50 Lakh) FAQs.

ICICI Bank RTGS Form Download, Limit and Charges

NEFT transactions don't have a fixed maximum limit, but individual banks may impose specific limits for their NEFT services. For example, HDFC Bank allows a daily NEFT transfer limit of ₹25 lakhs per customer ID when using online mode. 5.

How to increase rtgs limit in sbi? YouTube

There's a minimum limit of Rs. 2 lakhs for RTGS transactions, and there's no maximum limit as such. To get an RTGS-enabled account, you can either contact your bank or check your eligibility status in your online banking portal. If you're using RTGS for a fund transfer, make sure that both you and the recipient have RTGS enabled accounts.

Axis Bank RTGS Form Download, Timings & Limit

The lowest amount you can transfer with NEFT is Rs. 1. There's no limit on the maximum amount. But as per the Indo-Nepal Remittance Scheme, the maximum amount per transaction should be Rs. 50,000 for cash-based remittances within India and Nepal. RTGS; Here, you need to transfer at least Rs. 2,00,000 to transfer money via RTGS. There's no.

Difference between NEFT and RTGS with Comparison Table

Earlier, RTGS transactions were permitted between 7.00 a.m. and 6.00 p.m. on all working days. However, in December 2020, the Reserve Bank of India modified the RTGS time limit policy and made the facility available 24x7, 365 days a year. As such, you can now initiate RTGS transactions at any time of the day without worrying about RTGS time limits.

RTGS vs NEFT Full form, Timings, Difference, Limits Insuregrams

Ans. RTGS offers many advantages for funds transfer: It is a safe and secure system for funds transfer. RTGS transactions / transfers have no amount cap set by RBI. The system is available on all days on 24x7x365 basis. There is real time transfer of funds to the beneficiary account. The remitter need not use a physical cheque or a demand draft.