Prepaid Expense Pengertian, Contoh, dan Cara Menjurnalnya

Prepaid expenses, or Prepaid Assets as they are commonly referred to in general accounting, are recognized on the balance sheet as an asset. A "prepaid asset" is the result of a prepaid expense being recorded on the balance sheet. Prepaid expenses result from one party paying in advance for a service yet to be performed or an asset yet to.

What is prepaid expenses Example Journal Entry

The most common examples of prepaid expenses include items such as employee insurance benefits, company-related insurance policies, taxes, interest expenses, salaries, leased office equipment, prepaid rent for office space, and bulk orders of supplies. For instance, if a business pays $12,000 in rent for a 12-month lease on January 1st, the.

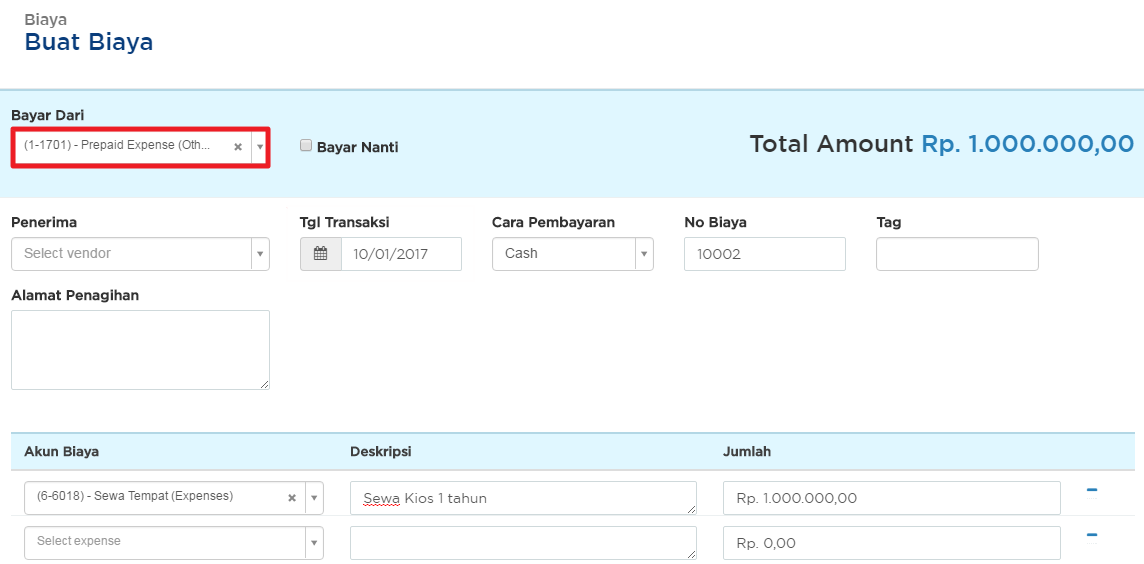

Mencatat Prepaid Expense dan Amortisasi Mekari Jurnal

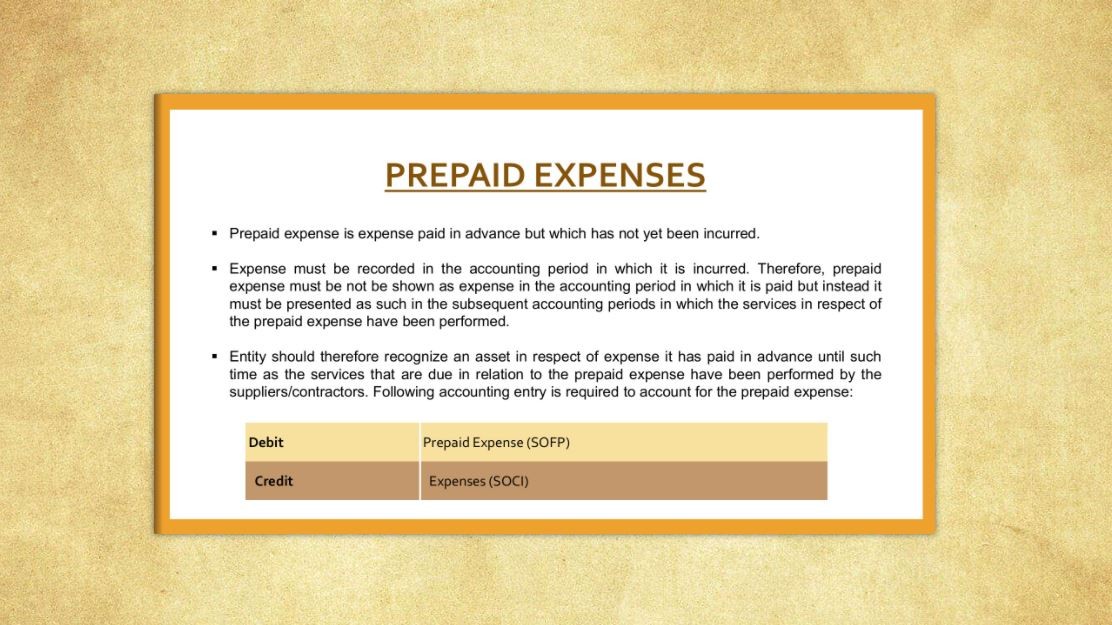

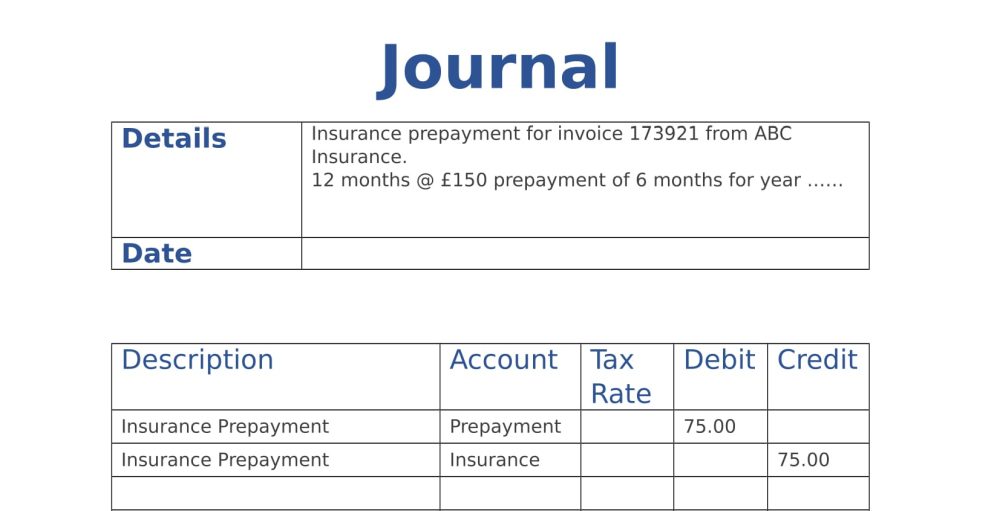

The initial entry is a debit of $12,000 to the prepaid insurance (asset) account, and a credit of $12,000 to the cash (asset) account. If you want to create a prepaid expenses journal entry, the best method is to identify the expenses first and use adjusting entries. The advance payment of expenses does not provide value right away.

:max_bytes(150000):strip_icc()/prepaid-expense-4191042-final-936e813abfe74ae8a62880f4be96eb52.png)

Prepaid Expense Definition and Example

Prepaid Insurance. Prepaid insurance is a key component of business accounting, whereby advance payments are made for insurance coverage. This involves a business paying for insurance coverage upfront for a specified duration, typically ranging from a few months to a year. The payment is usually recorded as a prepaid expense on the balance.

What is Prepaid expense Example Journal Entry Tutor's Tips

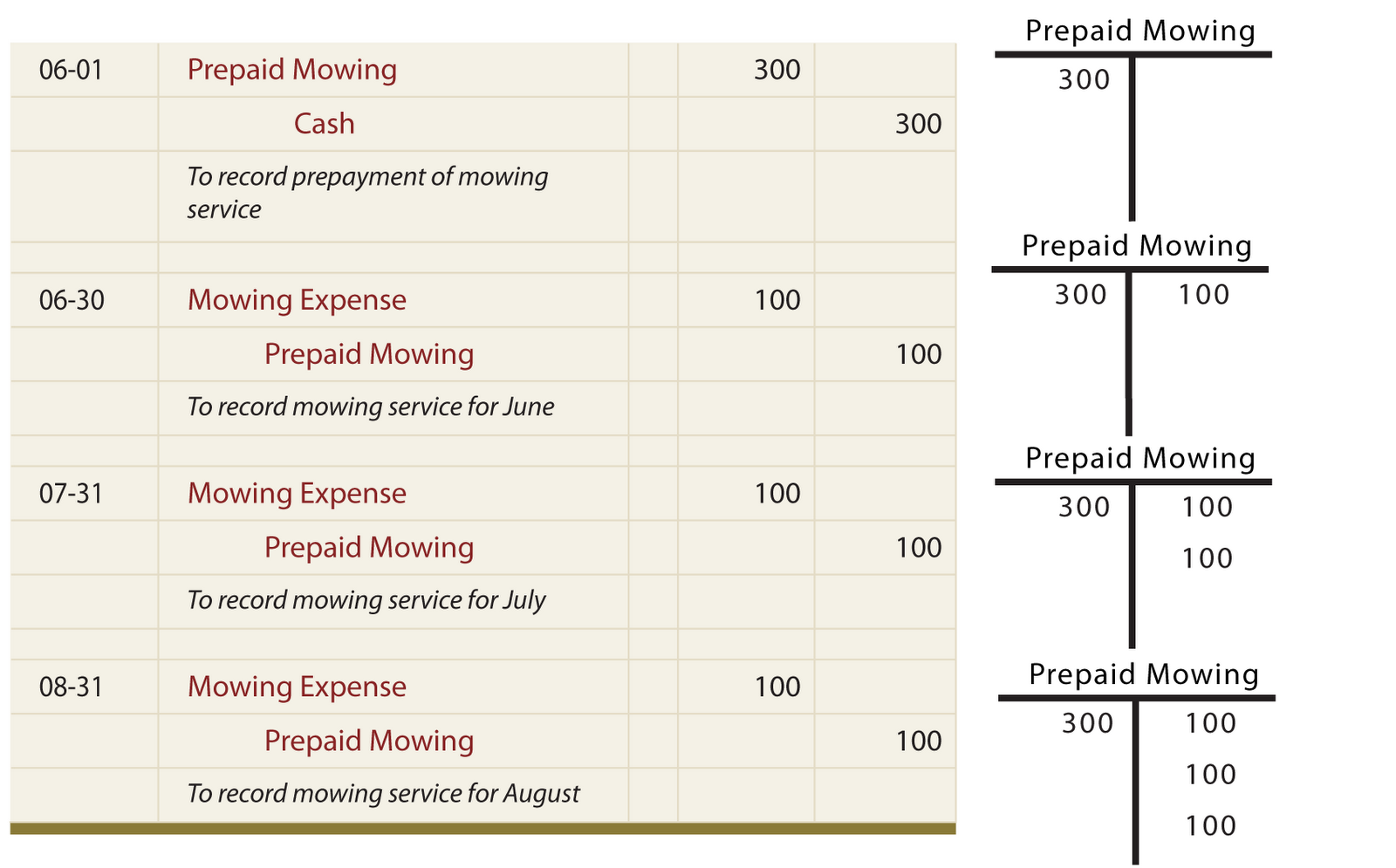

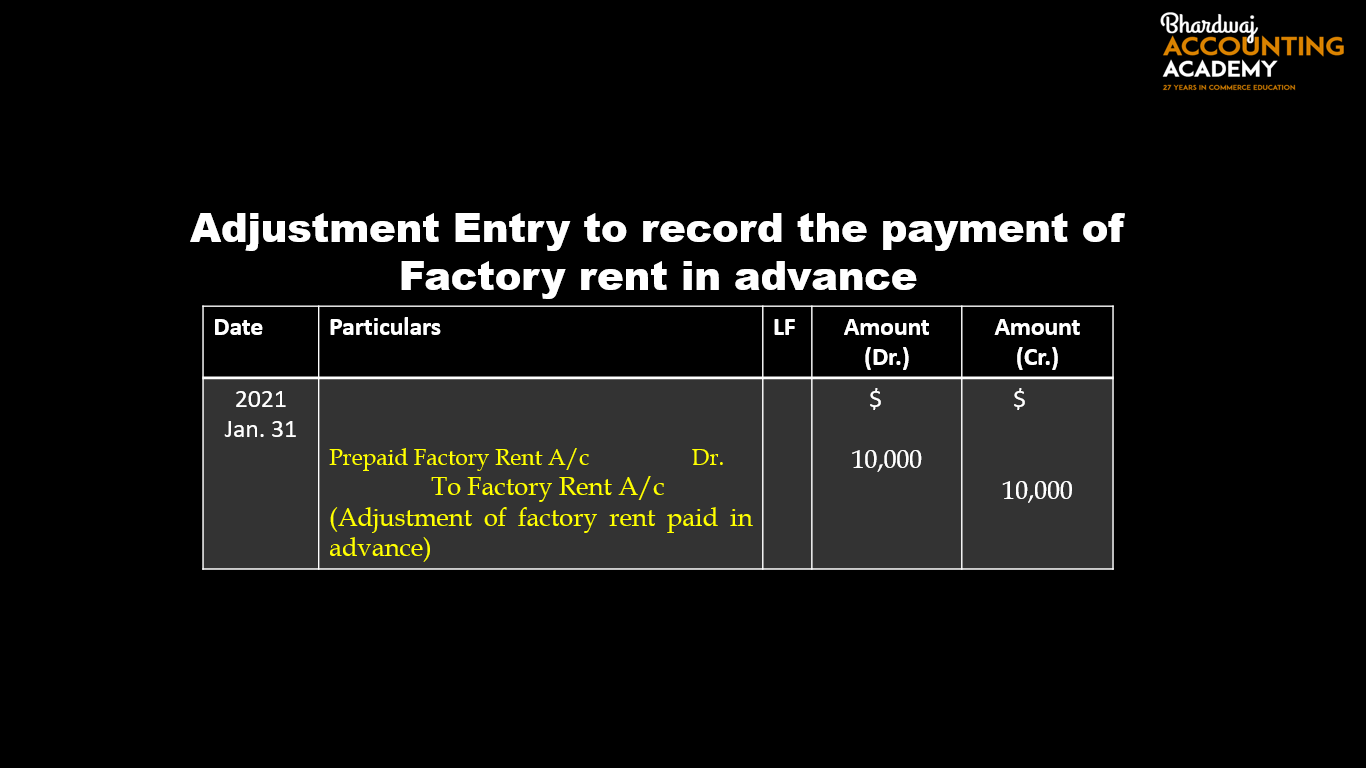

We will look at two examples of prepaid expenses: Example #1. Company A signs a one-year lease on a warehouse for $10,000 a month. The landlord requires that Company A pays the annual amount ($120,000) upfront at the beginning of the year. The initial journal entry for Company A would be as follows:

Journal Entry for Prepaid Expenses

The benefits of such expenses are to be utilized by the person on a future date. Once the amount has been paid for the expenses in advance (prepaid), a journal entry should be passed to record it on the date when it is paid. When the benefits have been received against it, the entry should be passed to record it as an actual expense in the.

Journal Entry For Prepaid Expenses

The correct insurance expenses for 2019 comprise 4/12th of $4,800 = $1,600. The balance, $3,200 (4,800 - 1,600), relates to 2020 and should be charged to that year's profit and loss account. Although Mr. John's trial balance does not disclose it, there is a current asset of $3,200 on 31 December 2019.

Prepaid Expense Pengertian, Contoh, dan Cara Menjurnalnya

Steps involved in journal entry of prepaid expenses: Step 1: Create Advance Payment Invoice. Debit: Prepaid expense. Credit: Liability. (Proforma invoice being received and payment to be made) Step2: Payments of prepaid expenses. Debit: Liability A/C. Credit: Cash/Bank. (Advance payment being made)

Journal Entry for Prepaid Insurance Online Accounting

In this accounting lesson, we explain what prepaid expense is, how it is adjusted, and how to record it in a journal entry. Check it out.Accrued Expense Expl.

Prepaid expense journal entry important 2022

Since the prepayment is for six months, divide the total cost by six ($9,000 / 6). Adjust your accounts by $1,500 each month. Expense $1,500 of the rent with a debit. Reduce the Prepaid Expense account with a credit. Repeat the process each month until the rent is used and the asset account is empty.

Prepaid Expense Explained With Journal Entry and Adjusting Entry Example YouTube

Prepaid expenses are current assets. The adjusting entry for prepaid expense will depend upon the initial journal entry, whether it was recorded using the asset method or expense method. The adjusting entry if the asset method was used is: Dr Expense account. Cr Prepaid expense account. for the amount incurred.

(PDF) Adjusting Journal Entries Prepaid Expenses adler gabriel Academia.edu

Examples of Prepaid Expenses. Examples of prepaid expenses include: Paying for a subscription for a year upfront because they were offering a large discount. Signing a 12-month lease for office space that requires 6 months of upfront payment. Paying for a 24-month insurance policy for office space with cash upfront.

Free Prepaid Expense Schedule Excel Template Printable Form, Templates and Letter

A prepaid expense is an expense that has been paid in advance but from which no gain has yet been realized. When a business pays in advance for products or services that will be received in the future, the prepaid expenses are recorded as assets on the balance sheet. Prepaid expenses are originally listed as assets, but as time passes, their.

Free Prepaid Expense Schedule Excel Template Printable Templates

Read More »Jurnal Biaya Dibayar Dimuka (Prepaid Expense) Dalam metode pencatatan akuntansi secara akural, biaya dibayar dimuka merupakan beban yang dikapitalisasi, artinya beban tersebut pada saat uang kasnya dikeluarkan dicatat sebagai aset di neraca karena beban tersebut belum terjadi. Biaya disini bukanlah uang muka atau down payment.

Jurnal Penyesuaian Deferrals Prepaid expenses (beban dibayar dimuka) Part 1 YouTube

ABC Ltd. can make the prepaid expense journal entry for office supplies on June 15, 2020, as below: In this journal entry, the supplies account is a prepaid expense that will be recognized as an expense when it is used. Likewise, the $5,000 is recorded as a prepaid expense in the current asset of the balance sheet.

Excel for All Prepaid expense amortization template to automate your journal entries

Recording a journal entry for prepaid expenses involves the following steps. STEP # 1: First of all, the entity has to fully pay the expense. To record the full amount of prepayment a simple journal entry is made where we have to debit the prepaid expense account as it is an asset for us as discussed earlier and an increase in the asset is.