Convenience fee explained ShinePay

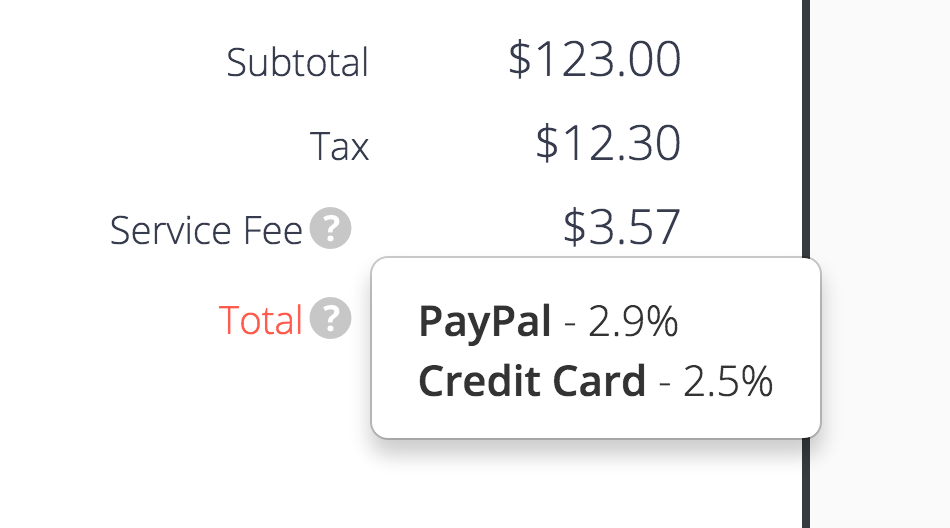

The average credit card processing fee is between 1.5% and 3.5%. [2] According to the Federal Reserve, the average debit card interchange fee was 0.51% for all covered transactions in 2020. [3] You can see an example of credit card and debit card convenience fees if you pay your taxes online. The payment processor payUSAtax charges a flat $2.55.

Understanding Credit Card Convenience Fees Explanation and Examples

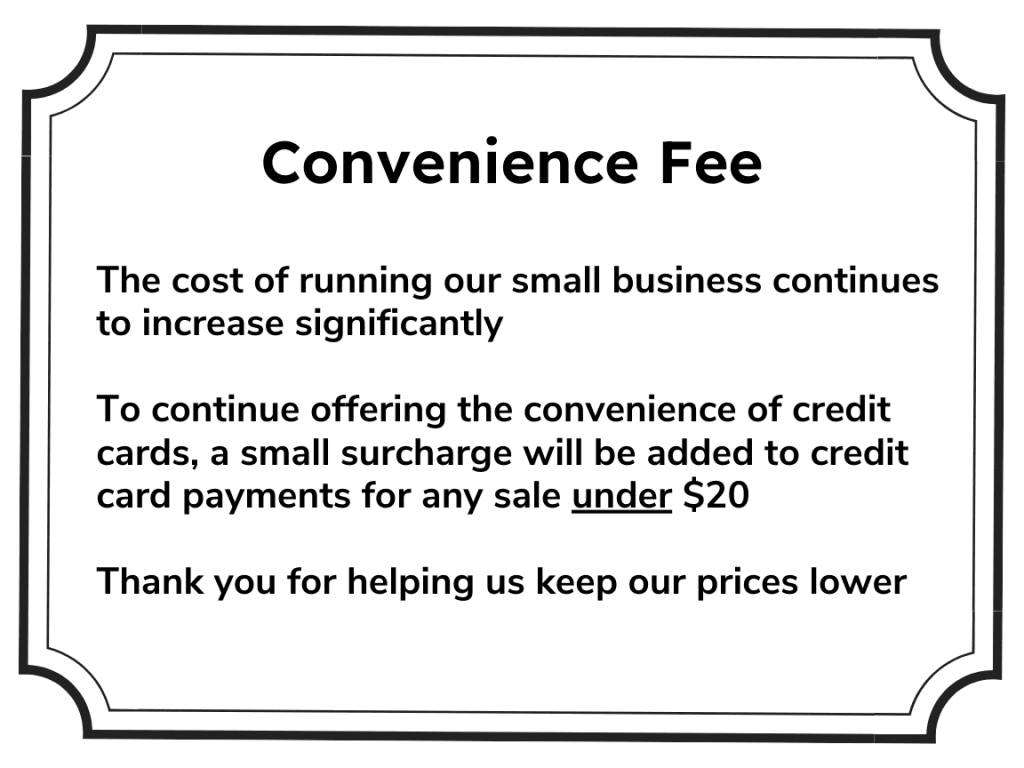

Convenience fees are legal in the United States. But if you decide to charge one, it will need to be a flat fee, such as $1 per transaction instead of a percentage of the transaction amount, such.

Convenience Fee Model Savings

Convenience Fee: A charge assessed by a payee when a consumer pays with a credit card rather than by check or Automated Clearing House (ACH) transfer. Convenience fees can be a fixed dollar amount.

What is a Convenience Fee? And How to Avoid It Self. Credit Builder.

bahasa Indonesia terjemahan disediakan oleh Oxford Languages. volume_up. convenient adjective 1. praktis, tidak menyusahkan frozen food is very convenient makanan yang beku sangat praktis if that's convenient for you kalau tidak menyusahkan Anda 2. dekat the house is convenient for shops and schools rumah itu dekat dengan toko dan sekolah.

What to Know About Charging Payment Processing & Convenience Fees

The convenience fee came into existence when credit cards were rare and those who used them understood that venues went out of their way to accommodate. Now, people use credit cards for everything all the time. It's time to start expecting credit card payments and changing your policies to adapt to this. If for some reason you can't cover.

PPT Convenience Fees Solving the Puzzle PowerPoint Presentation, free download ID1705736

As the name suggests, convenience fees are fees merchants charge customers in exchange for the convenience of paying with a credit card. The cost can be a fixed amount or a percentage between 2.5%-4% and is meant to be reflective of the actual costs incurred by the merchant to process the credit card transaction.

What’s the Difference Between Surcharges and Convenience Fees? Lexactum Credit Card

convenience fee meaning: 1. an extra cost charged when you pay for something in a particular way or use a particular…. Learn more.

What is a convenience fee and should you charge it? YouTube

Google's service, offered free of charge, instantly translates words, phrases, and web pages between English and over 100 other languages.

What is Convenience Fee? Paystand Help Center

Convenience fee adalah biaya yang dikenakan saat konsumen membayar dengan kartu pembayaran elektronik daripada uang tunai. Biaya ini biasanya berupa persentase dari jumlah transaksi dan harus diungkapkan kepada konsumen. Contoh pengenaan convenience fee adalah saat pembayaran hipotek, pajak properti, atau biaya kuliah. 5. Royalty Fee

What are Convenience Fees? The Pros and Cons for Merchants

Frasa yang serupa dengan "convenience" dengan terjemahan ke dalam Indonesia. convenient. besar · cocok · dekat · lapang · luas · mudah · praktis · sesuai · tepat · tidak jauh. conveniently. ada. convenience store. Toko kelontong · toko kelontong. public convenience. tandas.

2023 Guide To Convenience Fees

convenience fee definition: 1. an extra cost charged when you pay for something in a particular way or use a particular…. Learn more.

Add a Service/Convenience Fee to your Payment Options Sprout Invoices

A pay-to-pay fee - also known as a convenience fee - is a fee charged by a company when you make a payment through a particular channel. For example, companies sometimes allow you to make a payment in person or by mail for free but charge you a fee for the convenience of taking your payment over the phone or online. These fees generally.

Printable Credit Card Convenience Fee Sign

In the United States, credit card convenience fees are legal. But they have to be a flat fee (say, $2 per transaction) rather than a percentage of the transaction amount (such as 2% of the total.

Convenience Fee Vs Service Fee Ppt Powerpoint Presentation Ideas Elements Cpb Presentation

A convenience fee is a fee charged by a business when a customer makes a payment via a non-standard payment method, like cash. Convenience fees are most commonly charged for online, phone, or credit card payments. Convenience fees may be charged either as a flat fee or a percentage of the transaction. Although both are used to help businesses.

What are Convenience Fees? How to Pass On Credit Card Fees and Not Piss Off Customers

Convenience fees and surcharges are legal, as long as they stay under a certain percentage of the purchase price and aren't assessed in a state that bans them. Because "convenience fees" in.

Merchants Can Begin Charging Convenience Fees In Canada Retail PointofSale Software One

A convenience fee is charged by a seller when the customer uses a credit card instead of a standard form of payment accepted by the business, such as cash or check. A convenience fee is typically a percentage of the transaction amount (usually 1% to 4%), or a small flat fee, and must be disclosed to the customer.