Risk Management Framework And Why It Matters In Business FourWeekMBA

Operational Risk Management has increasingly become the most important of the three primary risks (along with Market and Credit Risk) facing corporations, and not just in financial services. Its key sub-disciplines - cyber security, business continuity, fraud (especially internal fraud), vendor management, and IT risks have assumed significant standalone proportions in recent years.

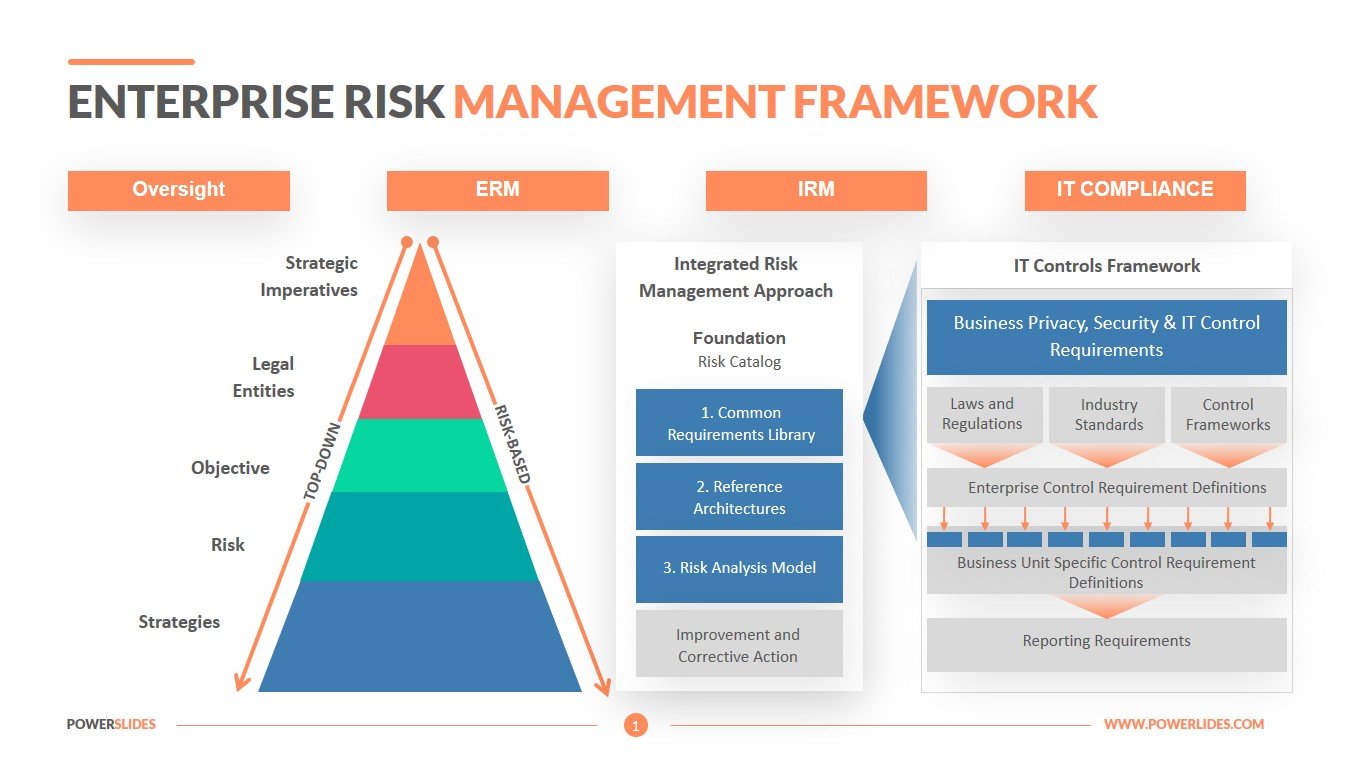

Risk Management Framework

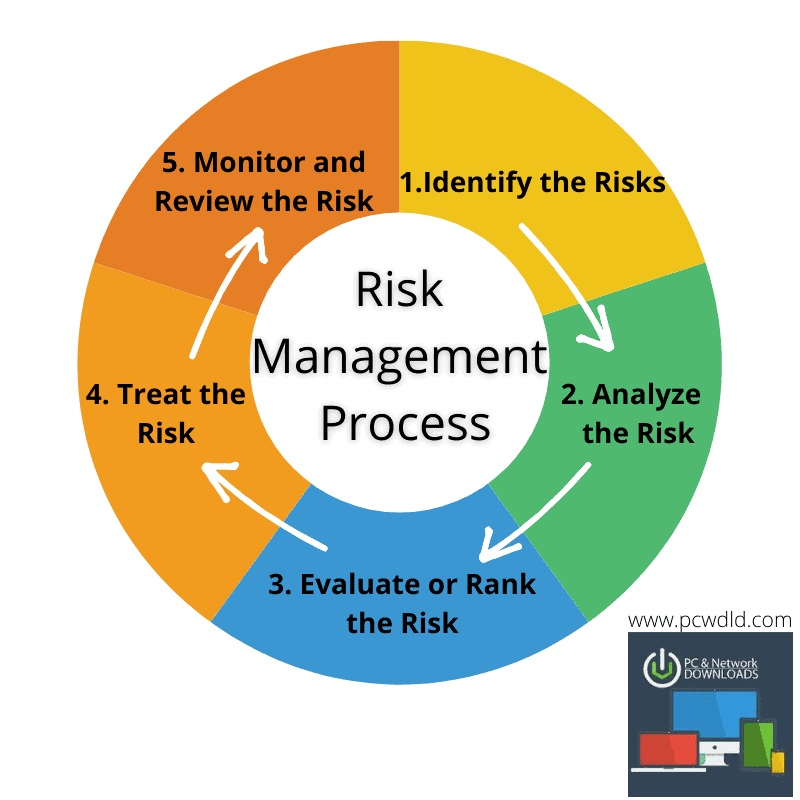

Use this risk management checklist to guide you through the following stages of establishing your risk management framework, as per the ISO 31000 risk management standard. This checklist document includes the following sections on effective risk management: Plan the Establishment of Your ISO 31000 Risk Management Framework

Nist Risk Management Framework Template Risk management, Risk analysis, Management infographic

Project Risk Management Plan Template This template allows you to create a project risk management plan for Excel, which may be helpful for adding any numerical data or calculations. You include typical sections in the template, such as risk identification, analysis and monitoring, roles and responsibilities, and a risk register.

Operational risk management framework. Download Scientific Diagram

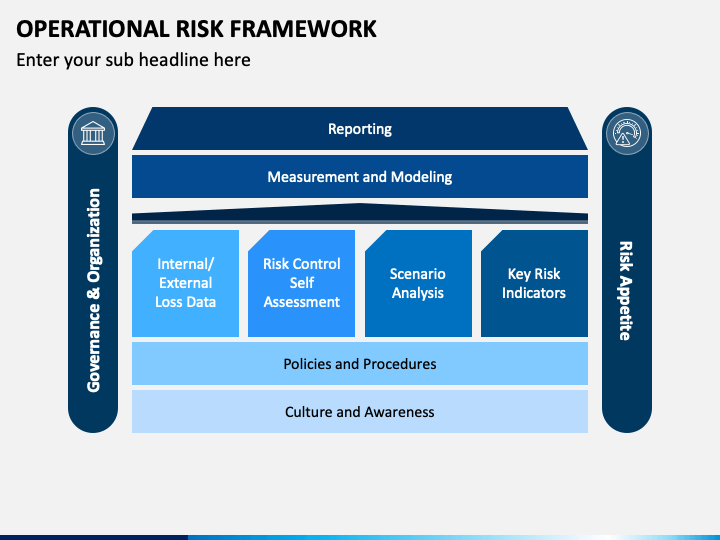

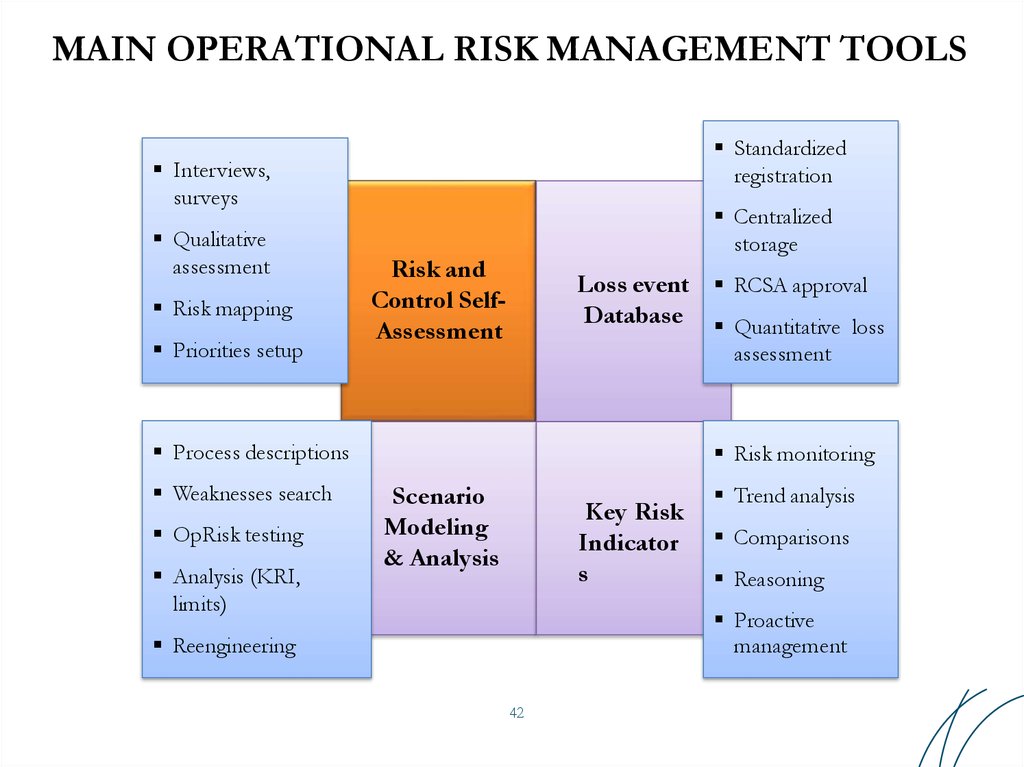

TheOperational Risk Management Framework is comprised of sevencritical elements and seeksto address regulatory expectationsby leveraging applicable KPMG methodologies related to enterprise risk management. A high level description of thesekey elements can be found below. Risk Strategy& Risk Appetite Risk Governance Risk Culture

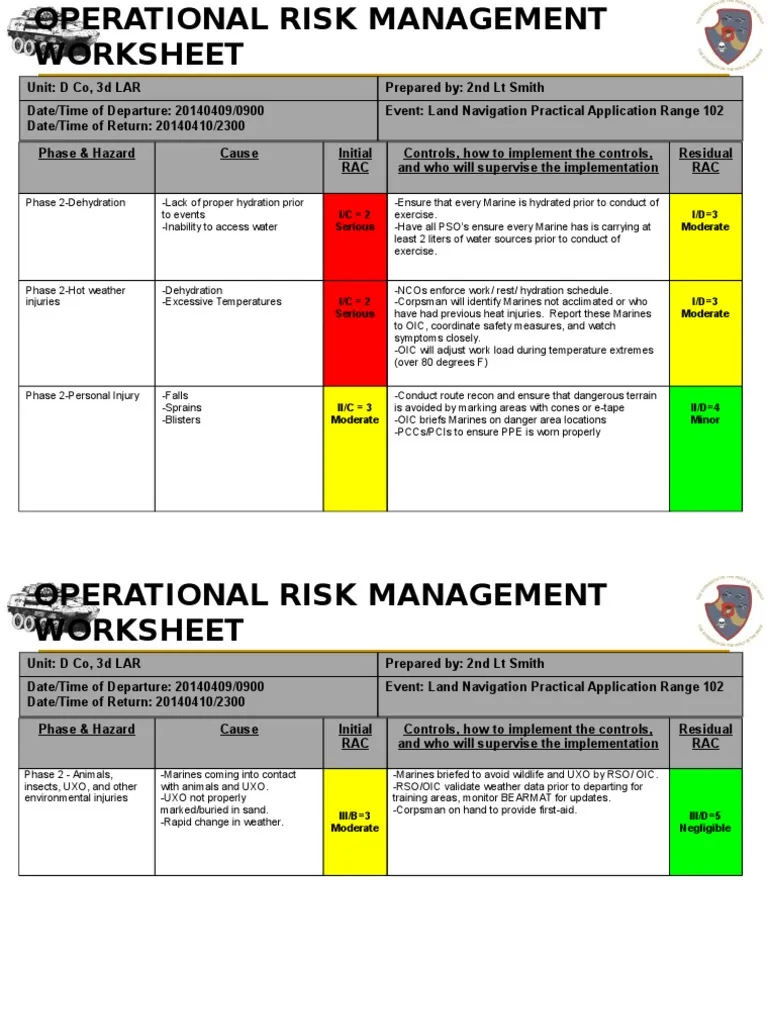

Operational Risk Management A comprehensive overview of ORM

Operational risk management Embedding operational risk management: The real use test Use test: the need for banks to demonstrate that risk management processes are truly integrated into the management of the business. The real use test: giving the business a risk framework that they can actually use.

Elements For Operational Risk Management Framework PPT Images Gallery PowerPoint Slide Show

They represent a collection of operational risk management activities and processes, including the design and implementation of the FRFI's framework for operational risk management. The second line of defence Footnote 3 is best placed to provide specialized reviews related to the FRFI's operational risk management.

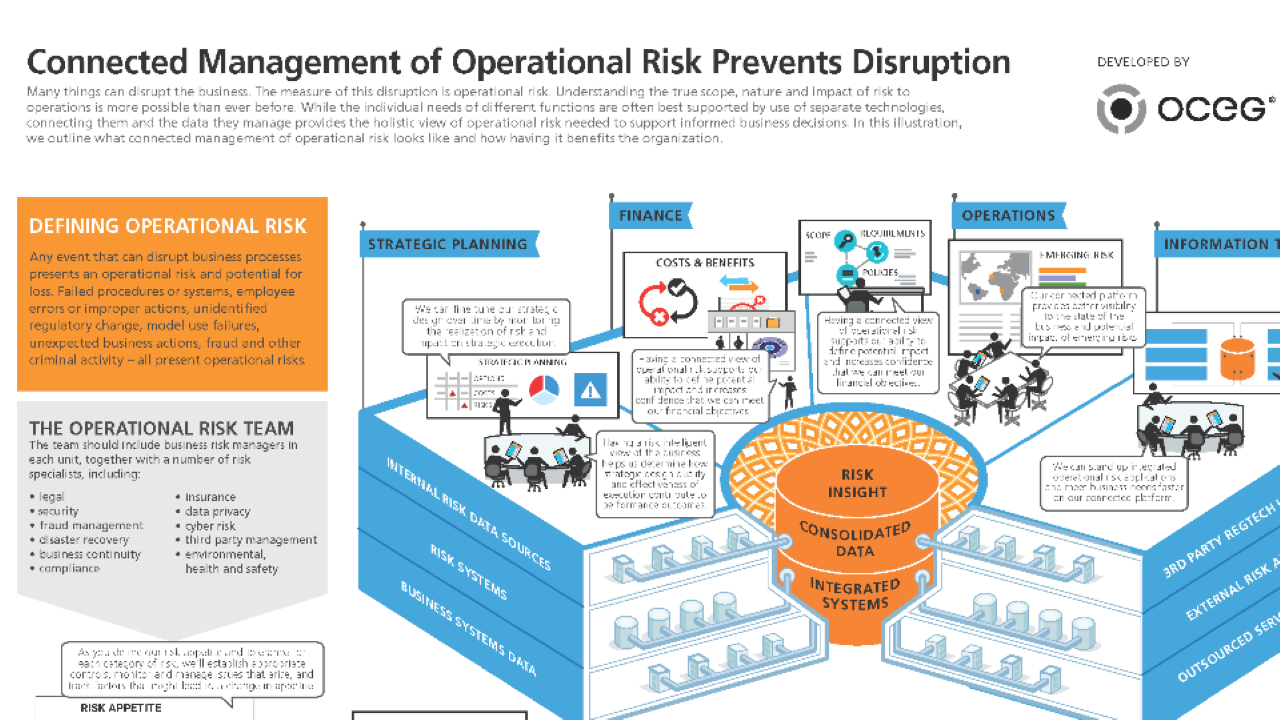

Operational Risk Management OCEG

shifted to operational risk after greater initial focus on credit and market risk. An emerging regulatory focus—very much in line with sound day-to-day risk management—is to ensure that the . CCAR loss estimation framework be firmly grounded in the institution's regular operational risk management process.

Operational Risk Framework PowerPoint Template PPT Slides

Our ORM framework can help you meet the challenge. Empowering informed business decisions The value proposition for strong operational risk management (ORM) is the effective management of operational risks that are inherent in the delivery of the business strategy.

Operational Risk Management Gets Smart with AI

Operational Risks: This category contains operational risk, empowerment risk, IT risk, integrity risk, and business reporting risk. Strategic Risks: This category includes competition, customer risk, demographic and cultural risk, innovation risk, capital availability, regulation, and political risk.

Operational Risk Management Best Practice Overview and Implementation online presentation

This Operational Risk Management Framework is accomplished through a process that includes governance structure, operational risk identification, assessment, measurement methodologies, policies, procedures, and strategies for mitigating, controlling, monitoring, and reporting operational risks.

The Risk Management Framework

Here's a risk assessment framework template that covers all the stages of project procurement: Project Conceptualization, Project Planning, and Project Implementation. This PPT Template helps you review previous assessments and PRA (procurement risk assessment) of your company. perform internal and external analysis.

Operational Risk Management in Banks

Transparency of controls. Framework for management process. Adherence to regulatory and legal requirements. Protection of Reputation. Positive influence on rating. Best practice implementation. Service Quality Improvement. Preservation of Capital.

Risk Management Definition, Strategies and Processes

This step is where business managers identify, own, and manage operational risks and the controls that mitigate the identified risks. Risk identification should include triggers that institutions use to identify potential control failures that may result in operational losses.

Risk management B2Holding Annual report 2020

The goal of the operational risk management function is to focus on the risks with the most impact on the organization and to hold employees who manage operational risk accountable. Breach of private data resulting from cybersecurity attacks. Technology risks tied to automation, robotics, and artificial intelligence.

Enterprise Risk Management Framework Download Now

1. Operational Risk Management faa.gov Details File Format PDF Size: 103.4 KB Download Now 2. Reaping the Benefits of Operational Risk Management accenture.com Details File Format

Operational Risk Management Template Risk Management Risk

Get free Smartsheet templates By Andy Marker | October 21, 2020 (updated September 16, 2021) We've compiled expert tips and resources for implementing enterprise risk management, including best practices and advice on how to overcome common implementation challenges.