Stock Market Crash And Recession Strategy That Always Works Sven Carlin

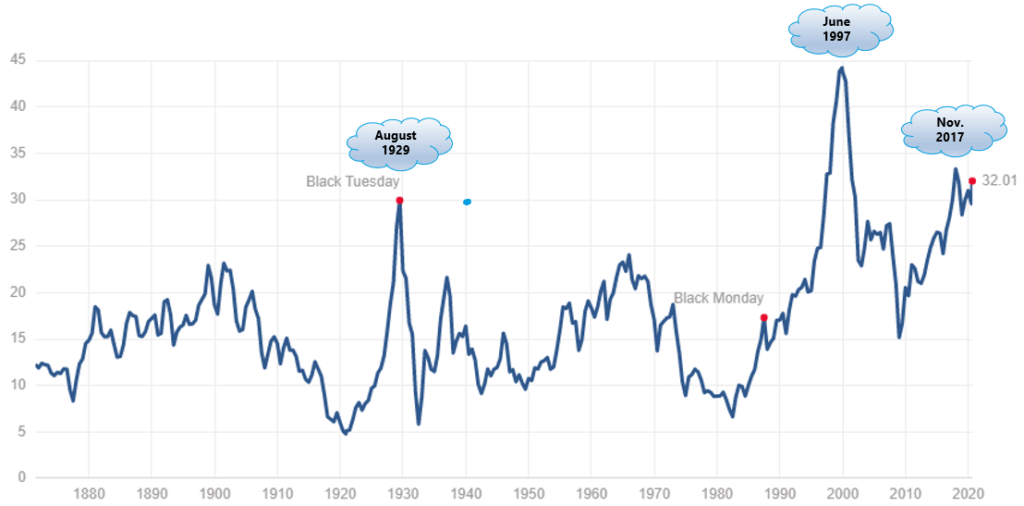

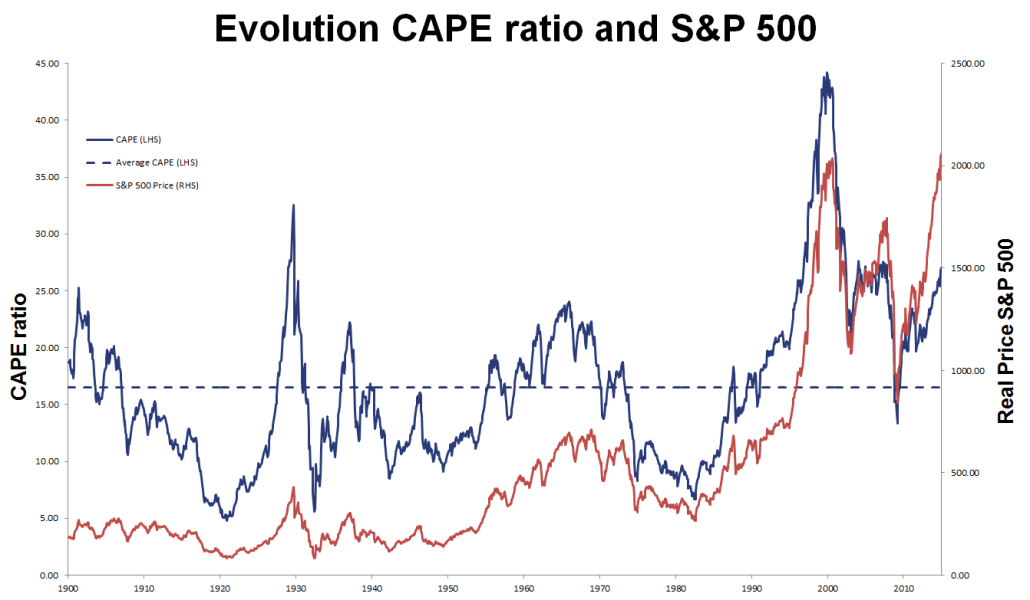

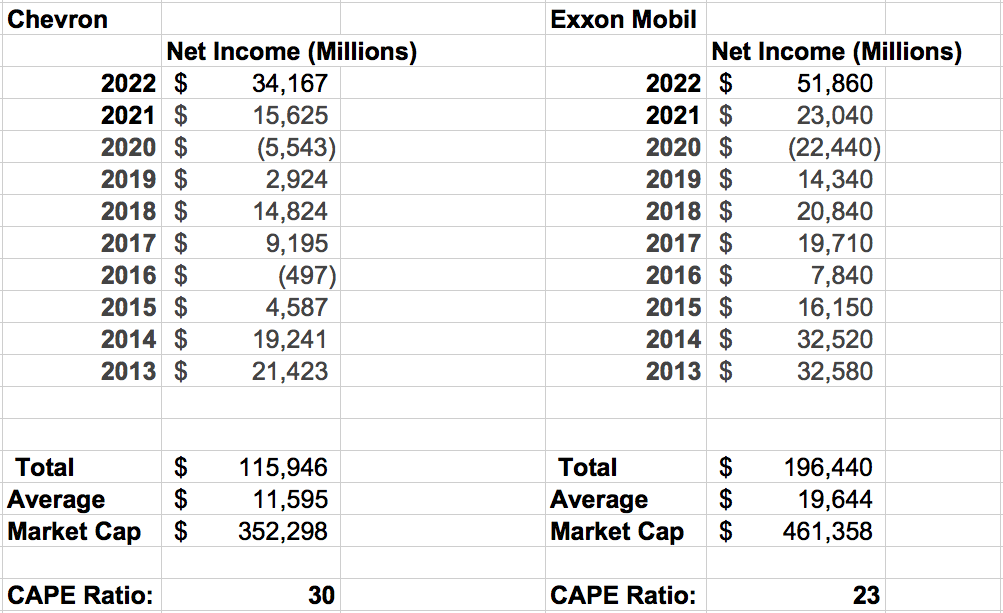

The Cyclically Adjusted Price to Earnings Ratio, also known as CAPE or the Shiller PE Ratio, is a measurement from Robert Shiller. It adjusts past company earnings by inflation to present a snapshot of stock market affordability at a given point in time. This page contains a Shiller PE ratio which calculates the number for the last 10 years.

CAPE Ratio Example and Explanation with Excel Template

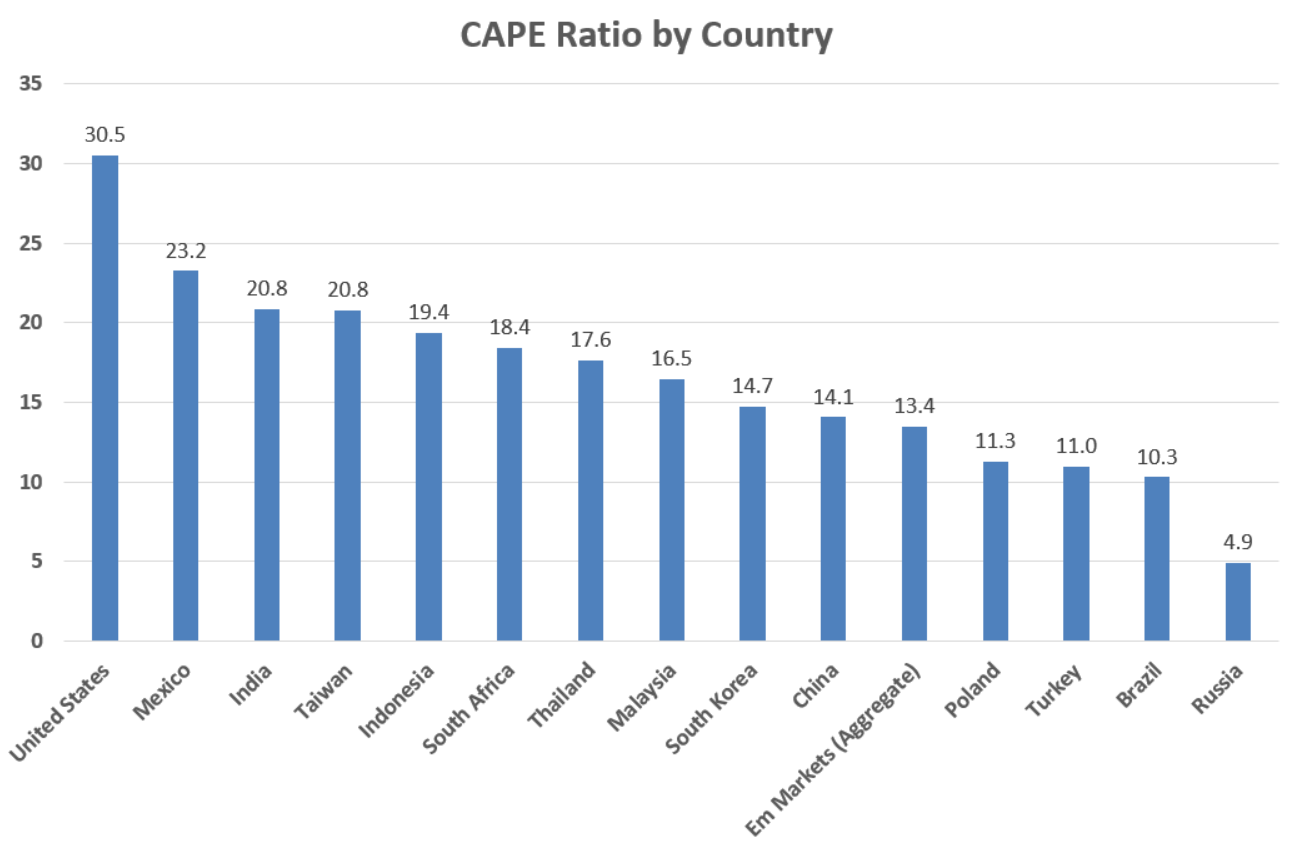

CAPE ratio by country / region / world Region / Country Research Affiliates (31/5/22) Barclays Research (31/5/22) Cambria Investment (10/4/22) Historical median (Research Affiliates) Global 25 n/a 18 22 Developed markets 27 n/a 23 23 Emerging markets 15 n/a 16 16 Europe 18 21 - 17 UK 14 18 16 14 US 32 32 36

3 Investments to Consider for an Expensive Market RHS Financial

The cyclically adjusted price-to-earnings ratio (CAPE) uses the average for ten years of earnings, and adjusts them for inflation. This smoothens the cyclicality of a single year P/E. It's more.

S&P 500 CAPE Ratio Since 1872 Chart

Price-to-earnings ratio is maybe the most fundamental metric used by investors when both individual companies and markets as a whole are evaluated. The ratio is easy to understand and calculate but the problem arrives when it's time to select which earnings should you actually use.

Is the Stock Market Actually Cheap? Not According to the CAPE Ratio

The CPI-U (Consumer Price Index-All Urban Consumers) published by the U.S. Bureau of Labor Statistics begins in 1913; for years before 1913 1 spliced to the CPI Warren and Pearson's price index, by multiplying it by the ratio of the indexes in January 1913. December 1999 and January 2000 values for the CPI-Uare extrapolated.

CAPE ratio by country how to find and use global stock valuation data

A more accurate method is the take the total of dividends paid by the companies and divide the sum by the total market capitalization of the companies. The dividend yields calculated by Siblis Research are calculated using the companies part of the most followed stock index of each country. Do dividends matter?

What is the CAPE ratio and how do you calculate it? IG South Africa

The CAPE ratio ( Shiller PE) of the global stock market is currently 21.45 (July 1st, 2023). This global stock market is calculated using an index of the 3,000 largest public companies around the world, including the United States, developed world and emerging markets.

The Mousetrap 07/13/2014 Calculating the True CAPE Ratio

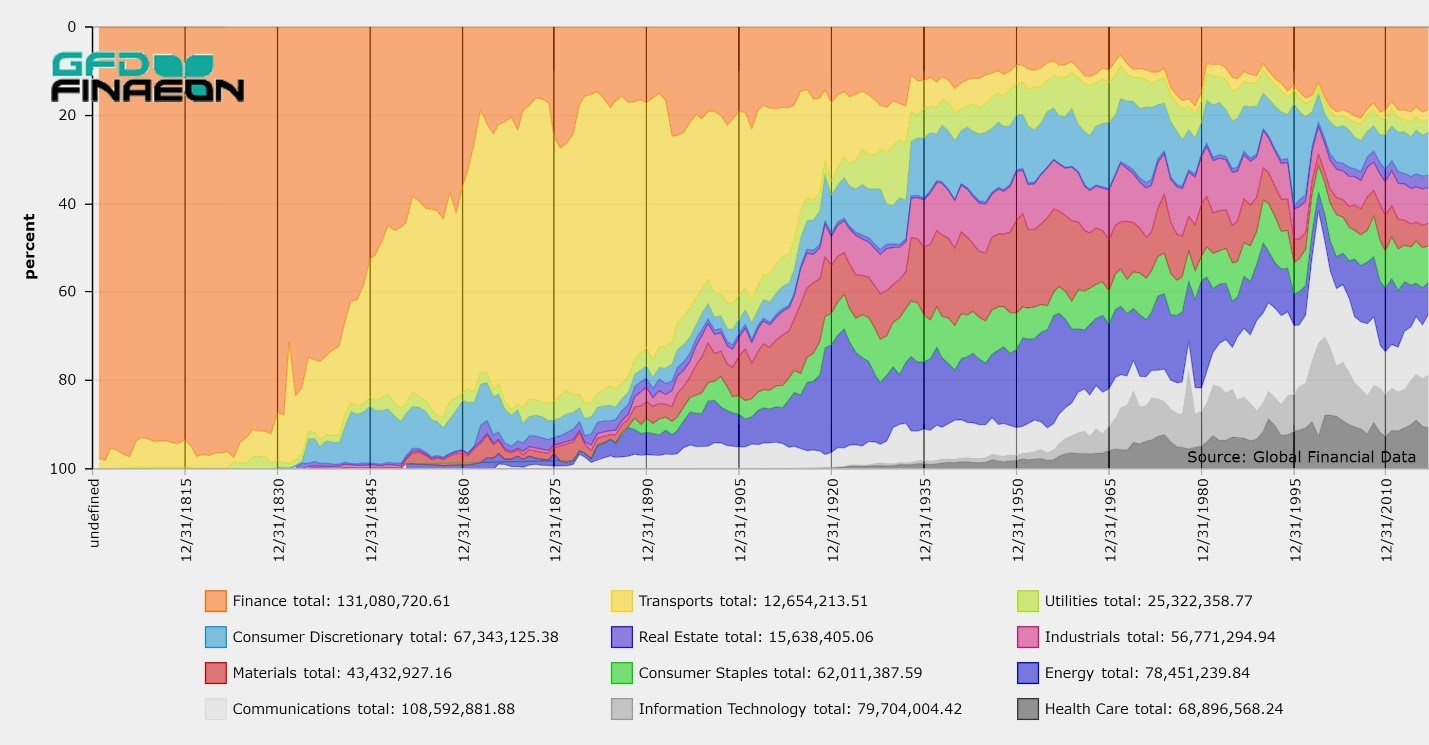

The purpose of this page is to provide an overview of the stock market valuations of the 26 largest economies in the world. The indicators we use are still the percentages of the total market caps of these countries over their own GDPs and the modified indicator, TMC / (GDP + Total Assets of Central Bank) ratio.

CAPE Ratio Definition, Interpretation and Criticisms

CAPE Ratios by Country (Global Shiller PE Ratios) The table below lists the historical and current CAPE ratios of the largest equity markets in the world. Among the largest economies, the most expensive stock markets can be found from India, the U.S. and Japan.

CAPE ratio by country how to find and use global... Big Money Investing

The PE ratio was high because earnings were depressed. With the PE ratio at 123 in the first quarter of 2009, much higher than the historical mean of 15, it was the best time in recent history to buy stocks. On the other hand, the Shiller PE ratio was at 13.3, its lowest level in decades, correctly indicating a better time to buy stocks.

Chevron And Exxon Reason To Be Cautious (NYSECVX) Seeking Alpha

The CAPE ratio or Shiller P/E stands for the cyclically adjusted price-to-earnings ratio ( CAPE ). CAPE is a stock market valuation signal. It is mildly predicative of long-term equity returns. (The CAPE ratio is even more predictive of furious debate about its accuracy). In brief:

WHAT IS THE CAPE RATIO AND HOW CAN IT HELP YOU INVEST IN GLOBAL MARKETS

Stock screener for investors and traders, financial visualizations.

Using the CAPE ratio for market beating returns YouTube

Total Market Value of the U.S. Stock Market CAPE Ratios by Country (Global Shiller PE Ratios) NASDAQ 100 Index P/E, EPS & CAPE Ratio EV/EBITDA (Enterprise Multiple) by Sector/Industry (U.S. Large Cap) FTSE 100 / 250 / All-Share Dividend Yield & Total Return Latest Datasets Japan Stock Market Valuation (2023) NASDAQ 100 Index P/E, EPS & CAPE Ratio

CAPE ratio by country how to find and use global stock valuation data

The CAPE ratio is calculated by dividing the current price of a single stock or a broad stock market index by the average inflation-adjusted earnings of the stock or the index components over the past 10 years.

Is the Stock Market Actually Cheap? Not According to the CAPE Ratio

The cyclically-adjusted price-to-earnings (CAPE) ratio of a stock market is one of the standard metrics used to evaluate whether a market is overvalued, undervalued, or fairly-valued. This metric was developed by Robert Shiller and popularized during the Dotcom Bubble when he argued (correctly) that equities were highly overvalued.

More Problems With The CAPE Ratio Seeking Alpha

Median CAPE Ratio: 25% most expensive: 23 (U.S. in this bucket) 25% cheapest 10 Average of Foreign Developed 17 Average of Foreign Emerging 14 We've mentioned this a lot in the past but bears repeating. We use the MSCI Investable Market Indices below, but MSCI also calculates their Standard Indices too.