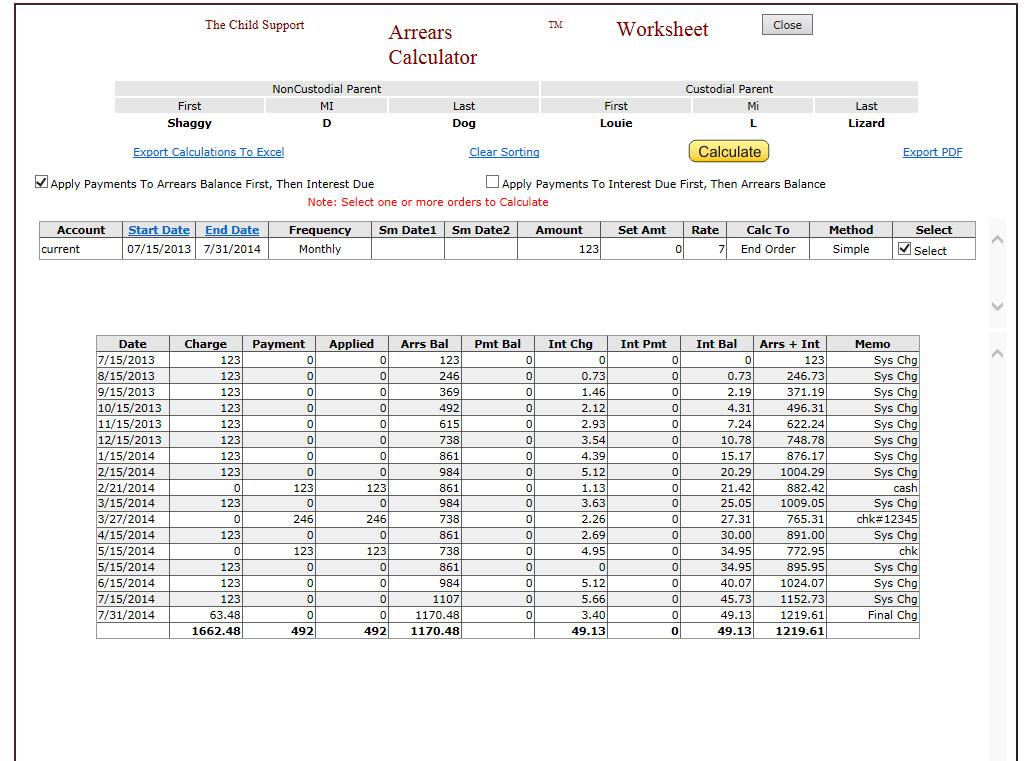

Arrears Calculator Sample Of Typical Spreadsheet Calculation

3. Calculate the separation of a space in the interval of (1) and (2). 4. Taxes payable on the total taxable income for the year to which arrears are linked, including arrears. 5. Calculate the separation within the limits of (4) and (5) in any place. 6. The amount of the deductible is (3) plus the multiple of (6).

erPro Education HR & Payroll

Res. Seniors, I am New in HR Field. Recently Join in Industry. I got a job calculating Arrears for the workers, as Management decided to give increments in Sept. 2009, I have to calculate arrears from April 2009 till August 2009. Please help me and provide me with any format or Formula to calculate Arrears. 12th August 2009 From India, Pune

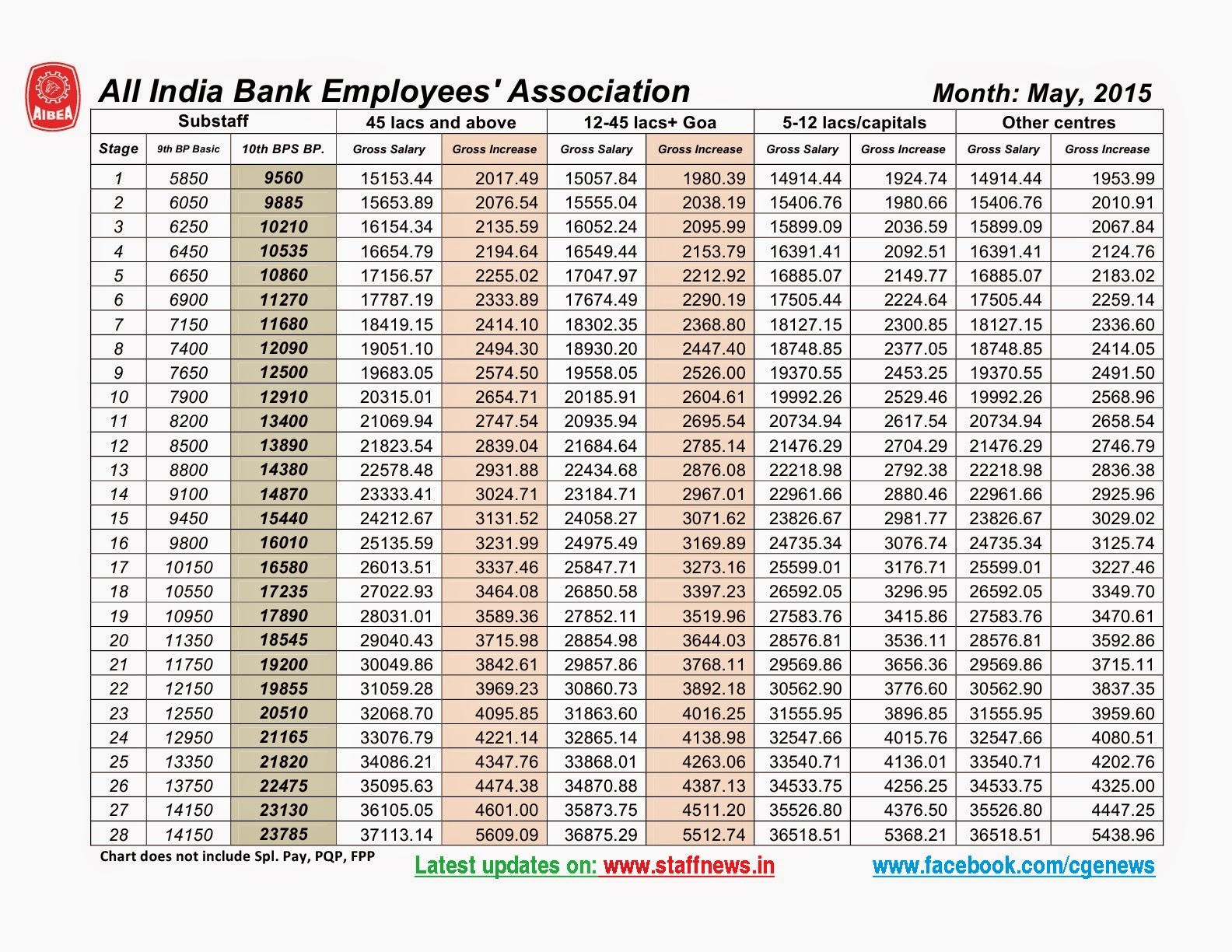

10th Bipartite Settlement Arrears Charts Gross Salary, Gross increase for all the four Areas

Hello Bankers, We would like to share with you a quick and easy arrears estimation tool that provides you with a month-by-month breakdown along with new Basic, special allowances, quarterly updated DA's, and factoring everything that is known or expected at this point. To give you a reasonable estimate of your actual take-home, we have also.

TAX BY MANISH Save Tax on Salary Arrears, Tax Relief Calculations u/s. 89(1) of IT

DownloadAutomated Income Tax Arrears Relief Calculator U/s 89(1) along with Form 10E from the Financial Year 2000-01 to Financial Year 2022-23 (Up-to-date Version) Facebook. Download and prepare at a time Income tax Computed Sheet + H.R.A. Exemption U/s 10(13A) + Automatic Form 10E + Form 16 Part B and Part A&B for the F.Y.2023-24 in Excel.

5 to 7 D.A ARREAR CALCULATION SHEET FOR ALL TEACHERS! No.1 Educational Website

Excel Form 10E-Salary Arrears Relief calculator AY 2023-24 (FY 2022-23) for claiming rebate under section 89 (1) of Income Tax Act 1961-Download. As per section 89 (1) of the Income Tax Act, 1961 relief for income tax has been provided when in a financial year an employee receives salary in arrears or advance. As per Rule 21AA of the Income Tax.

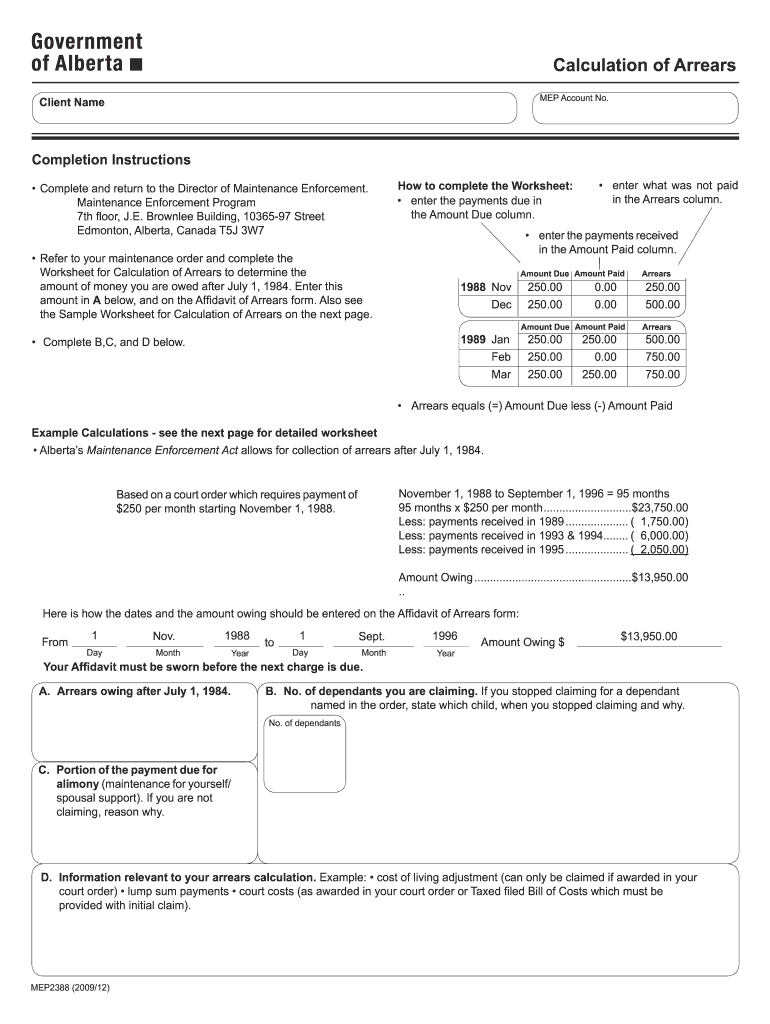

Arrears Form Alberta Fill Online, Printable, Fillable, Blank pdfFiller

Download Excel Form 10E -Salary Arrears Relief Calculator U/s 89 (1) for A.Y 2022-23 |. Under Section 89 (1) of the Income Tax Act, an income tax exemption is granted in 1961 when an employee receives arrears or prepayments in a financial year. Form 10-E is required to apply for relief under Rule 21A of the Income Tax Rules, 1962.

Da arrear calculation sheet in excel । जुलाई 2019 से फरवरी 2020 YouTube

The Calculator generates a one-page Summary Sheet that provides grand totals across all orders as well as year-by-year breakdowns of payments owed and made, arrearages accrued, interest charges, and unpaid fees.. These Annual Pages show the amount of support due each month, accrued arrearages, the applicable interest rate on arrears, and the.

Calculation of Arrear Regarding Premature Increment on UpGradation Galaxy World

To claim the benefits under section 89 (1), filing of Form 10E is mandatory. This form can be filed online on the income tax e-filing portal. As per Section 89 (1), tax relief is provided by recalculating tax for the year in which arrears are received and the year to which the arrears pertains; and the taxes are adjusted in the year in which.

salary arrear calculation sheet

Download Salary Sheet Excel Template. Salary Sheet is a ready-to-use template in Excel, Google Sheets, OpenOffice Calc, and Apple Numbers that helps you easily calculate the salary. It is a payroll document in which you can record payroll data for multiple employees along with a Salary slip prepared according to Indian rules of Employment.

Arrears Calculations Sheet FGEIs Upgradation of MTTs to ESTs 2019 Galaxy World

In payroll terms, arrears are basically increments of salary carried over to the month of payment from the last. In order to accurately calculate arrears payments for employees, you need to do the following: Start with the employees' regular monthly salary. Calculate the amount from the end of the previous month up to the appropriate arrears.

ARREAR CALCULATION EXCEL SHEET FOR CLERKS / CLERICAL STAFF AFTER 11th BIPARTITE SETTLEMENT

Update: DEC 3, 2020 | Download the new version of the Arrears Calculator by clicking on the blue button with the calculator icon.. Once downloaded, open the excel sheet and you are going to see a display similar to the attached screenshot below. The look of the excel sheet if you're using a different version than mine, but don't worry!

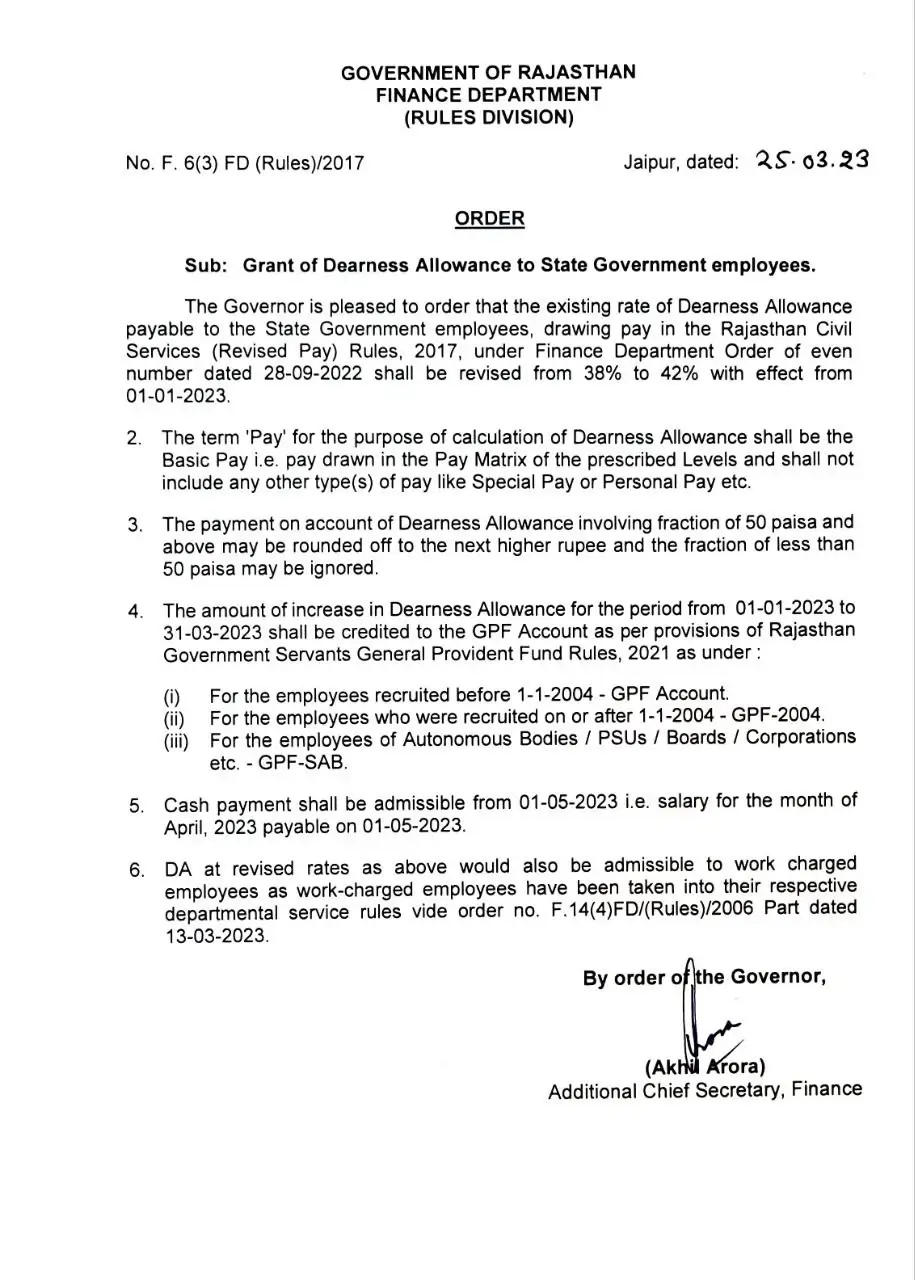

DA ARREAR 38 TO 42 PERCENT DIFFERENCE CALCULATION EXCEL SHEET PROGRAM Shala Sugam

Maxutils.com Congratulates Bankers for their Salary stands to be revised from Nov'17 Click Here to Calculate Tax Relief U/S 89(1) on the arrear payable to you and know to claim tax relief u/s 89(1) is it beneficial in your case or not. This calculator also does your Income Tax Calculations For FY 2020-21 under New & Existing Tax Regime with gross arrear amount and arrear amount that pertains.

7th Pay Arrear Excel Sheet Rajasthan

MACP Calculator for Revised Pay and Arrears. Name: Designation: Pay in PB before MACP: HRA: No HRA 10% 20% 30%. Grade Pay before MACP: 1800 1900 2000 2400 2800 4200 4600 4800 5400 6600 7600 8700 8900 10000 12000. Receiving NPA?:

EXCEL of Salary Arrears Calculator.xlsx WPS Free Templates

arrear salary calculation For employees. salary arrear calculation excel sheet__/LINKS\_ Facebook: https://www.facebook.com/shahabislam123 Twitter: https.

DA Arrear Calculation Central Government Employee News and Tools

July 2023 DA Arrears Calculation Table. The esteemed Union Cabinet Committee granted their approval on the auspicious day of October 19th, 2023. Subsequently, the Finance Ministry took swift action by issuing an official memorandum to facilitate the distribution of Dearness Allowance and Arrears for the diligent Central Government employees.

salary arrear calculation excel sheet YouTube

To calculate arrearage, you'll need to know the following: Begin by constructing a simple layout in Excel. Create three columns: Paid, Should Have Paid, and Difference. Then, create a row for each pay period missed. In the Paid column, place what was actually paid in each period: $2,000. In the Should Have Paid column, place $2,500.