How to use BEST stochastic divergence indicator mt4rsi divergence

#1 Here is one of the momentum oscillators for ThinkorSwim called Lane Divergence. It shows bullish and bearish signals on the lower study of your chart. The overbought area is set to 80 while the oversold area is set to 20, similar to RSI parameters. The indicator also comes with an alert system. thinkScript Code Rich (BB code):

Stochastic divergence trading signals YouTube

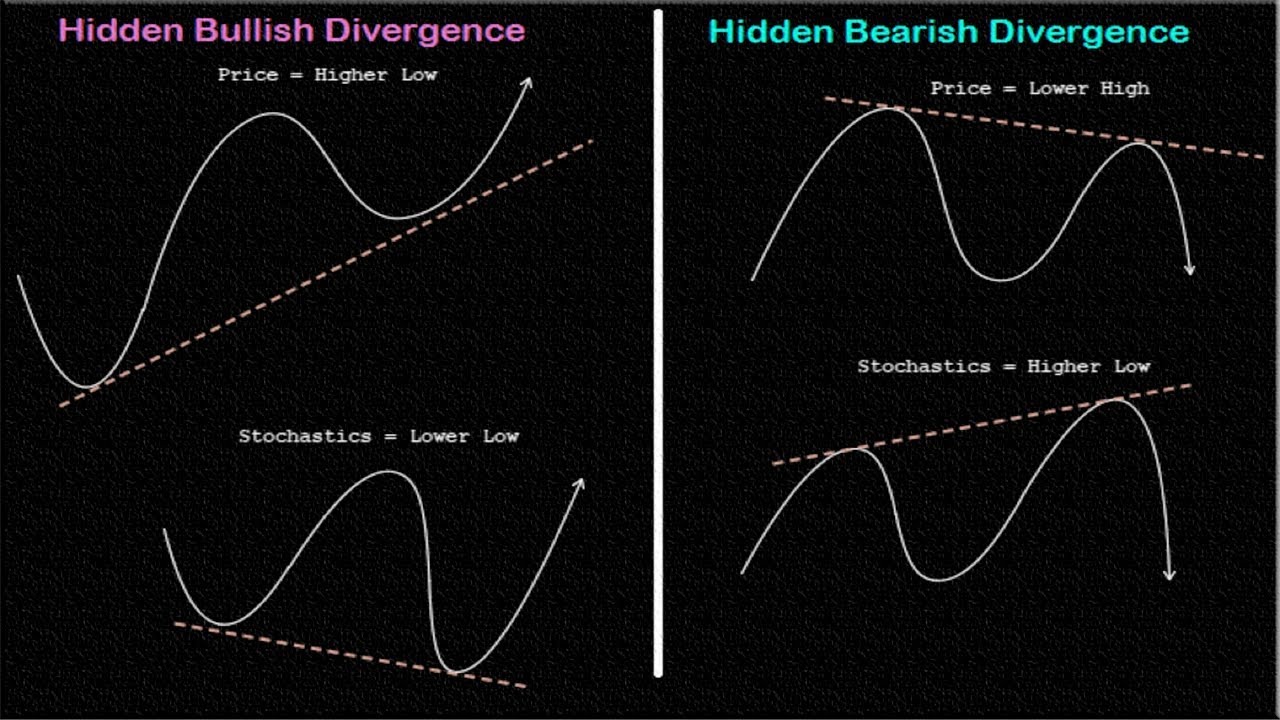

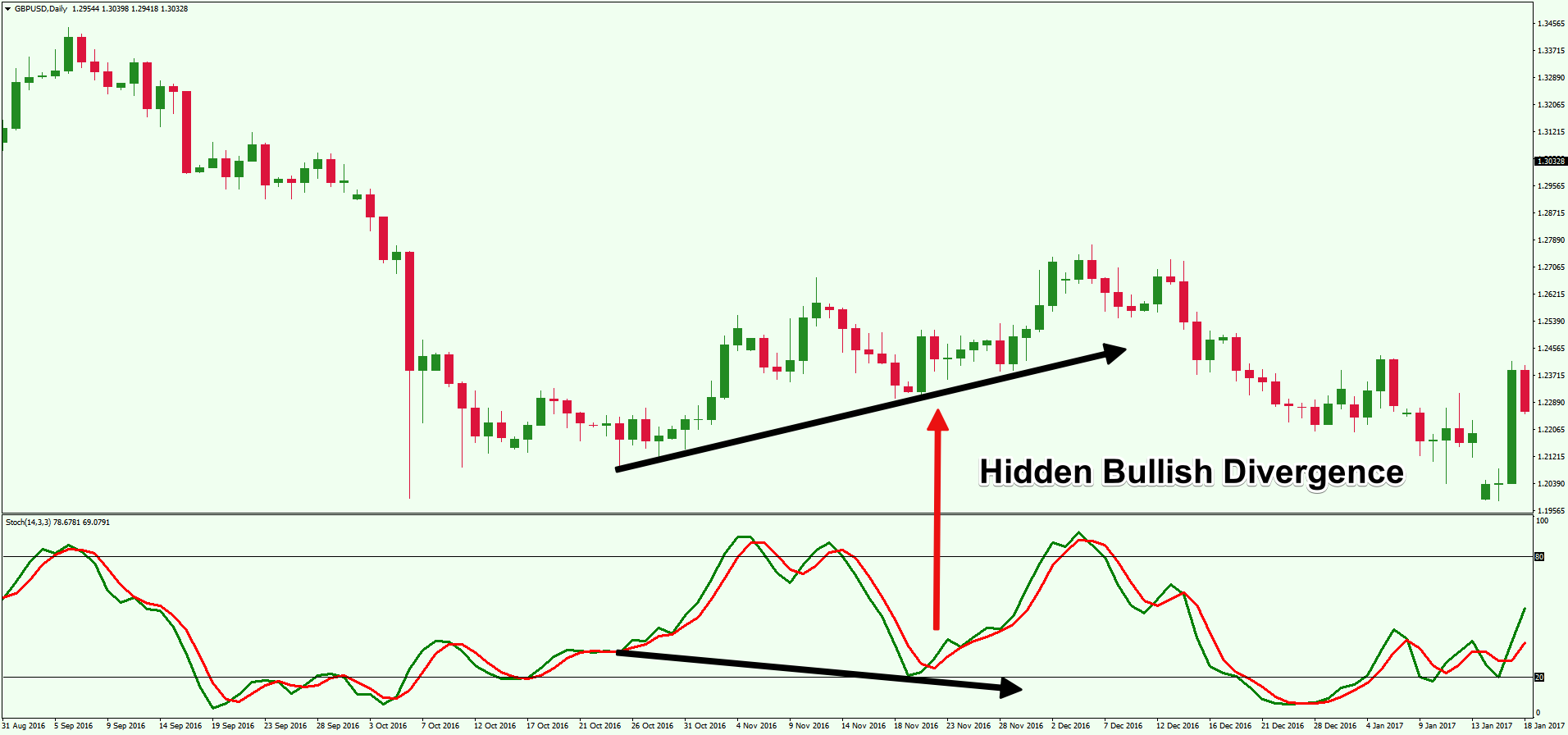

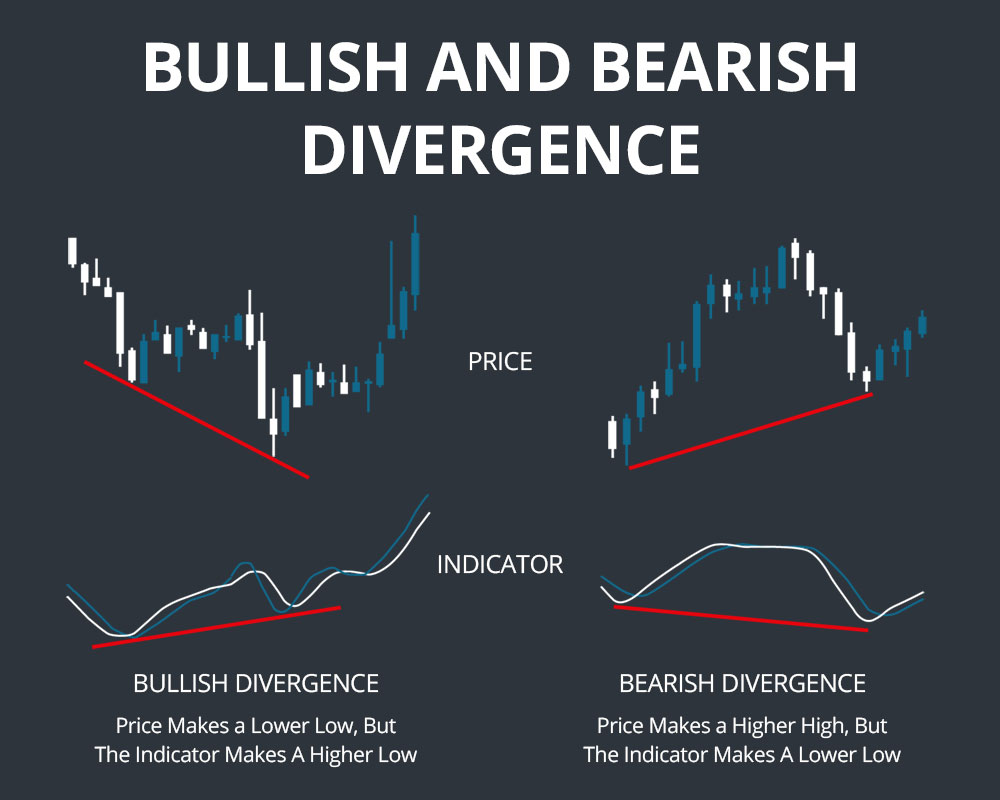

Here are the two types of stochastic divergences some traders like to use: Bullish divergences. A bullish divergence is when the price performs two lower lows, while the second low appears higher in the stochastic indicator. This signals that the bearish trend is due for a change sometime soon. Bullish Divergence Bearish Divergences

Beginners Guide to Trading with the Stochastic Oscillator Forex

Divergence is when the price of an asset is moving in the opposite direction of a technical indicator, such as an oscillator, or is moving contrary to other data. Divergence warns that the.

Stochastic Divergence MT4 pokazatelji

MACD and Stochastic: A Double-Cross Strategy By Glenda Dowie Updated April 08, 2022 Reviewed by Charles Potters Fact checked by Kirsten Rohrs Schmitt Ask any technical trader and they will tell.

Stochastic Divergence Indicator

Also, the stochastic didn't reach the oversold area but soon returned to the overbought conditions. Divergences. Divergence is one of the most prominent signals of many indicators, including the stochastic and the RSI. Divergences occur when a price moves in one direction, but it's not confirmed by the oscillator.

Stochastics Technical Indicator StepbyStep Guide for Traders

Divergences between the stochastic oscillator and trending price action is also seen as an important reversal signal. For example, when a bearish trend reaches a new lower low, but the oscillator.

stochastic hidden divergence YouTube

What are Trading Divergences? Simply put, divergences occur when a price moves in one direction while another indicator—typically an oscillating indicator—moves in a different direction. In essence, you have a divergence if you observe the price rising and setting new higher highs while the oscillator is setting new lower lows.

Stochastics Technical Indicator StepbyStep Guide for Traders

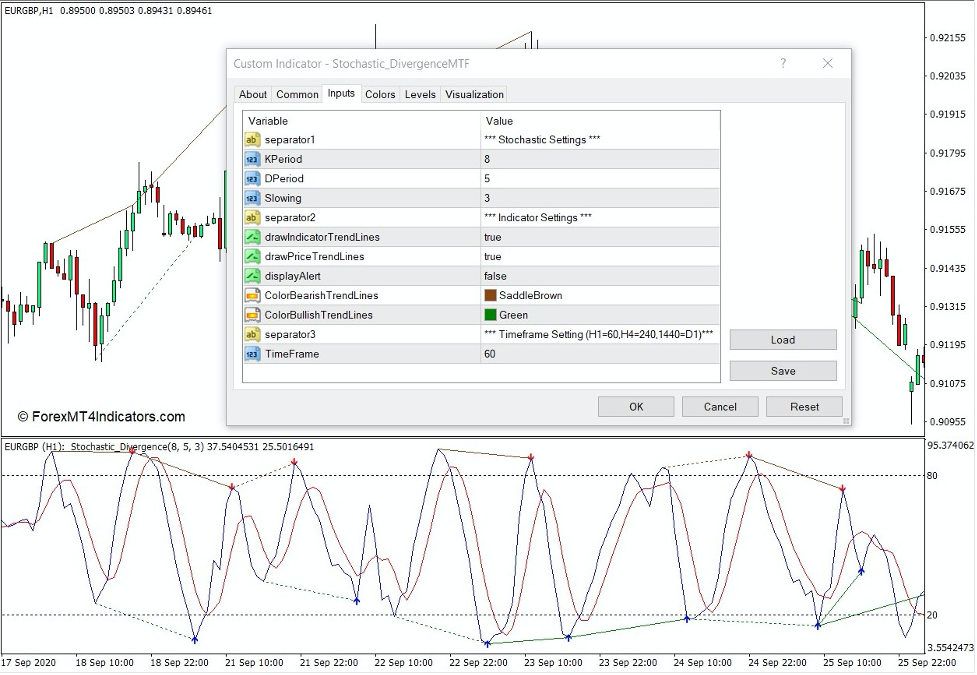

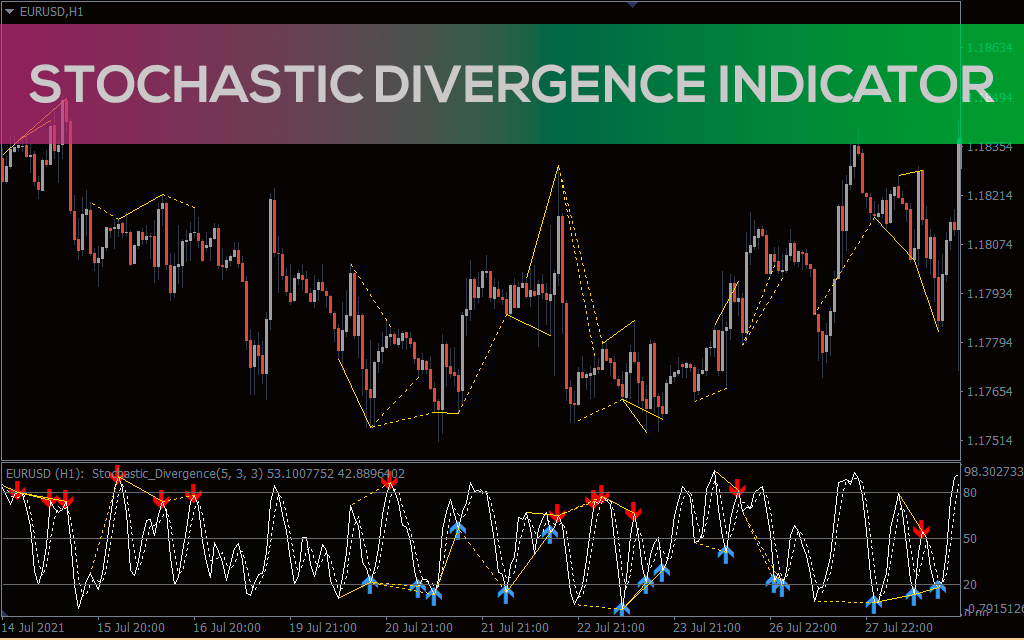

The Stochastic Divergence Indicator effectively searches for divergences on a specified timeframe and notifies you as soon as they appear. You will not miss a single signal because you can set to display arrows on the chart, receive signals by email or as a notification in the Alerts window.

Stochastic Divergence Indicator for MT4 The Ultimate Guide To Business

A stochastic divergence strategy is a trading approach that looks for convergence and divergence between two moving averages. This strategy can be used to identify both bullish and bearish market conditions, as well as fading and momentum trades.

Stochastic Divergence Indicator MT4 DER FOREX OPA

The stochastic oscillator is interpreted as a sine-like wave fluctuating from below the 20 level, which marks oversold territory, to above the 80 band, which marks the overbought boundary.. Divergence—My Favorite Technical Indicator. The foregoing technical indicators are popular and, therefore, useful to understand, but I don.

Stochastic Divergence Indicator for MT4 Download FREE IndicatorsPot

Hidden bearish divergence occurs when the price chart shows a lower high while the stochastic shows a higher high. The "Only Trending Divergences" option, if enabled, will only show bearish divergences during a down trend (price is below 200 EMA) and only show bullish divergences during an uptrend (price is above 200 EMA).

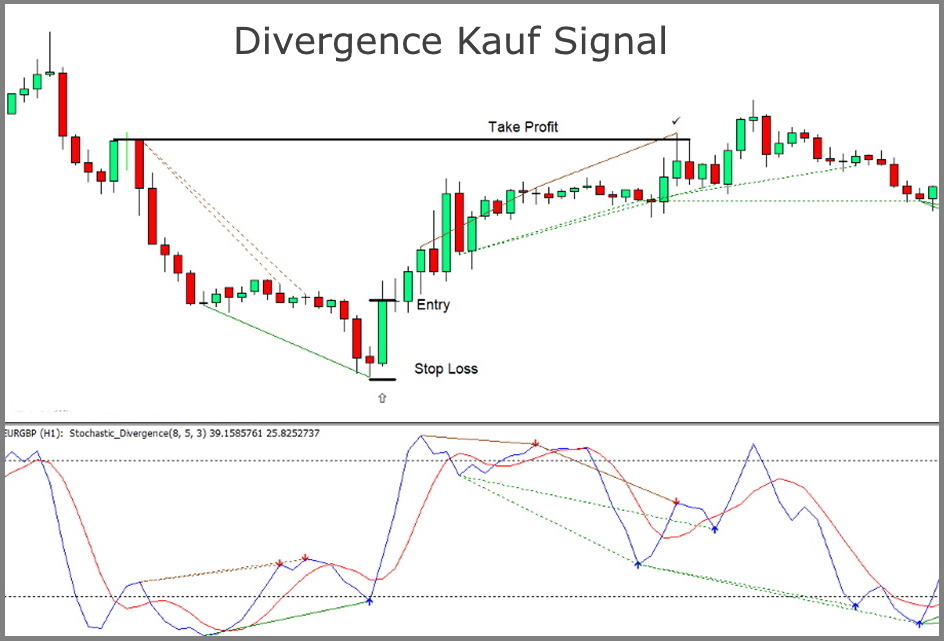

Stochastic Divergence Forex Trading Strategy

In a simple word, the stochastic divergence indicates the divergence of the Stochastics indicator. Explanation: When the share price and the indicator movement in the opposite direction then this indicator will draw a divergence line. so that you will understand what when the indicator is not following the share price direction.

2_Stochs_Divergence

Common momentum indicators for measuring price movements include the relative strength index (RSI), stochastics, and rate of change (ROC). Figure 2 is an example of how RSI is used to measure.

Stochastic Divergence Strategy The Forex Geek

What is stochastic divergence? Stochastic divergences appear when a new high or low in the currency pair price is not confirmed by the stochastic oscillator. A bullish divergence forms when price on the chart makes a lower low, but the stochastic oscillator is forming higher lows.

Stochastic Divergence Indicator for MT4

stochasticdivergence Trading Ideas 5 Educational Ideas 1 Scripts 19 Education and research Videos only Divergence Cheat Sheet / Types of Divergence ELGIEQUIP , 75 Education AfnanTAjuddin Updated Dec 8, 2022 What is divergence?

Stochastic Divergence Indicator Strategy Earnfo

Stochastic with Divergences theehoganator Reuploading as there was an issue with the description. This indicator uses the popular Stochastic indicator as its base. I have included the ability to draw divergences on the indicator as they occur live.