PPT Chapter 16 Joint Cost s PowerPoint Presentation, free download

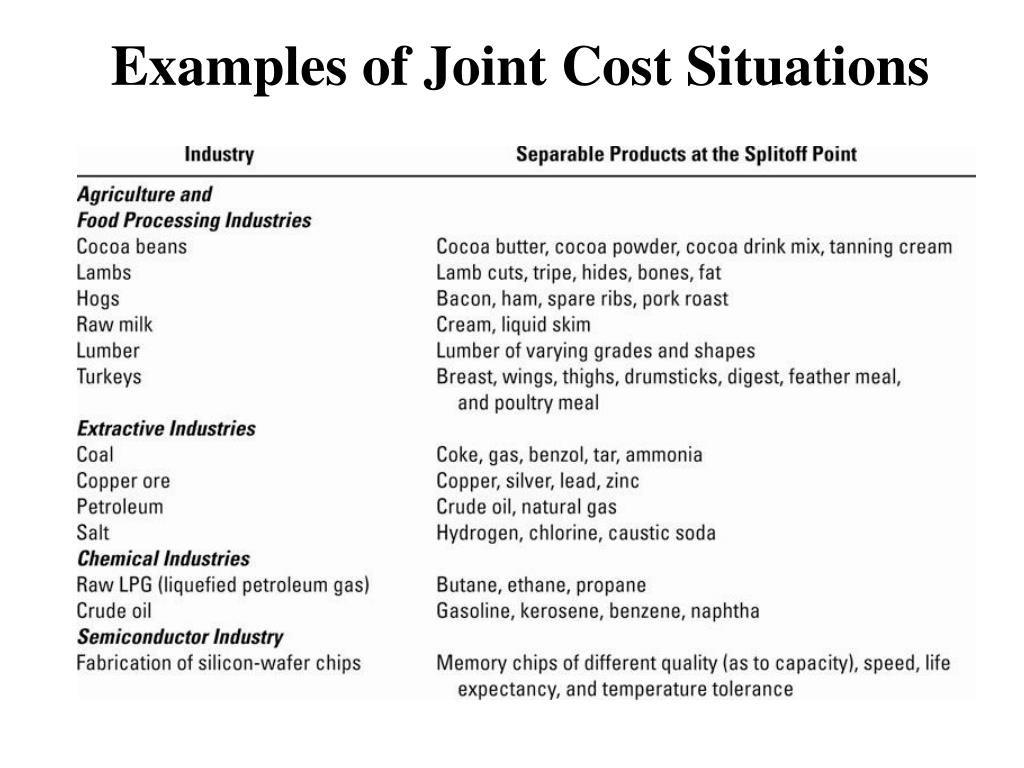

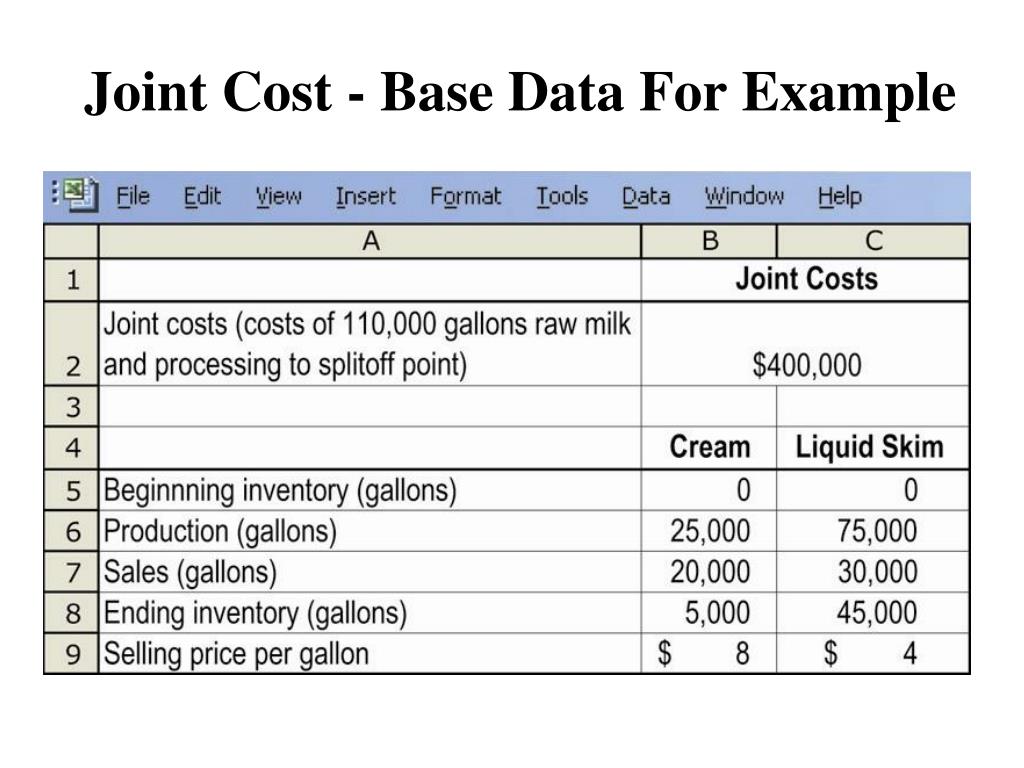

The cost of this single input and the related manufacturing process costs are called joint costs 15. For example, lumber companies often must deal with joint products (different types of lumber) resulting from one input (a log). How do the concepts of joint products and joint cost help a lumber company establish a cost for each of its products?

PPT Cost Allocation Joint Products and Byproducts PowerPoint

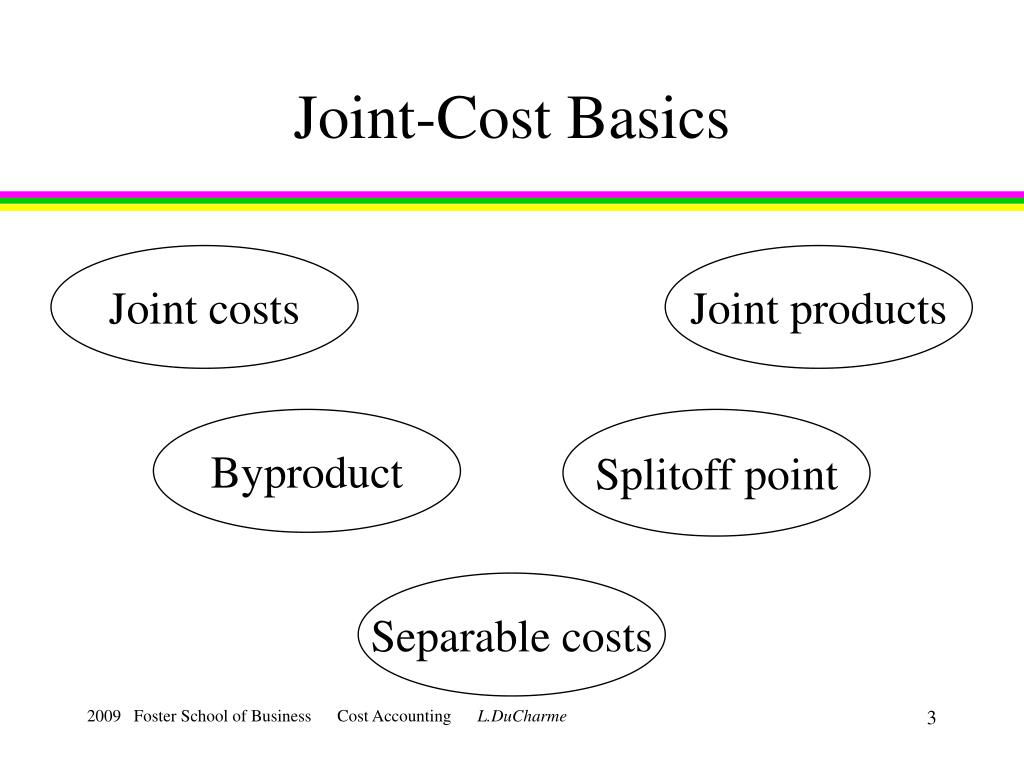

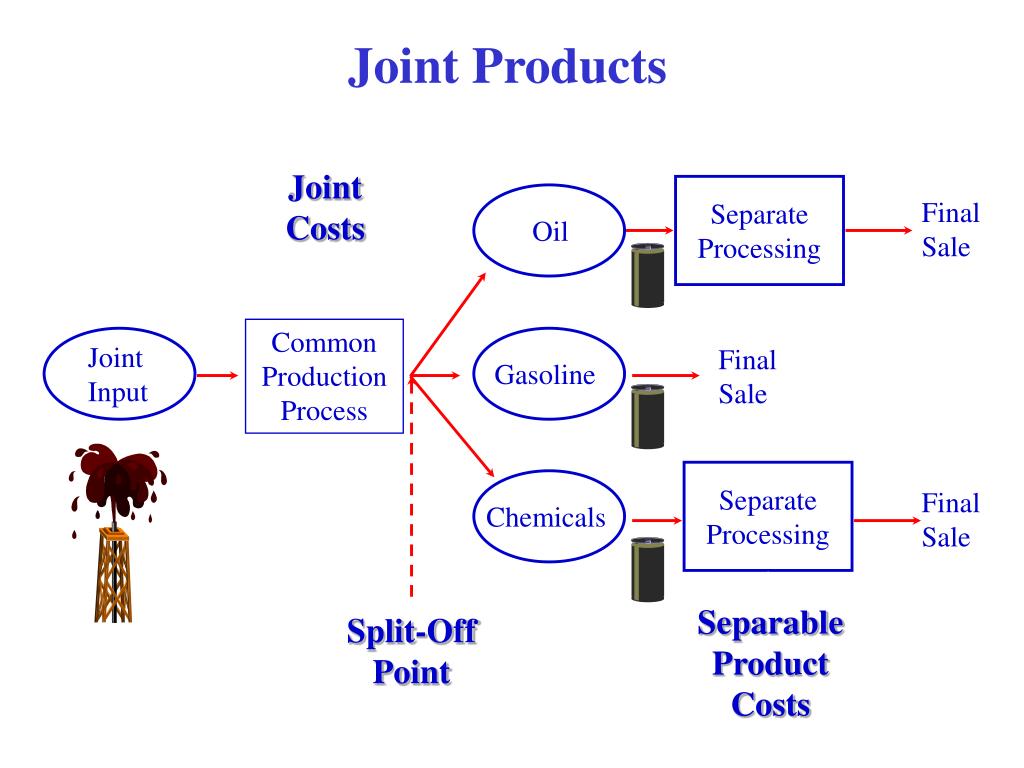

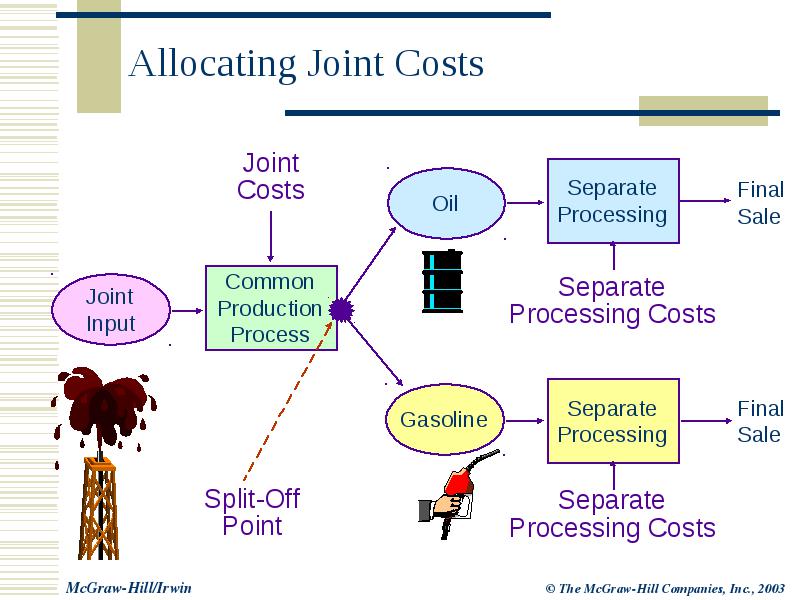

In accounting, a joint cost is a cost incurred in a joint process. Joint costs may include direct material, direct labor, and overhead costs incurred during a joint production process. A joint process is a production process in which one input yields multiple outputs. It is a process in which seeking to create one type of output product.

PPT Cost Allocation Departments, Joint Products, and ByProducts

Formulated with evidence-based doses of patented Curcumin C3 Complex, FruiteX-B, Boswellin Super, UC-II Collagen and Bioperine. Promotes healthy joint integrity, eases inflammation and fights.

PPT Cost Allocation Joint Products and Byproducts PowerPoint

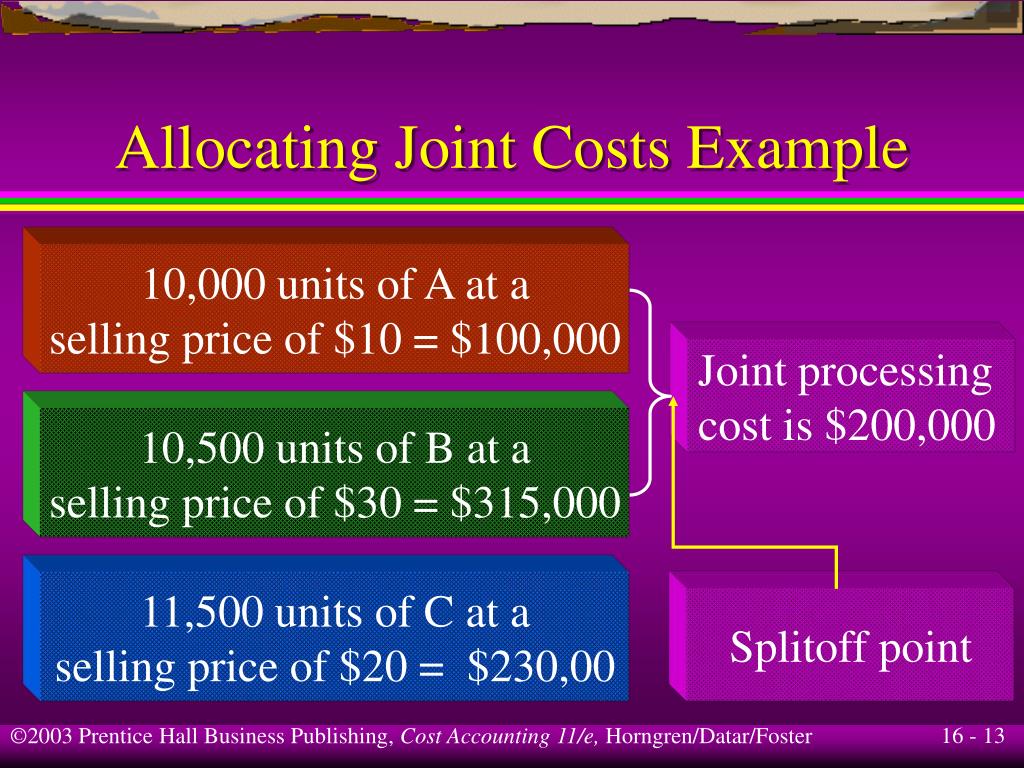

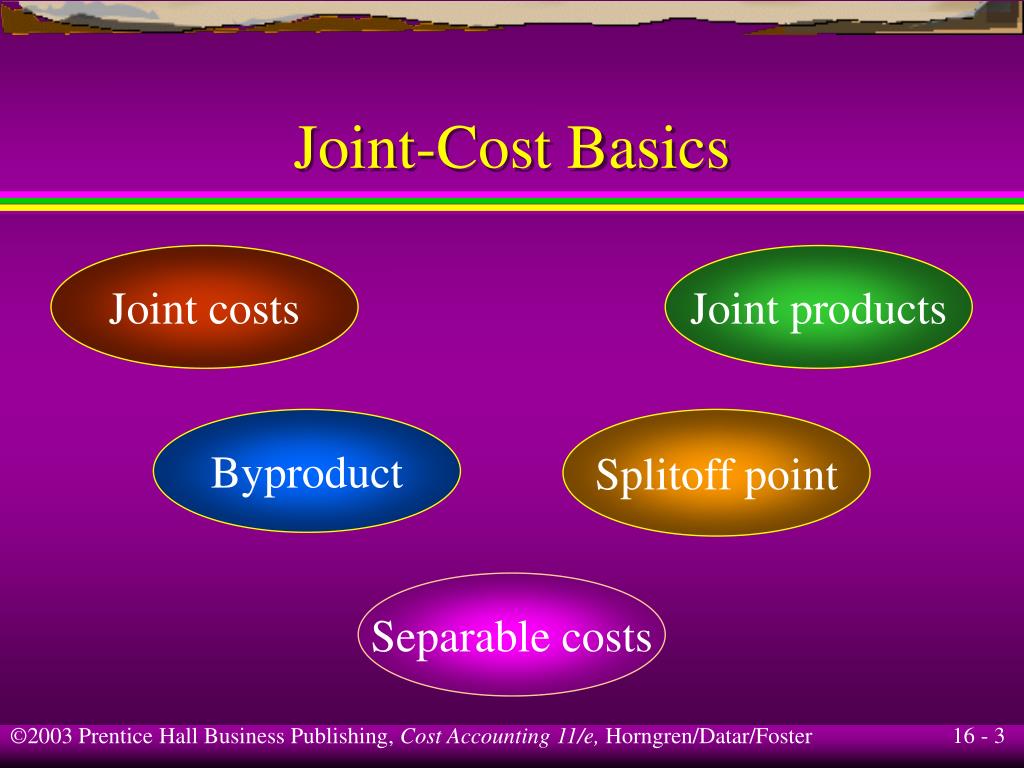

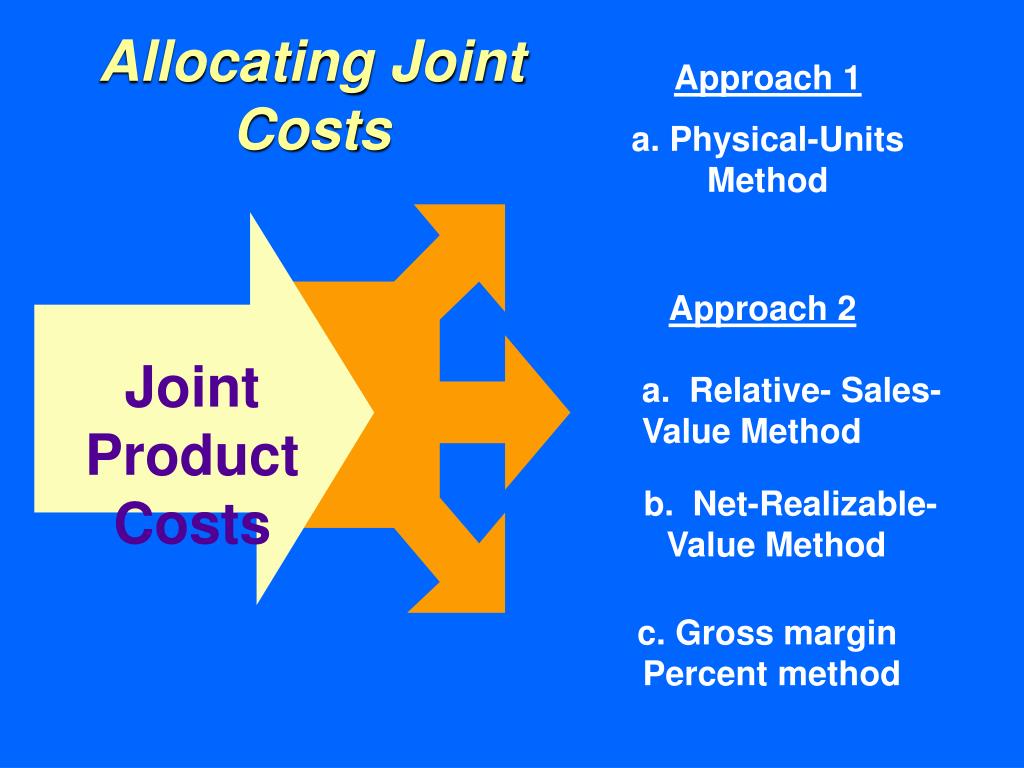

Joint cost is a crucial aspect of accounting and management in production processes. Before products reach the split-off point, where they become separately identifiable, joint costs are incurred. These costs need to be allocated accurately to determine the true cost of each product. Various methods are employed to allocate joint production.

PPT Cost Allocation Joint Products and Byproducts PowerPoint

Joint Cost = C/U. Where, C = Total cost of joint products. U = Total units produced. Another method to calculate the joint cost function is the survey method. Under this method, other factors such as material quality, marketing, and selling price are also considered. In totality, both qualitative and quantitative measures are considered before.

PPT Chapter 16 Joint Cost s PowerPoint Presentation, free download

The joint cost helps to set the finished goods' valuation and keep the work in progress. It helps to meet the cost audit regulations. It helps to keep basic track of the correct determination of costs and justify the cost in price control. The selling price of the products is to be set depending upon the joint cost.

Cost Accumulation, Tracing, and Allocation Chapter 5 Introduction

Definition: Joint costs are costs that are incurred from buying or producing two products at the same time. In cost accounting terms, joint costs have the same cost object. What Does Join Cost Mean? Manufacturers incur many costs in the production process.It is the cost accountant's job to trace these costs back to a certain product or process (cost object) during production.

Allocating Joint Cost YouTube

Joint costs are production costs incurred in creating two (or more) products. The splitoff point is the point when the costs of two or more products can be separately identified. After splitoff, each product incurs separable (or independent) costs. Figure a product's total cost in cost accounting.

PPT JointProcess Costing PowerPoint Presentation, free download ID

Joint cost and oil industry. The oil industry is well known for using joint cost accounting. The oil filtration business processes the crude oil to produce petrol, gasoline, and higher octane, etc from a single resource consumed. Hence, the cost incurred on the purchase of crude oil is a joint cost that needs to be allocated.

PPT Cost Allocation Joint Products and Byproducts PowerPoint

October 03, 2023. A joint cost is a cost that benefits more than one product, while a by-product is a product that is a minor result of a production process and which has minor sales. Joint costing or by-product costing are used when a business has a production process from which final products are split off during a later stage of production.

PPT Cost Allocation Joint Products and Byproducts PowerPoint

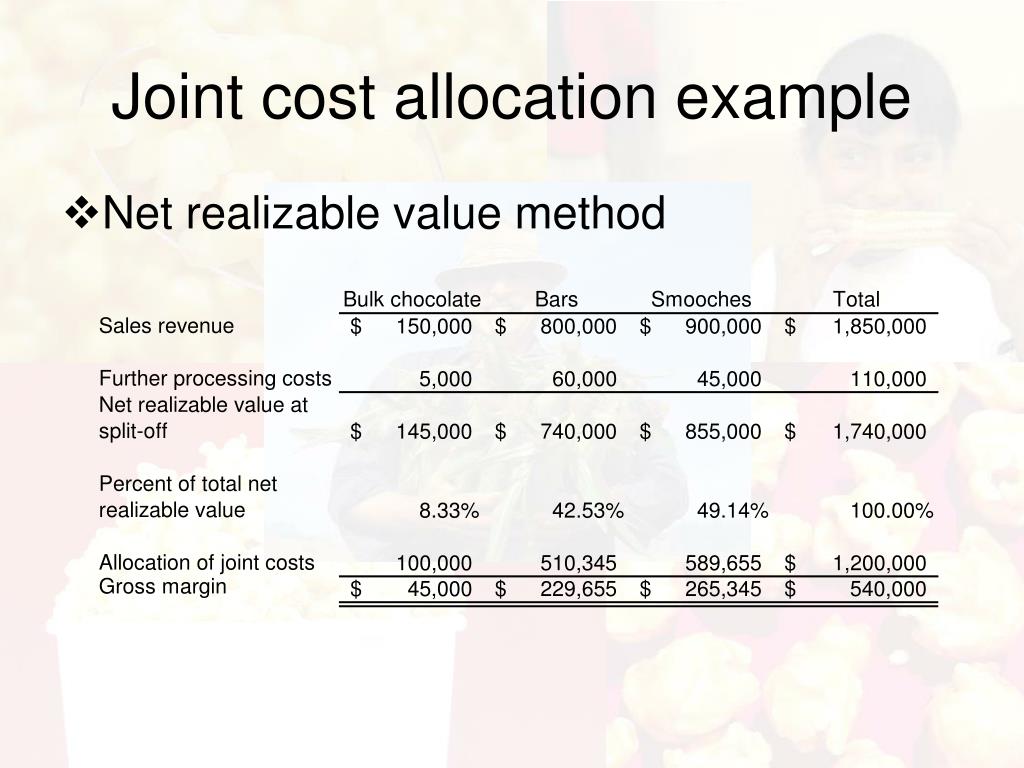

Example: Joint products A, B, C, and D are produced at a total joint production cost of $120,000. The following quantities are produced: A, 20,000 units. B, 15,000 units. C, 10,000 units. D, 15,000 units. Additionally, product A sells for $0.25, B for $3.00, C for $3.50, and D for $5.00. These prices are market or sales values for the products.

Joint Costs

Joint cost. Manufacturers incur many costs in the production process. It is the cost accountant's job to trace these costs back to a certain product or process (cost object) during production. Some costs cannot be traced back to a single cost object. Some costs benefit more than one product or process in the manufacturing process.

PPT Chapter 11 Allocation of Joint Costs and Accounting for By

A cashew nuts processing unit produces two varieties of cashew nuts, premium and regular, at a joint cost of ₹75000, out of which ₹25000 is the fixed cost. The quantity produced is 100Kg and 150Kg; and sold at ₹750 and ₹600 per Kg, respectively. Apportion the joint cost using the contribution margin method. Solution:

PPT JointProcess Costing PowerPoint Presentation, free download ID

A joint cost is a kind of common cost that occurs after a raw product, such as a sunflower crop, undergoes two separate production processes, reports Strategic CFO. For example, the cost of.

Joint Costs Allocation using the Physical Units Method (Cost Accounting

Joint Cost. The expense incurred by producers when creating more than one product or process is referred to as the joint cost. These costs include labor, materials, and overhead for the joint product's manufacture. Almost every manufacturer uses joint cost allocation to keep input costs under control.

PPT Chapter 16 Joint Cost s PowerPoint Presentation, free download

A joint cost is an expenditure that benefits more than one product, and for which it is not possible to separate the contribution to each product. The accountant needs to determine a consistent method for allocating joint costs to products. Joint costs are likely to occur to some extent at different points in any manufacturing process.