Understanding Price Rejection Full Guide to a Winning Trading Strategy

Candlestick rejection strategy is a pure price action swing trading strategy. It makes use of the concept of price rejection or candlestick rejection patterns to invalidate counter-trend momentum for a trade continuation.

My 3 Best Forex Trading Strategies For Beginners That Work!

But engulfing candles can also happen at rejection patterns and are common. Rejection II - Double bottoms The screenshot below shows a rejection at a double bottom. Price spiked into it and then immediately reversed and moved higher.

Advanced Candlestick Analysis Trading with Smart Money

Jan 4, 2020 These candles are a representative example of what a bullish rejection candle looks like. I have also added rules to identify a bullish rejection candle. These rules can vary somewhat but the more the rules are relaxed the less the candle acts to reject lower prices. Jan 19, 2020 Comment:

A GBPCHF bearish rejection candle forex price action signal formed at a

The Candlestick Rejection Strategy is a swing trading technique that relies solely on price action. It utilizes the concept of price rejection or candlestick rejection patterns to nullify counter-trend momentum and facilitate trade continuation.

Analisa Candlestick Rejection Candles Price Action Recipes

A 'rejection candlestick' communicates the rejection (or reversal from) higher or lower prices. Naturally, it is found when using Japanese candlestick charts. The candlestick shows that the market has pushed in one direction but then been rejected. Understanding Price Action CFD Trading

Advanced Candlestick Analysis Trading with Smart Money

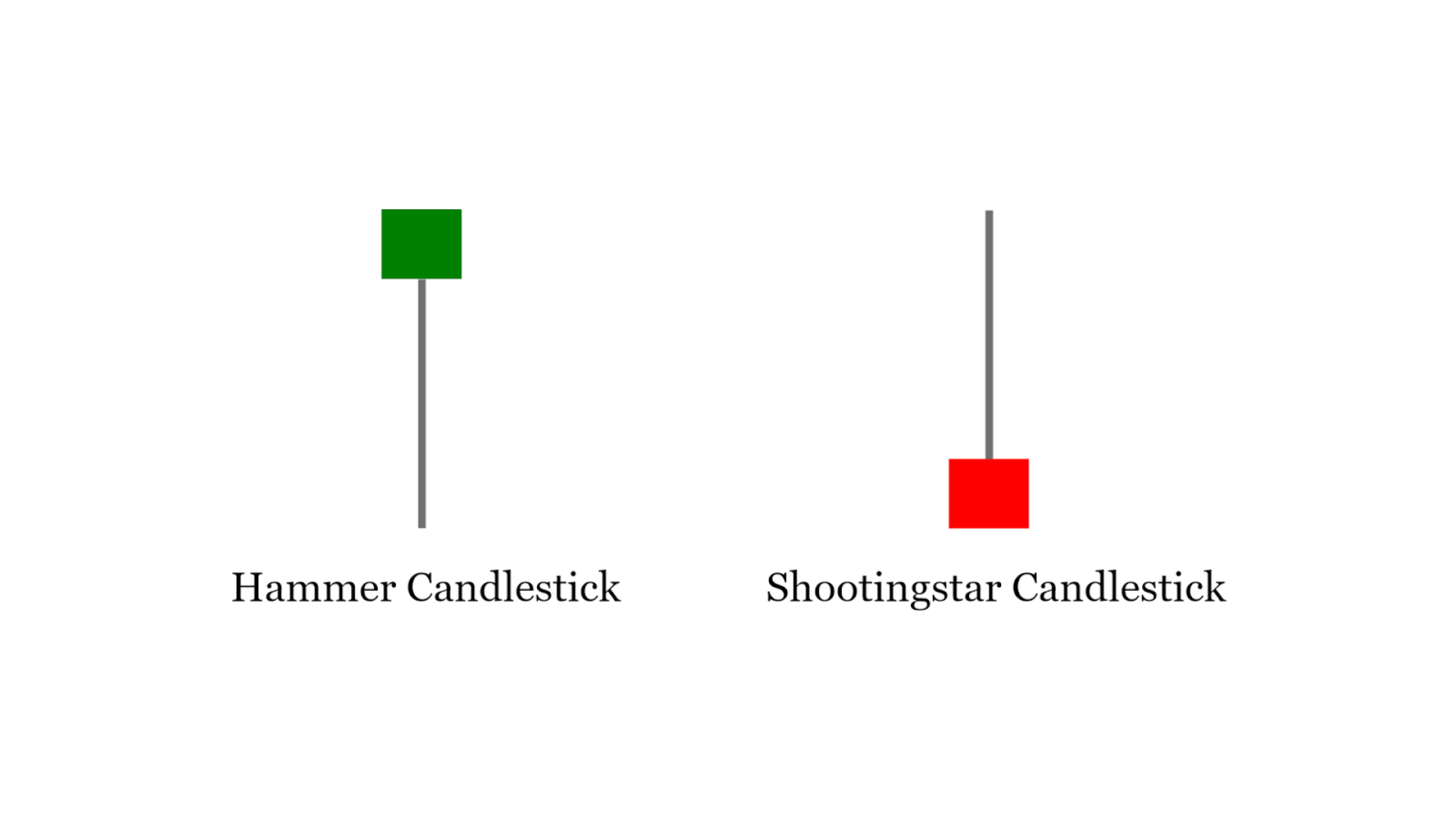

The hammer pattern is one of the first candlestick formations that price action traders learn in their career. It is often referred to as a bullish pin bar, or bullish rejection candle. At its core, the hammer pattern is considered a reversal signal that can often pinpoint the end of a prolonged trend or retracement phase.

Forex Pin Bar Trading Strategy Pin Bar Reversal

These candles are a representative example of what a bearish rejection candle looks like. I have also added rules to identify a bearish rejection candle. These rules can vary somewhat but the more the rules are relaxed the less the candle acts to reject higher prices. Disclaimer

*HIGH PROFIT* Rejection Candle Reversal Trade Signal

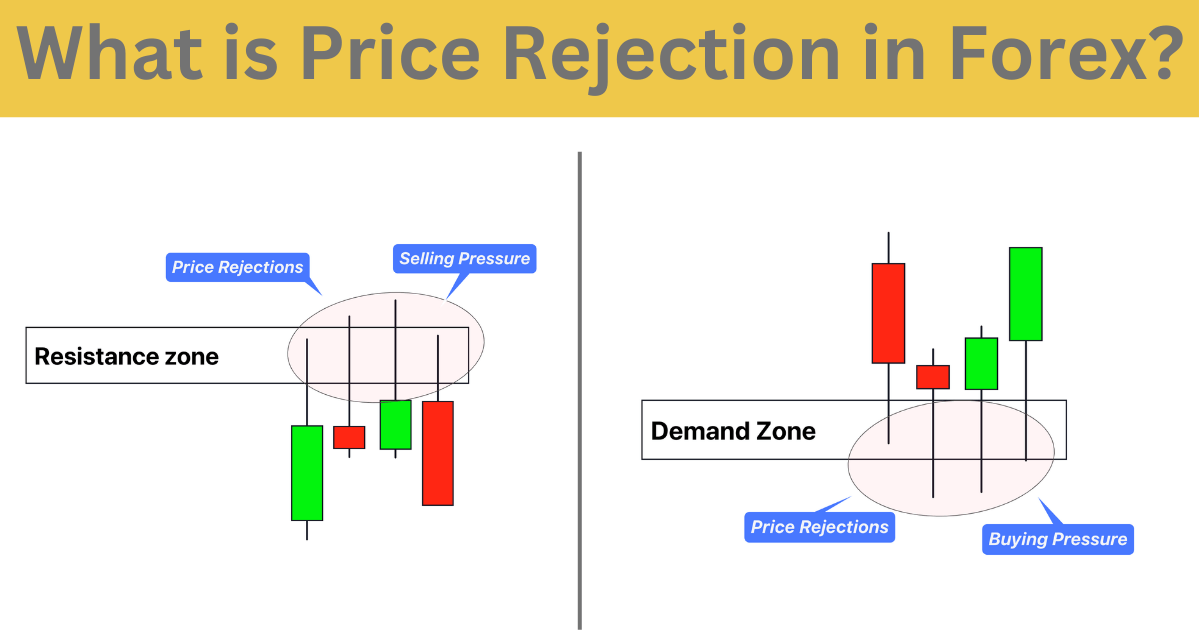

A rejection candle in forex is a candlestick pattern in which the price initially moves in one direction and then rapidly reverses in the opposite direction. This indicates that a certain level of resistance or support has been encountered and the move has been rejected. Rejection candles can provide valuable insight into potential momentum and.

Rejection Patterns Trading charts, Stock chart patterns, Trade finance

1 What are long wick candles? 2 How does a long wick candle form? 3 How to spot and trade rejection candles? 4 What to do when a candle has long wicks on both ends? 5 Long wick candles/rejection candles - the wrap-up What are long wick candles? As you know, a candlestick consists of a body and a wick.

Aspiring Forex Trader PRICE ACTION REVERSAL SIGNALS

Single candle rejection (pin bar) In an established downtrend, any Clear Rejection from resistance in the form of the pin bar or outside bar or engulfing bar confirms the resistance level MULTIPLE CANDLE REJECTION

Rejection Candle Trading Strategy Explained By a PRO

Why? Because it's easy to learn — and it works. That's why I've created this monster guide to teach you everything you need to know to learning all candlestick patterns (and how to trade it like a pro). Here's what you'll learn: What is a candlestick pattern and how to read it correctly Bullish reversal candlestick patterns

Candlestick Analysis in Trading Price Action Analysis

Kicker Pattern. The kicker pattern is one of the strongest and most reliable candlestick patterns. It is characterized by a very sharp reversal in price during the span of two candlesticks. In.

Price action CFD trading strategy rejection candles

The first candle can be a big bullish or bearish candle. The second candle is most likely to be an indecisive candle showing rejection of price from both directions. For bullish reversal, the second candle breaks the low of the first candle and form "lower low" and close above the previous red candle close.

The Best Forex Signals Price Action Trading Patterns

The wicks or shadows of candlesticks show the price rejection on the chart. It is a trend reversal pattern. In technical analysis, traders widely use the concept of price rejection to determine the strength and weakness of a particular support or resistance level.

My 3 Best Forex Trading Strategies For Beginners That Work!

Rejection candlestick pin bar patterns are explained in this video, with some price action trading strategies based on rejection candles. A rejection candle.

BEARISH REJECTION CANDLE EXAMPLES for by

A rejection candle shows rejection of higher or lower prices, and based on where the rejection candle pattern forms on the chart, trading strategies based on th