How to Use Shooting Star Candlestick Pattern to Find Trend Reversals Bybit Learn

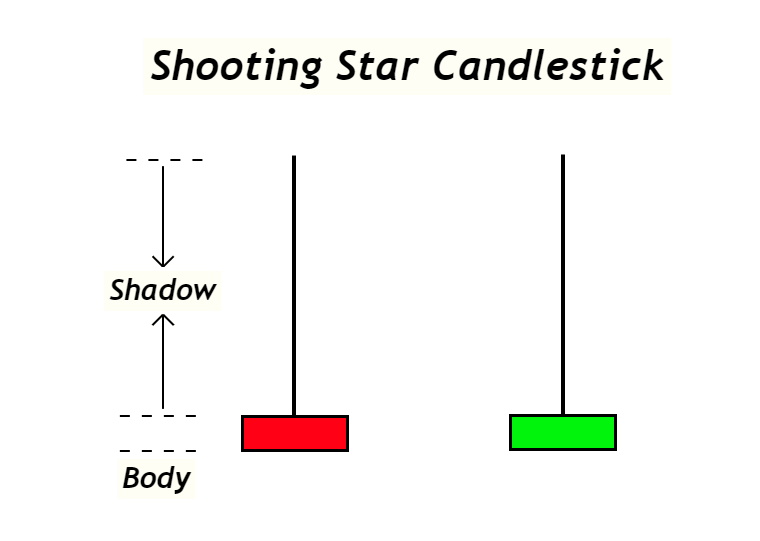

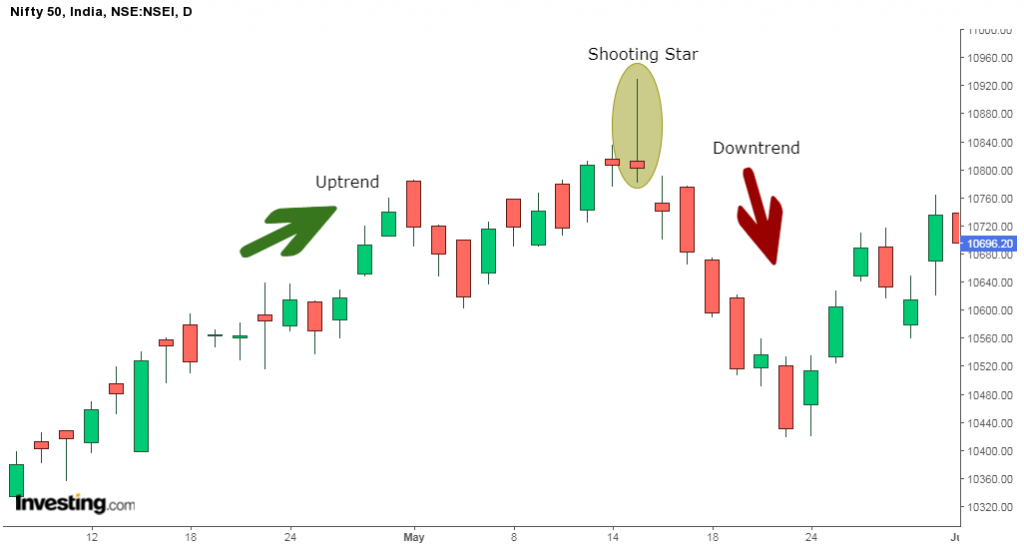

The Shooting Star candlestick pattern is a bearish reversal pattern that occurs at the top of an uptrend. It is a single candlestick pattern that is formed when the open, high, and close prices are all relatively close together, but the candle has a long upper shadow (wick) that is at least twice the size of the real body (the difference between the open and close prices).

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

A shooting star candlestick pattern is a chart formation. It occurs when the price of an asset is significantly pushed up, but then rejected and closed near the open price. This makes a long upper wick, a small lower wick and a small body.

Shooting Star Candlestick Pattern Trading the Shooting Star Candlestick Pattern (Pinbar

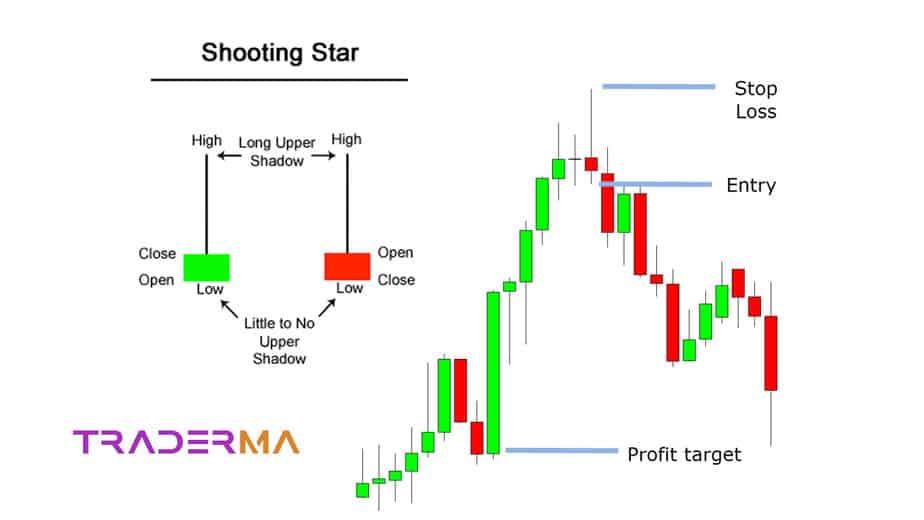

What is a Shooting Star Pattern? A shooting star pattern is a bearish candlestick that can be identified with a long upper shadow and little to almost no lower shadow (candle wick). It also has a small real body that closes close to the low of the session. The shooting star pattern only appears after an upward swing in the price action. This is.

How To Trade Blog What Is Shooting Star Candlestick? How To Use It Effectively In Trading

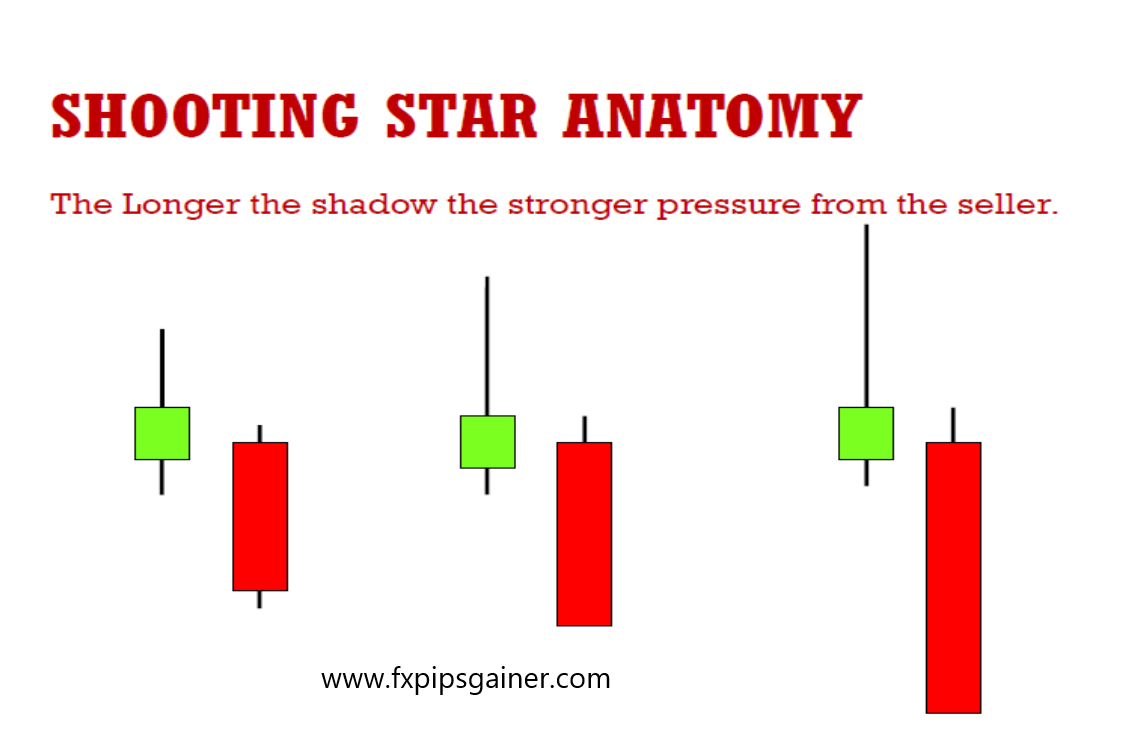

Variants of the Shooting Star Candlestick Pattern. The Shooting Star candlestick pattern may appear a little different on your charts. The color of the body doesn't matter, it can be either red or green (bearish or bullish). The existence or not of a wick (shadow) at the bottom doesn't matter too. As long as it's small you're good to go.

How to Trade the Shooting Star Candlestick Pattern IG Australia

September 3, 2022 Zafari. The Shooting Star Candlestick Pattern is a single reversal candlestick that forms at the top of a trend. It suggests a future downtrend. In other words, a shooting star candlestick is a single bearish pattern. A shooting star has a long upper shadow/tail and a small body at the bottom of the candle, with or without a.

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

In technical analysis, a shooting star candlestick is a bearish reversal pattern that forms after an uptrend. The meaning of the shooting star candlestick pattern is that buying pressure is starting to dissipate and a potential trend reversal may be on the horizon. The shooting star is sometimes referred to as the " shooting star Japanese.

Shooting Star Candlestick Pattern How to Identify and Trade

The shooting star pattern in candlestick charting represents a nuanced interplay of market forces, illustrating the ongoing battle between supply and demand, and the transition from bullish optimism to bearish reality. Central to the shooting star pattern is its pronounced upper shadow, symbolizing a significant change in market sentiment.

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals Bybit Learn

A shooting star is a single-candlestick pattern that forms after an uptrend. It's a reversal pattern and is believed to signal an imminent bearish trend reversal. As to the pattern itself, a shooting star has a small body that's located in the bottom half of the candle's range, and has a long upper wick, with a low or absent lower wick..

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals Bybit Learn

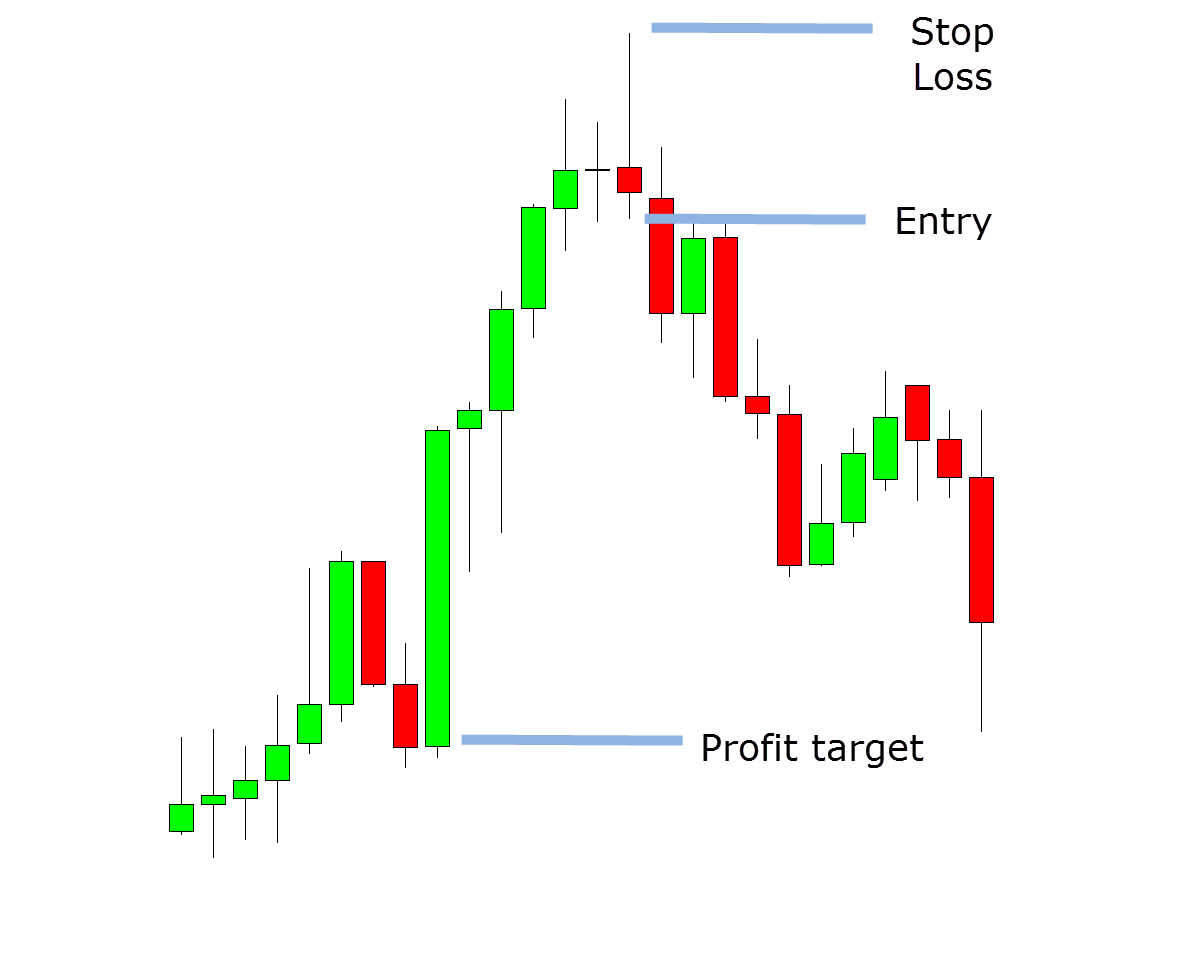

Raining Profits. The blue arrows on the image measure and apply three times the size of the shooting star candle pattern. After we short Apple, the price enters a downtrend. After the first bearish impulse on the chart, the price creates a range between $107.30 and $107.40 per share.

SHOOTING STAR Candlestick pattern explained AXIS BANK Procapital Academy

A shooting star candlestick is a technical analysis indicator. It is a Japanese candlestick pattern indicating a potential price trend reversal. It appears at the end of a bullish price trend. This candlestick pattern is characterized by its long upper shadow and a short lower shadow, with the candle body closer to the lower point.

Shooting Star Candlestick Pattern Beginner's Guide LiteFinance

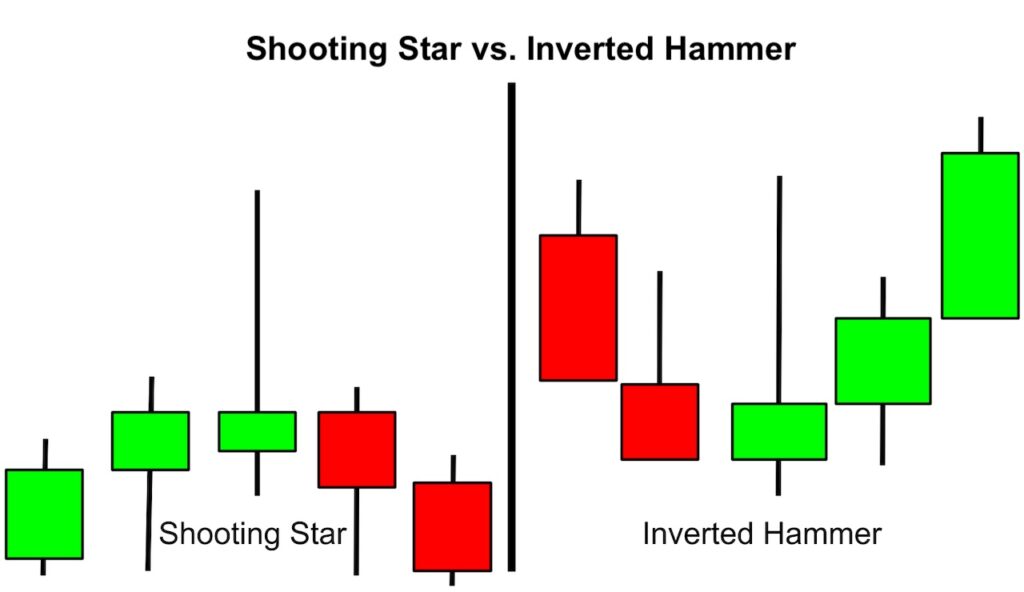

The shooting star candlestick pattern is a bearish reversal pattern. When this pattern appears in an ongoing uptrend, it reverses the trend to a downtrend. It has a bigger upper wick, mostly twice its body size. It has no lower wick or sometimes has a smaller wick. This is just an inverted hammer candle called a shooting star.

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

Shooting Star: A shooting star is a type of candlestick formation that results when a security's price, at some point during the day, advances well above the opening price but closes lower than.

Shooting Star Candlestick Pattern For Beginners Part 7 Traderma

A shooting star is a single-candle bearish pattern that generates a signal of an impending reversal. Similar to a hammer pattern, the shooting star has a long shadow that shoots higher, while the open, low, and close are near the bottom of the candle. It is considered to be one of the most useful candlestick patterns due to its effectiveness.

What Is Shooting Star Candlestick? How To Use It Effectively In Trading

A shooting star formation is a bearish reversal pattern that consists of just one candle. It is formed when the price is pushed higher and immediately rejected lower so that it leaves behind a.

Shooting Star Candlestick Pattern Forex Trading

The inverted shooting star is a bullish analysis tool, looking to notice market divergence from a previously bearish trend to a bullish rally. An inverted shooting star pattern is more commonly known as an inverted hammer candlestick. It can be recognized from a long upper shadow and tight open, close, and low prices — just like the shooting.

Powerful Shooting Star Candlestick Formation, Example & Limitations2022

A shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. It is a popular reversal candlestick pattern that occurs frequently in technical analysis and is simple and easy to identify.