Pengertian Roi Dan Cara Menghitung Return On Investment My XXX Hot Girl

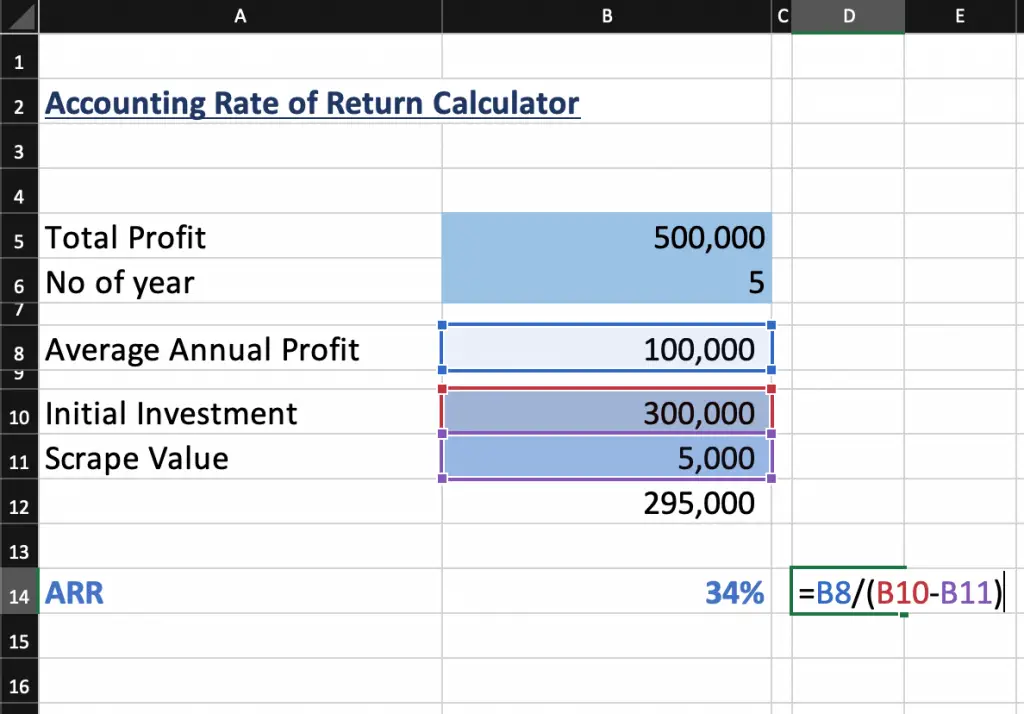

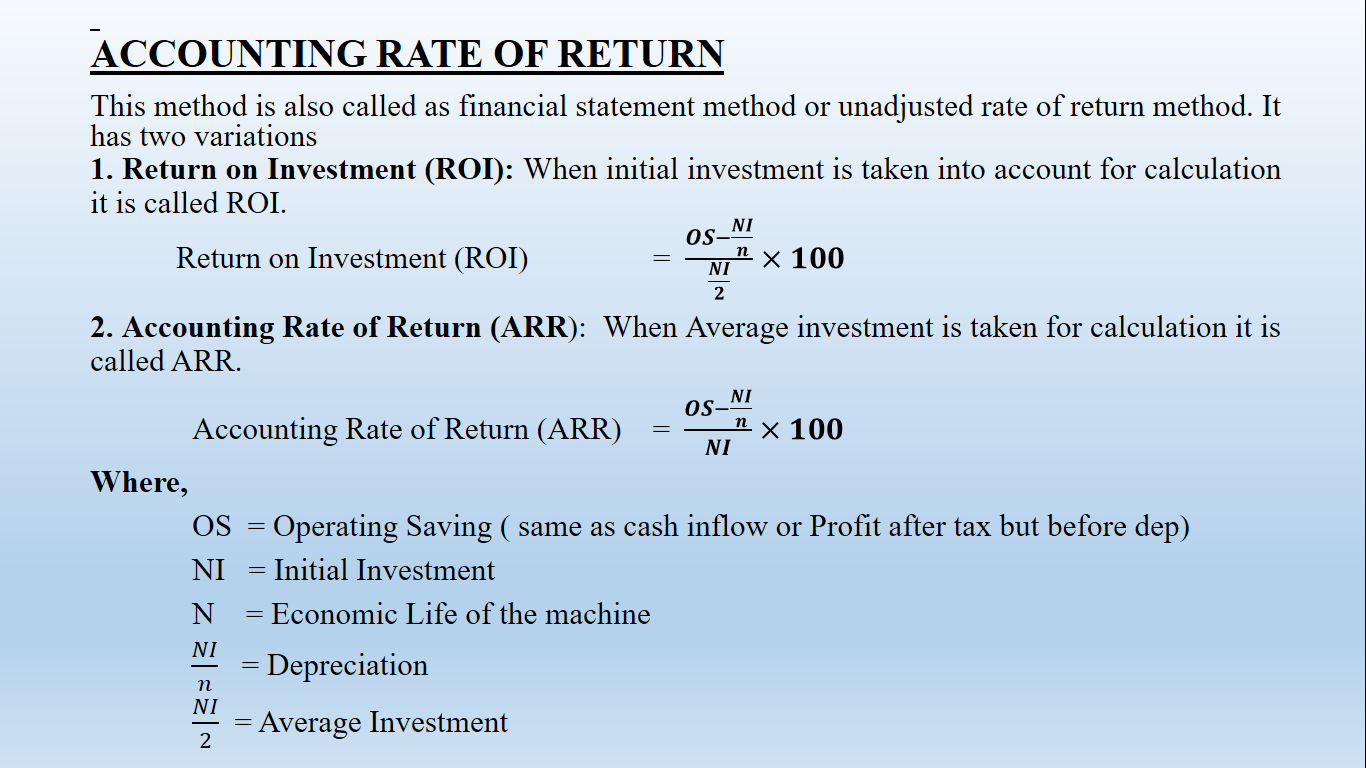

Accounting Rate of Return (ARR) is the average net income an asset is expected to generate divided by its average capital cost, expressed as an annual percentage. The ARR is a formula used to make capital budgeting decisions. It is used in situations where companies are deciding on whether or not to invest in an asset (a project, an acquisition.

8.the Rate Of Return Method 970

Average Rate of Return Formula. Mathematically, it is represented as, Average Rate of Return formula = Average Annual Net Earnings After Taxes / Initial investment * 100%. or. Average Rate of Return formula = Average annual net earnings after taxes / Average investment over the life of the project * 100%. You are free to use this image on your.

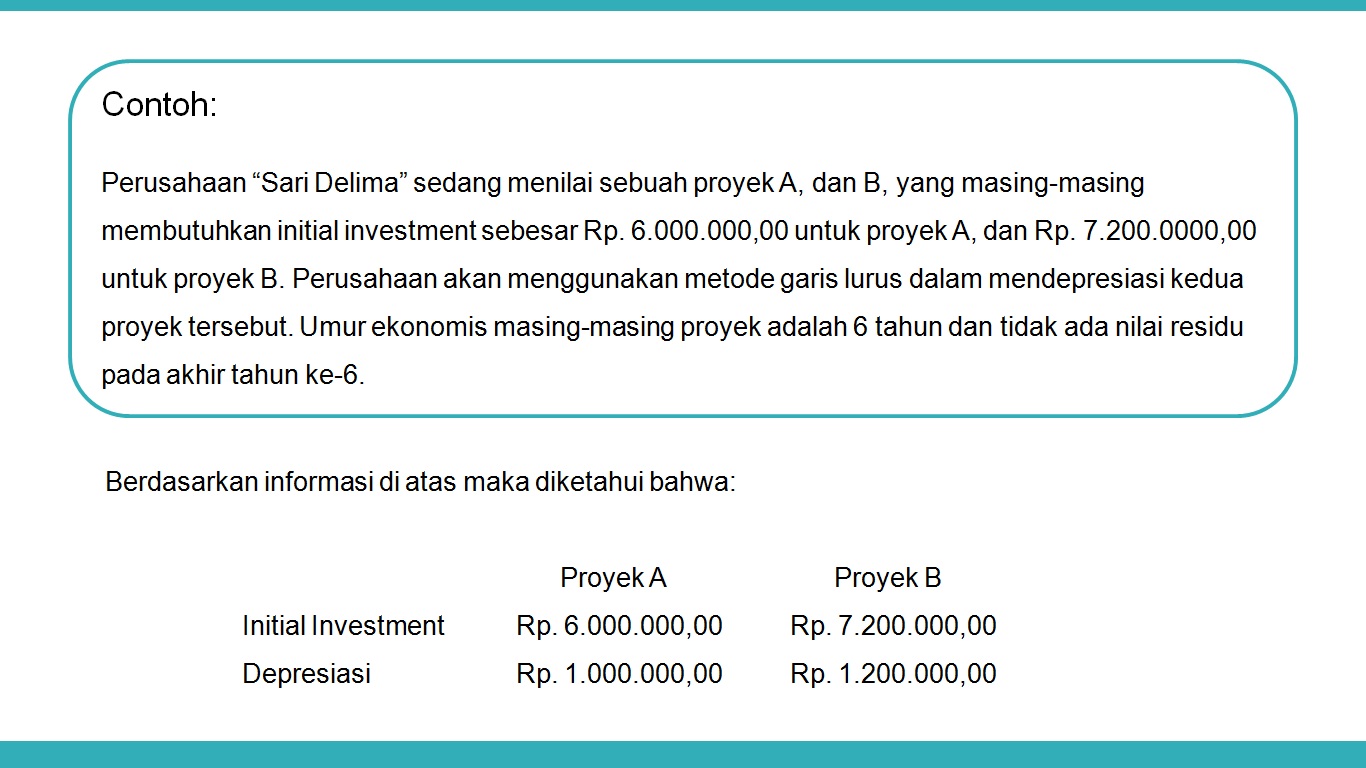

Cara Menghitung Average Rate Of Return Dikte ID

Rumus Average Rate of Return. ARR adalah perbandingan antara keuntungan bersih rata-rata tahunan dengan nilai investasi di awal. Supaya lebih mudah dipahami, mari simak contoh berikut. Contoh 1. Sebuah bisnis UMKM di bidang kuliner ingin membeli sebuah oven dengan harga 10 juta rupiah.

Cara Menghitung Average Rate of Return HSB Investasi

Average Annual Return - AAR: The average annual return (AAR) is a percentage used when reporting the historical return, such as the three-, five- and 10-year average returns of a mutual fund . The.

Pembahasan Lengkap Internal Rate Of Return (IRR) dan Cara Hitungnya

Average Rate of Return (AAR) atau Rata-rata Tingkat Pengembalian adalah jumlah rata-rata dari arus kas yang diterima dalam satu tahun selama periode investasi. Cara menghitung AAR adalah dengan menggabungkan semua perkiraan arus kas dari investasi tersebut dan membaginya dengan perkiraan total tahun investasi.

What Is Rate of Return and What Is a Good Rate of Return? TheStreet

Mudah! Anda hanya perlu mengenal dan menerapkan apa yang disebut sebagai average rate of return (ARR) atau tingkat pengembalian rata-rata. Metode ARR digunakan untuk menilai profitaitabilitas investasi berdasarkan informasi yang terdapat dalam laporan keuangan tahunan. Penghitungan ARR.

What is the Average Rate of Return? How to Calculate Average Rate of Return YouTube

The average return is defined as the mathematical average of a series of returns generated over a period of time. In regards to the calculator, the average return for the first calculation is the rate at which the beginning balance concludes as the ending balance, based on deposits and withdrawals that are made in-between over time.

Contoh Soal Average Rate Of Return

Rate of return ini terdiri dari dua jenis, yaitu internal rate of return (IRR) dan average rate of return (ARR). Di antara dua jenis tersebut IRR adalah indikator yang paling sering dijadikan patokan. Baca Juga: Mengenal Jenis dan Cara Investasi untuk Pemula. IRR adalah. Secara singkat, pengertian internal rate of return atau IRR adalah.

Contoh Soal Average Rate Of Return Kondisko Rabat

Let's imagine all the return in the form of capital gains. The arithmetic average return will equal 6.4% i.e. (5% + 8% + (-2%) + 12% + 9%)/5. The investment value after 5 years will be $135.67 million as calculated below: However, the 6.4% arithmetic average return suggest the investment value will be $145.09 million: Arithmetic average.

Rate of Return Pengertian, Fungsi, Manfaat dan Cara Kerjanya

Accounting Rate of Return - ARR: The accounting rate of return (ARR) is the amount of profit, or return, an individual can expect based on an investment made. Accounting rate of return divides the.

Accounting Rate of Return Formula Example Accountinguide

Plug all the numbers into the rate of return formula: = (($250 + $20 - $200) / $200) x 100 = 35%. Therefore, Adam realized a 35% return on his shares over the two-year period. Annualized Rate of Return. Note that the regular rate of return describes the gain or loss, expressed in a percentage, of an investment over an arbitrary time period.

Cara Menghitung Internal Rate Of Return (IRR) dengan Rumus

The average rate of return for each option would be calculated as follows: Average annual profit = £50,000 ÷ 5 = £10,000: £28,000 ÷ 4 = £7,000: Average rate of return =

PPT Average Rate of Return PowerPoint Presentation, free download ID6663053

Rate of Return % = [(Current Value - Initial Value) / Initial Value] x 100. Rate of Return Example. For example, if a share price was initially $100 and then increased to a current value of $130.

Average Rate of Return (ARR) GCSE Business Revision YouTube

The average return for six years is computed by summing up the annual returns and divided by 6, that is, the annual average return is calculated as below: Annual Average Return = (15% +17.50% + 3% + 10% + 5% + 8%) / 6 = 9.75%. Alternatively, consider hypothetical returns of Wal-Mart (NYSE: WMT) between 2012 and 2017. The returns on investments.

Accounting Rate of Return Method of Capital Budgeting

Rate of Return: A rate of return is the gain or loss on an investment over a specified time period, expressed as a percentage of the investment's cost. Gains on investments are defined as income.

PPT CAPITAL BUDGETING PowerPoint Presentation, free download ID5435732

Average return is the simple mathematical average of a series of returns generated over a period of time. An average return is calculated the same way a simple average is calculated for any set of.